Home » Cashless Payments Knowledge Hub » Renting Vs. Buying Property in UAE – Which is Better?

In 2024, property prices in Dubai are expected to increase by 5-10%, driven by high demand and limited supply. This is beneficial if you already own a property. However, you may face a dilemma if you want to buy or rent residential/ commercial property, as real estate prices can significantly impact your decision.

This article details whether you should rent or buy a property in the UAE in 2024. Let’s get started.

Here are a few factors you should consider to determine whether renting or buying a property is beneficial for you.

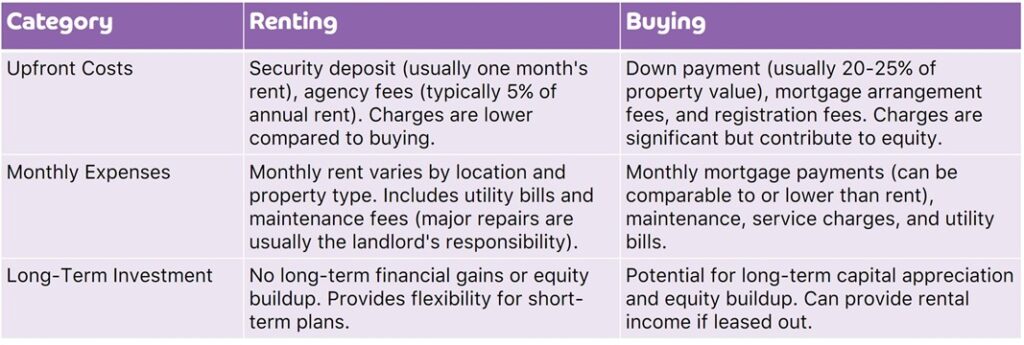

Cost is the biggest and most important factor in deciding whether to rent or buy a property in the UAE.

Renting provides great flexibility, giving tenants the freedom to move without the stress of selling a property. This is ideal for expatriates or individuals with uncertain long-term plans.

Since the landlords are responsible for maintenance in renting a property, renters don’t need to worry about it.

On the other hand, homeownership ties individuals to a specific location, making relocation more challenging. Selling a property can be time-consuming and subject to market conditions. Additionally, owners are responsible for all maintenance and repair costs, which can cost a lot over time.

For individuals whose careers involve frequent relocations or who work in industries with high mobility, renting can offer the flexibility needed to move without the constraints of property ownership. For instance, professionals in the tech industry or international business may find renting more suitable to accommodate job transfers or project-based assignments.

On the other hand, those with stable, long-term employment in a specific location may benefit from buying, as it offers stability and potential financial growth through property appreciation.

Retirement planning plays a crucial role in buying or renting a property in the UAE. For those planning to settle in a particular location for retirement, buying property can provide stability and reduce living costs in the long term.

Owning a home can also be seen as an investment that may be appreciated, offering financial security during retirement. Conversely, retirees who prefer a more nomadic lifestyle or wish to travel extensively might find renting more suitable, as it provides the flexibility to relocate without the burden of property maintenance.

The intended duration of stay in a particular location is a critical factor. If an individual plans to stay in one place for an extended period, buying a home can be more cost-effective than renting.

For instance, over 10-years, the total cost of renting a property in Dubai can be comparable to the cost of owning, but owning provides the opportunity for equity buildup. However, for those uncertain about their long-term stay and plans, renting offers the flexibility to move without the complexities of selling a property.

Flexibility is a significant advantage of renting. Individuals anticipating changes in their personal or professional lives, such as starting a family, changing jobs, or pursuing further education, may prefer renting.

Renting provides the freedom to adjust living arrangements quickly and without the financial burden of selling a property. On the other hand, buying a home offers less flexibility but provides a sense of permanence and stability, which can be beneficial for those with long-term commitments in a specific location.

Consider renting a property in Dubai, if you have-

Consider buying a property in Dubai, if you have-

The best decision will be based on what you require, what you prefer, and what your life goals are.

This was all you needed to know about renting vs buying a property in Dubai. Both offer their distinct advantages and shortfalls. The ultimate choice of whether to rent or buy depends on your life goals and needs.

Download the Payit app and manage your payments more effectively. You can send/receive money, pay bills, recharge, send eGift vouchers, transfer money internationally, and more.