Home » Cashless Payments Knowledge Hub » Short Before Payday? Manage Cashflow with onDemand Payit.

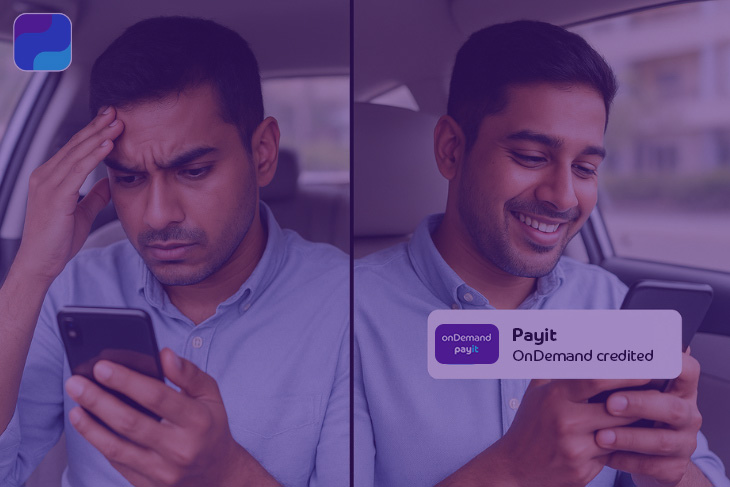

The days leading up to payday can feel like a tightrope walk. When bills arrive too soon and your account looks thin, a little planning and the right tools can turn anxiety into control.

Start by pinpointing exactly how much you need and when. List upcoming bills, groceries and essentials. Knowing your shortfall helps you choose the best solution and avoid borrowing more than necessary.

Need funds before payday? onDemand Payit is a fast, transparent short-term credit feature designed for urgent needs. With easy digital approval, no paperwork, and instantly deposited cash, you can cover unexpected expenses swiftly. While there’s no interest, a one-off, clearly stated service fee applies based on the amount. Eligibility depends on your KYC and income profile.

Running out of money before payday doesn’t have to mean panic. With onDemand Payit, smart budgeting and thoughtful borrowing, you can smooth out cashflow bumps and keep your finances on track.

When you’re ready, explore how onDemand Payit can help you navigate cash‑flow gaps with confidence!