Home » Cashless Payments Knowledge Hub » Digital Payments: How Mobile Wallets Boost the Growth of Your Small Business?

As per the survey conducted by Visa, 82% of small and medium business owners responded to using more digital payment options, including mobile wallets, to offer their customers simple and secure payment methods.

In fact, nearly 60% of these small business owners replied they would only use digital wallets to accept payments. However, this shift in trends has primarily occurred among large businesses that have the means to provide customers with various payment options.

So, let’s dive deep into what mobile wallets are and how they help you grow your small business.

It is an electronic wallet where you can store your money electronically and use it to make online payments. While Gen Z (read: digitally native) and millennials have already moved towards using mobile wallets, they also prefer making payments using them.

Thus, you could lose customers if your business does not accept wallet payments since their preferred payment method is a mobile wallet. It increases cart abandonment rates. Thus, accepting mobile payments directly connects with your business’s growth.

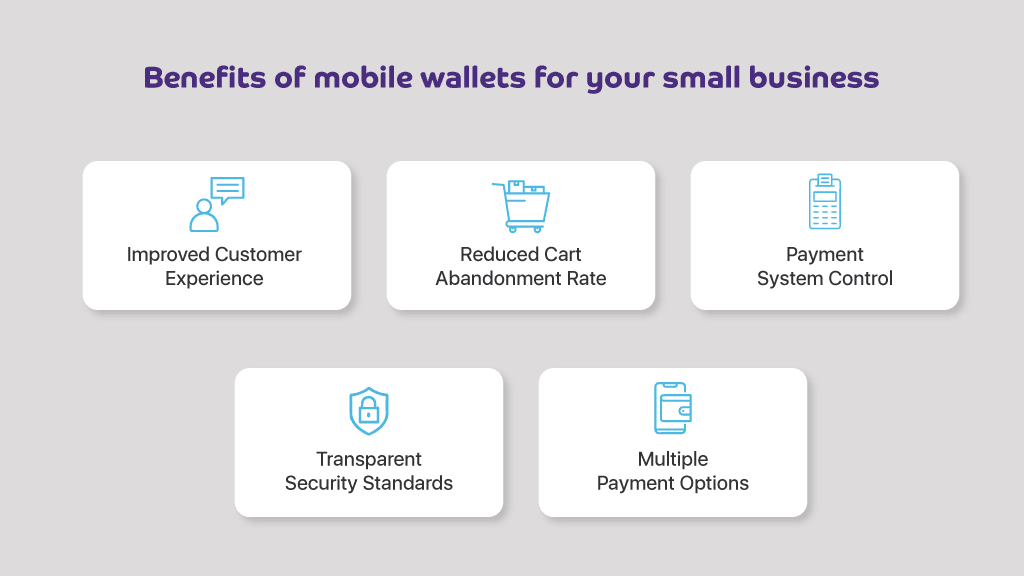

Let’s see how digital wallets can benefit your small business.

More than 50% of the consumers in the UAE said they will go cashless by 2024. Thus, the customers set the tone for the future of using digital payment methods. If yours is a small or medium-sized business, read on to learn the benefits of accepting mobile wallet payments.

Mobile wallets are simple and secure; hence, your customers can experience more convenience in making payments. One-tap payments, QR code payments, sound payments, etc., are some examples of digital payments that purely simplify the customer experience.

Mobile wallets untangle the complexities of carrying cash or a card for your customers since they can pay simply using their phones.

Since you accept payments in your customer’s preferred payment method (mobile wallets), they will not leave the cart in real life or online. Customers always look for a more straightforward, faster, and more convenient way to make payments.

Digital wallets have been the most popular payment method for customers, and you will see reduced CAR when you start accepting payments through mobile wallets.

Mobile wallets let you set the payment terms on your own, and you decide how the payments will be received. For example, if you accept cryptocurrency through your mobile wallet, you can set it to receive directly from your customer without any interference from the crypto exchange.

Mobile wallet transactions are all saved on the cloud; hence, you can view them anytime and anywhere. These transactions are highly secure since they must follow the security standards established by the relevant authorities.

Mobile wallets allow you to accept various payment options such as cards, PayPal payments, QR codes, cryptocurrencies, etc. Thus, they enable your customers to choose multiple payment options.

So, how should you incorporate a mobile wallet payment method for your business? Let’s see how Payit makes it easier, faster, and more comfortable for your business to receive payments differently.

Payit digital wallet is the most popular option for small business owners in the UAE. Payit offers businesses services as follows:

| QR Code Payments | Get your unique QR code that customers can scan to make a purchase |

| Integrated Payments | Enable Payit as an API-integrated payment option on your website, app, or a payment gateway |

| POS Terminals | Get POS terminals set up at your shop to receive payments instantly |

| Sound Payments | Get instant payments that are transferred to your account within seconds |

| eDirham Instant | Pay any government taxes you may have with Payit |

Are Mobile Wallets Safe?

Yes, they are safe since they use payment verification methods such as biometric or mobile PINs to authenticate the payments. Your personal information is also encrypted to protect your data privacy.

What is the difference between mobile wallets and digital wallets?

There is a thin line difference between them. While digital wallets are used for online payments from a website, mobile wallets are used on your phones to make payments.

How do mobile wallets work?

Mobile wallets use near-field communication technology to enable contactless payments from your mobile phones.

How do mobile wallets make payments?

You can save your debit/credit card, add a balance from your bank account, or link your bank account with your mobile wallet app to enable payments from the wallet.