Home » Cashless Payments Knowledge Hub » 6 Tips to Plan for Back-to-School Finances: Back-to-School Students’ Guide

Only 25% of the high school students in the USA have access to personal finance education this year. However, 80% demanded to be educated about managing their personal finances.

It is not new that financial literacy has been one of the biggest challenges for students, women, and small business owners in general. Without the knowledge of personal finance, students can face difficulty managing their own money when they grow and start earning more money.

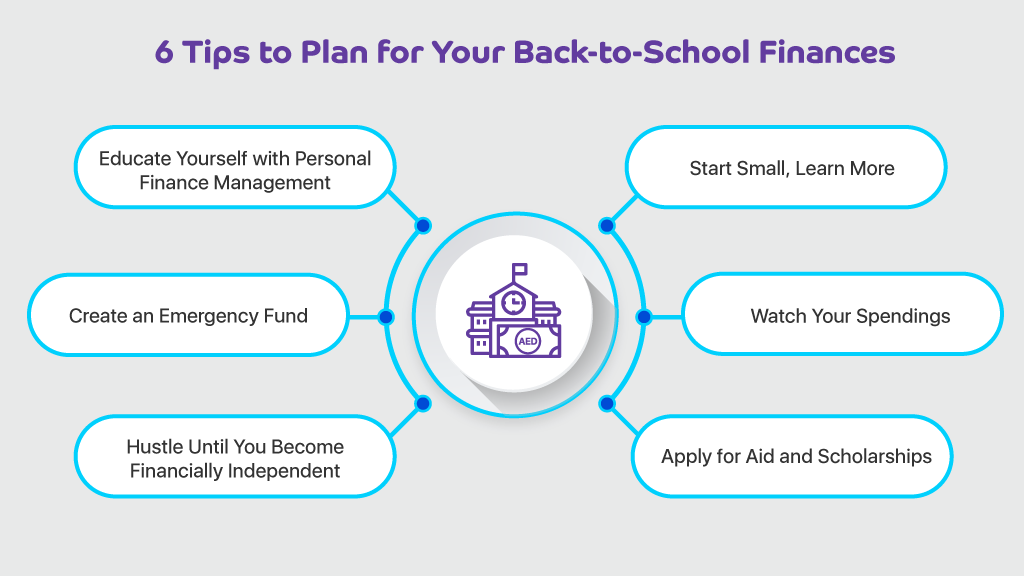

So, how do you manage your finances when you are about to start school again? Here are a few tips to help lay down the foundation for going “Back to School.”

Whether you are a high school student or a young adult going to start your master’s studies, you must have a clear plan for managing your finances. Although you may have your parents’ back when it comes to paying your fees, many students do it on their own.

Let’s see six excellent tips to manage your finances when returning to school. Educate Yourself With Personal Finance Management

When you start earning your money, the first thing you will need is to manage your income, expenses, and savings. Suppose you have not educated yourself with personal finance education. In that case, it will be difficult for you to do it, and you may lack saving enough money to pay your upcoming expenses.

Although today, you get a personal finance assistant at your fingertips through many apps, knowing the basics will help you get clarity on how you want to manage them. It will help you set your financial goals and better understand your savings and spending habits.

Even if you received only 20 bucks, you must plan how you will use it and how much you will save. A small beginning will give you a more significant advantage in the long run. If you managed your 20 bucks successfully, you wouldn’t find it challenging to handle more significant amounts later.

With every 20 bucks you manage, you will learn a new way of saving or spending it more efficiently. Note down your learnings and store them as a treasure to use in the future.

College students tend to have a lot of financial difficulty during their late teens and early twenties. However, returning to school when you’re an adult doesn’t get any easier. In fact, with more responsibilities and without the financial support of parents, it’s arguably even more difficult!

However, there are ways that you can help cure these financial worries. One of the most significant ways is building up an emergency fund. Before starting your academic journey, set aside a period to let you build up the fund.

You can use a savings account to store the money, or alternatively, you could keep it in a digital wallet. Where there are several cashback promotions in case, you do end up spending money from the fund.

Experts suggest that you should have around three months of emergency expenses tucked away in a savings account. That way, in case of any emergency, you’ll be able to ensure that you can cover your immediate bills.

Also read, Budgeting Tips for New Parents in the UAE

There are no two ways about things, and higher education prices have been increasing consistently. Unfortunately, you will have to watch your spending habits if you want to go back to school with your existing finances.

Luckily, there are a few easy ways to cut down on basic costs.

Instead of paying excessive money for many TV channels, you don’t need, why not just use your favorite streaming service? Most of us already have Netflix or Amazon accounts, and no one watches cable anymore.

You can save yourself a decent amount every month just by getting rid of cable and using streaming services!

Going back to school may also make you lean towards student habits like overeating and going out all the time. However, that can have a significant impact on your expenses.

You can cook a healthy meal or delegate the cooking work to your roommates if you do laundry or other cleanings at your shared apartment.

Many people don’t realize they can save significant money by actively searching for discounts. Digital wallets like payit currently offer some of the best offers in UAE market. Make full use of these to help you save money wherever possible.

If you’re used to buying a particular expensive everyday item, maybe it’s the right time to find a cheaper alternative. Making these sacrifices and looking for discounts might seem annoying, but with the cost of education these days, it’s a good idea to start spending smartly.

If you’re deciding to go back to college full-time and aren’t working for the duration of your academic year, then going for a work-study option or a student job is a good idea. These can help cover everyday expenses while you’re not getting your regular income. There are multiple different types of student jobs available.

Food Service

It is arguably the most common job on college campuses. You can enter food service to help prepare food, wait on tables, work at the cashier, or wash dishes. Most campus food courts or cafeterias have jobs like these.

You should be able to find a few openings on your campus’s bulletin board.

University Tours

If you enjoy being social and talking to new people, a campus tour guide job might be a good option. These roles are seasonal, but they’re fun to earn money while studying.

Tutoring

Going back to college as an adult, you have an advantage over younger students. You have more life and professional experience than the students just starting their higher education.

Due to these factors, tutoring might be the perfect way to get through college. There are plenty of benefits that come with tutoring. You can set flexible hours and schedule the sessions according to the time that suits you best.

Aside from the financial compensation, you’ll receive, there’s something inherently satisfying about teaching someone and watching them excel in their classes.

Research

There’s always some sort of research in colleges and universities. Most of the time, the research requires some experimentation requiring test subjects. It might be a great chance to get some insight if it’s related to your field.

You’ll usually find opportunities like these on the campus bulletin board.

You might be unaware that financial aid and scholarships are only available to students graduating from high school. However, that isn’t the case. There are financial assistance programs and scholarships specifically for adults returning to college.

Many people don’t understand precisely how much money is available for scholarships. If you never apply, you’re not going to find out anytime soon. Who knows, it might just be your lucky day!

Going back to complete your education or gain more education as an adult is a courageous decision. Not only does it require bravery, but it also requires you to lay down the proper financial groundwork. Following these tips can help you return to school on your current finances without landing yourself in a troublesome situation!

With the Payit wallet app; you can pay your school fees faster, smarter, and more conveniently from your phone. Instead of waiting in long queues and worrying about any potential delays, you can pay your school fees from a digital wallet on your phone.