Home » Cashless Payments Knowledge Hub » 5 Tips to Stay Safe from Scams While Transferring Money Online in the UAE

Paying bills, sending money to family, or shopping online — online money transfer always comes in handy. But with this convenience comes risk. In 2024, hackers leaked 269 million card records and 1.9 million stolen U.S. bank checks on the dark web and public platforms. Scammers are becoming smarter.

So, how to protect yourself? Let us guide you.

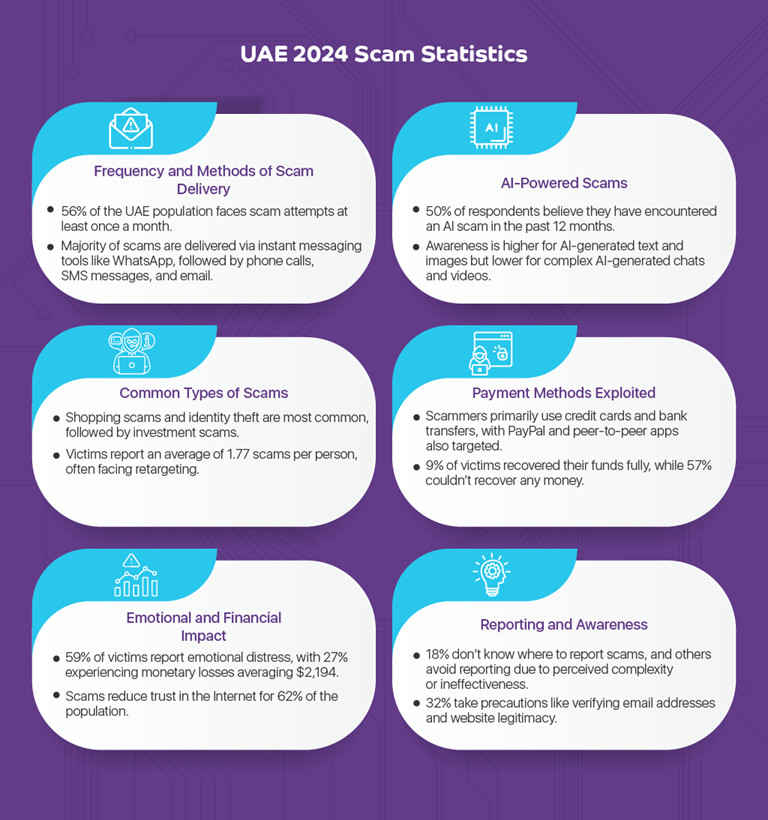

In the UAE, most common scams include shopping fraud, identity theft, and investment scams, resulting in victims averaging 1.77 scams and high retargeting. Of these, 56% of residents encounter scams monthly, primarily through WhatsApp, phone calls, SMS, and email.

AI-powered scams are rising, with half of respondents believing they’ve faced one, though awareness of AI-generated content is lower. Scammers often use credit cards, bank transfers, and peer-to-peer apps, with only 9% of victims recovering losses.

Let’s understand which are the most common scams:

Also, read 10 Ways Scammers Can Scam You in the UAE.

Credit card fraud is one of the most common financial crimes, affecting millions worldwide. Scammers use various tactics to steal card details and make unauthorized transactions, often leaving victims unaware until they check their statements. Understanding these fraud methods is crucial in protecting yourself from financial losses.

Fraudsters use multiple techniques to steal credit card information, including:

Use these five tips to avoid scams while transferring money online:

Scammers often design fake websites or apps that appear authentic but are planned to steal your information or money.

How to avoid this? Choose reputable platforms by looking for HTTPS in the URL for a secure connection. Check app reviews on trusted stores like Google Play or the App Store, and avoid unknown sources.

Enable two-factor authentication (2FA) on your accounts for added security. It requires a second verification step, like a code sent to your phone or email, making it harder for scammers to access your data.

Some reliable platforms include PayPal, Venmo, Payit, and Zelle. Payit offers secure money transfers to over 200 countries. An offer seem too good to be true? Be cautious. A legitimate platform won’t ask for sensitive information via email or message.

Public Wi-Fi is convenient but risky; hackers can intercept sensitive information like bank details and passwords. To stay safe, avoid using public Wi-Fi for transactions and opt for mobile data instead.

If public Wi-Fi is necessary, consider investing in a Virtual Private Network (VPN) for encryption, making it harder for hackers to access your data. VPNs typically cost around $5 per month—worth the investment for your security. Always be cautious before clicking “send” on public networks.

Scammers often trick you into sending money to the wrong account through fake payment requests, altered account numbers, or lookalike emails. A small typo in the recipient’s email can lead to significant losses.

Transferring money? Always verify the recipient’s details. Double-check names, account numbers, and emails. If you receive a payment request, confirm it through a secondary method like a phone call or text.

Be cautious of links in messages; scammers use fake URLs. Don’t rush transactions—urgency is their tactic. Always check for misspellings or unusual domains as they are red flags.

One of the most common online scams. Scammers send fake emails or messages that look like they’re from trusted platforms. Their goal? They aim to steal your login credentials or financial information.

How do you spot phishing attempts? Look for grammatical errors, overly urgent language, and strange links. Got an email that says, “Update your account now or lose access?” Likely a scam. Hover over links. Check their real destination. If it doesn’t match the official website, don’t click.

Victims of financial fraud lose an average of $1,000 before detecting it. Regularly review your bank statements to catch unauthorized transactions early.

Set up real-time transaction alerts. These notifications immediately inform you of any activity on your account. Thus, you get a chance to act quickly if something seems off.

Spot an unauthorized charge? Report it immediately. Contact your bank to provide transaction details. Most institutions have fraud protection and may reverse the charge if reported promptly.

Convenience comes with conditions. A condition to be vigilant. Use trusted platforms, avoid public WI-Fi, double-check details, beware of scams, and check bank statements regularly, and you’ll minimize the chances of scams.

Want to enjoy exclusive deals and discounts while transferring money securely? Download the Payit app now!

Are online money transfers safe?

Online money transfers are safe when done through secure and trusted platforms with proper precautions.

Can a bank transfer be reversed?

Bank transfers can be reversed only in specific cases like fraud detection or errors.

How can you stay safe from phishing?

Avoid suspicious links, verify sender identities, and enable two-factor authentication.

How to get money back from a scammer?

Report the scam immediately to your bank. File a police report. Notify the platform used for the transaction.