Home » Cashless Payments Knowledge Hub » The Ins and Outs of International Money Transfer in UAE

Smartphones have made our lives easier in almost every aspect, and international money transfers are no exception. Need to send money across borders? It is simpler than ever. Just a few taps on your smartphone, and you can transfer funds to friends, family, or businesses anywhere in the world.

The UAE is among the top remittance-sending countries globally, with people sending over USD 38.5 bn in 2023. Here, international mobile money transfer is a blessing. But what are the ins and outs of international mobile money transfers? Let’s understand.

International mobile money transfer is a digital method that lets you send or receive money across borders using mobile platforms or apps. It eliminates the need for physical bank visits.

The process is straightforward. You choose a mobile money transfer app like Payit, create an account, and link it to your bank or e-wallet. To send money, you enter the recipient’s details and the amount and select the currency. The platform processes the transaction; the recipient can withdraw or spend the money directly from their account. Quick, safe, and hassle-free.

These are the benefits that mobile money transfers offer:

Imagine transferring money at midnight or during a busy day. Mobile money lets you do this. You don’t need to visit a bank or stand in long queues. It’s accessible 24/7.

Time is crucial, especially when sending money for emergencies. Transfers from the UAE typically take less than 24 hours. Services like Payit even offer instant transfers.

Sending money through mobile platforms is one of the cheapest options. Traditional methods charge higher fees. Many platforms even offer free remittance on certain transactions.

Worried about safety? Mobile money platforms use advanced encryption and multi-factor authentication to secure your transactions. Many also notify you of every activity, ensuring you stay informed.

Mobile money transfer also provides services to the unbanked. For example, Payit allows people without traditional bank accounts to access financial services like international transfers, bill payments, eGift, education fees, etc.

Want to know where your money is? Mobile money platforms provide real-time tracking. You can monitor the entire process, from initiation to receipt.

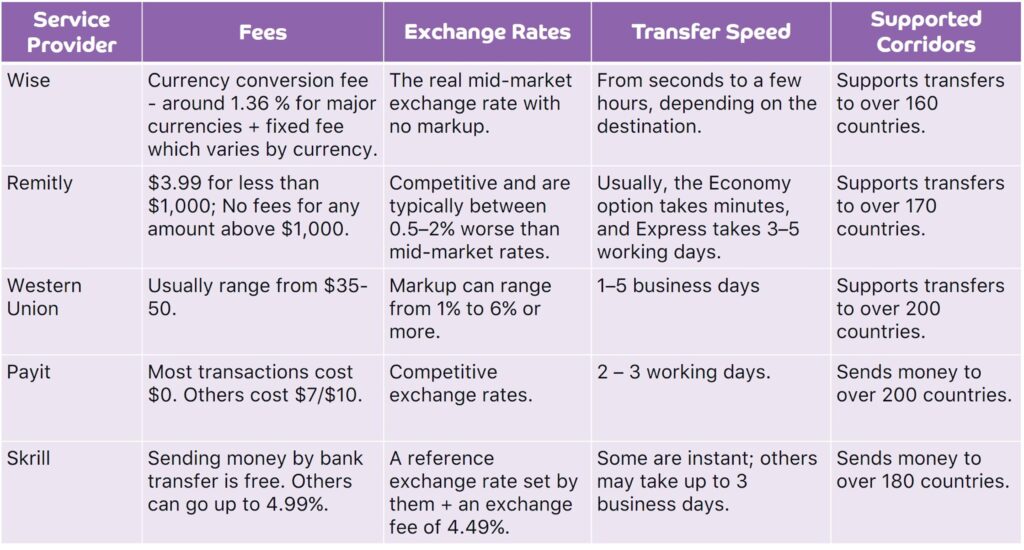

There are multiple types of fees involved in international fund transfers. Check it thoroughly before selecting any platform.

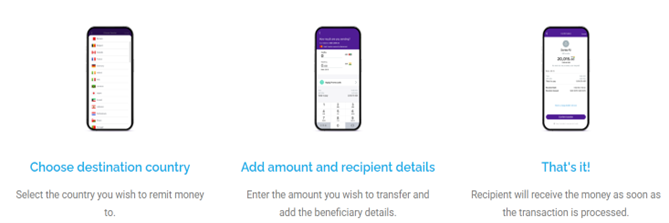

These are the common steps to transfer money internationally using the Payit app:

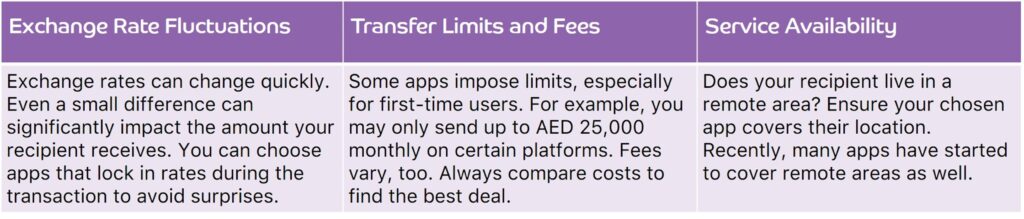

Despite all the benefits, international mobile money transfers have these challenges:

Here’s what you need to know about the regulations governing international money transfers:

Only institutions licensed by the Central Bank of the UAE (CBUAE) can offer remittance, transfer, and foreign exchange services. They must clearly inform customers about fees and exchange rates and display buy and sell rates for major currencies. Understand the total cost before completing a transaction.

When making a remittance, you’ll need to provide:

The UAE has strict Anti-Money Laundering regulations. Financial institutions may require identification and documentation to verify the source of funds, especially for large transactions.

The Central Bank of the UAE mandates that all international wire transfers of ê 3,500 or more must include detailed information about the originator and beneficiary, such as names, ID numbers, and account details. Transfers below this amount also require this information, but strict verification is only necessary if suspicious activity arises.

Using Purpose of Payment (PoP) codes is mandatory to identify transaction reasons and ensure regulatory compliance. Select the correct PoP code to prevent processing delays.

Cryptocurrency transfers offer a faster and cheaper way to send money internationally by avoiding traditional banks. Digital currencies like Bitcoin and Ethereum enable peer-to-peer transactions through blockchain technology, making them appealing for tech-savvy users.

These transfers can be more cost-effective, especially for larger sums, and are accessible without a traditional banking system. While they provide secure transactions, cryptocurrencies also carry regulatory risks and potential volatility, which can affect the final amount received.

Cryptocurrency transfers carry several risks, including high volatility and varying regulations by country, with some imposing strict rules or bans. Transactions, once confirmed, are irreversible, making recovery of funds sent to the wrong address impossible.

In the UAE, cryptocurrency is regulated by the Dubai Financial Services Authority (DFSA) and the UAE Securities and Commodities Authority (SCA), with platforms like BitOasis and Binance facilitating trading and transfers.

Mobile money transfers are convenient, fast, and cost-effective. They let you send money anytime, anywhere. Plus, UAE regulations ensure your money is handled safely.

Still using traditional methods? Switch to Payit Money Transfers for a hassle-free experience. Switch towards ease today, and enjoy exclusive deals and discounts!

What is mobile money transfer?

Mobile money transfer is sending or receiving money electronically using a mobile phone.

What is the difference between mobile banking and mobile money transfer?

Mobile banking involves accessing bank services via a mobile app, while mobile money transfer enables transactions without needing a bank account through mobile wallets.

What is the best app to transfer money internationally?

The Payit mobile wallet app is the best international money transfer app offering you competitive rates, faster transfers, and doesn’t need a bank account.

What is the limit on mobile money transfer?

The limit varies by service provider and country regulations, typically ranging from a few hundred to several thousand dollars per transaction.

Can you transfer money from mobile money to a bank account?

Yes, most mobile money services allow transfers to linked bank accounts.