Home » Cashless Payments Knowledge Hub » Assessing Cash Now Pay Later Schemes: Why is it Good and Why is it not?

Cash now pay later has recently gained traction due to its flexibility with the installments and availability in smaller amounts.

Many individuals and small businesses need money for several reasons, such as

‘Cash Now Pay Later’ is an online borrowing option that allows individuals to obtain small loans. This approach offers flexible installment plans tailored to individual needs, often accompanied by low or zero interest costs.

It offers expedited approval for your loan application and immediate access to the funds. This becomes particularly crucial during financial emergencies, where quick access to cash is of utmost importance.

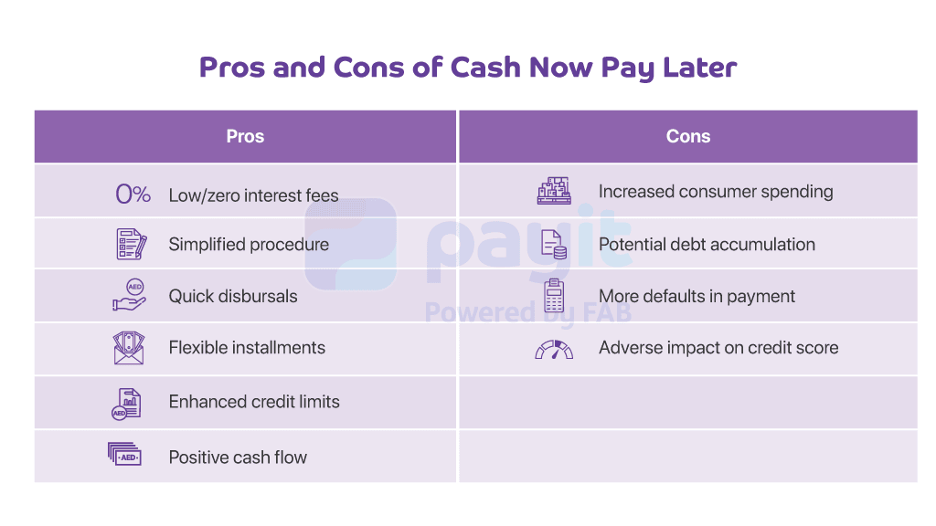

Let’s look at some of the key benefits of the cash now pay later scheme and how it attracts more consumers with its convenient application, simplified processes, low costs, and faster disbursals.

These schemes often come at low-interest rates while sometimes even at no interest costs. The use of technology, digitized solutions, and automated loan processing methods make it a highly affordable scheme.

Using banking APIs (application programming interfaces) makes processing your loan applications more convenient and straightforward. With the help of APIs, cash now pay later solution providers can instantly verify your identity, check your credit history and approve the loan terms.

You can immediately access the necessary funds with cash now pay later schemes. Once the online lender approves your application, the money is quickly disbursed to your digital wallet.

By spreading out payments over time, cash now pay later schemes provide financial flexibility to manage your finances better. Certain schemes also allow you to decide how you want to split your payments. This flexible payment structure eases the burden on your budgets, enabling you to meet your financial obligations while maintaining your day-to-day expenses.

Utilizing cash now pay later schemes can enhance your credit limits as consistent usage and timely payments can positively affect your credit score, indicating your strong creditworthiness.

It helps you maintain a positive cash flow since you get access to the cash you can pay in equal installments later. Maintaining positive cash flow is essential to ensure financial stability and meet financial obligations without relying heavily on debt or depleting savings.

Anything that is overused is not beneficial. Similarly, excessive use of cash now pay later schemes can also become a nightmare. Let’s see what are the drawbacks of this scheme.

Giving in to impulse buying and overspending is easy when you can make purchases without paying immediately. Schemes like POS (point-of-sale) financing, buy now pay later, etc., come with potential risks of overspending by most consumers.

These schemes offer cheaper loan solutions, but you have to pay hefty charges if you forget to repay. The default costs are pretty costly; hence, you must be extremely careful to make the payment.

The facility of immediate access to goods or services without upfront payment can lead to impulsive spending, causing individuals to take on more debt than they can afford, resulting in difficulties in meeting future payment obligations and an increased risk of defaulting on the payments.

Although some schemes may not require credit checks, late or missed payments can still impact your credit score if the provider reports to credit bureaus. An adverse credit history can affect your ability to access credit in the future.

One of the most effective ways to obtain instant money other than cash now pay later is Payit’s ‘Money on Demand.’

It is an instant cash solution provided by Payit mobile wallet app to meet your financial needs. Eligible Ratibi card holders can access instant money through the app’s ‘Money on Demand’ feature.

Read more about Payit’s ‘Money on Demand’ service on

Also Read, Unlocking Money on Demand Feature Through Ratibi Salary Cards.