Home » Cashless Payments Knowledge Hub » Best Money Transfer App in UAE: Who Wins the Top Spot?

The UAE, with over 9 million expats as of December 2024, relies heavily on seamless money transfers for personal and business needs. From sending funds overseas to splitting bills, money transfer apps have revolutionized transactions. This guide evaluates the best money transfer app in UAE for 2025, focusing on ease of use, affordability, security, and standout features to help you make an informed decision.their ease of use, affordability, security, and standout features to help you make the smartest choice.

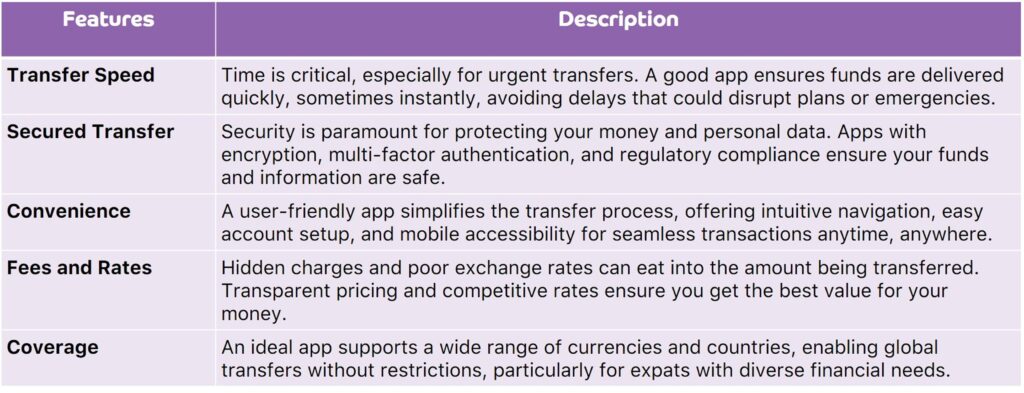

Here’s a breakdown of the key features to consider when choosing the best money transfer app in the UAE and why they matter:

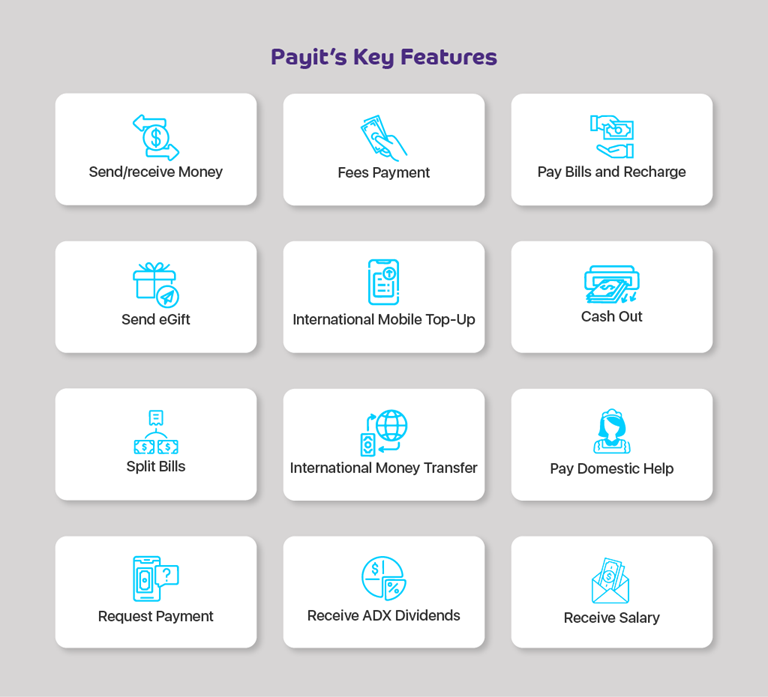

Payit is the UAE’s first fully digital wallet, which was launched by FAB (First Abu Dhabi Bank). Designed for convenience and inclusivity, it caters to everyone, including individuals without traditional bank accounts, providing a wide range of payment and money management solutions.

Here’s why Payit has become the best money transfer app for you:

Also, read Are eWallets the Future of Money Transfers? Discover the Key Benefits

XE is a globally recognized money transfer app known for its user-friendly interface and real-time currency exchange tracking. It’s particularly popular among users looking for transparency and competitive rates for international money transfers.

Remitly is a trusted name in global remittance services, especially for sending money to family and friends in developing countries. It’s designed with a focus on speed, affordability, and accessibility.

A household name in money transfers, Western Union, combines a legacy of trust with modern digital solutions. The app offers a range of options for both senders and receivers worldwide.

Al Ansari Exchange is a well-established remittance and foreign exchange service provider in the UAE. Its app brings decades of expertise into a digital platform for seamless money transfers.

Also, read Understanding Money Transfer Operators: Best Way for International Money Transfer

Here’s how you can ensure you’re getting the best value for your money:

1. Compare Exchange Rates

Exchange rates vary among providers. A slightly higher rate can significantly affect large transfers. Always compare rates from reputable services for competitive pricing.

2. Check for Hidden Fees

Many providers offer low fees but may hide costs with poor exchange rates or hidden fees. Read the fine print and choose services that are transparent about their costs.

3. Evaluate Transfer Speed

Fast transfers aren’t always economical. If it’s not urgent, consider slower, cost-effective methods.

4. Look for Discounts or Loyalty Benefits

Some services provide discounts for recurring transfers, first-time users, or loyalty programs, leading to significant savings over time.

5. Consider Digital Wallets or Apps

Modern money transfer apps and digital wallets typically offer lower fees than traditional banks and provide added convenience with features like QR code payments and real-time tracking.

6. Ensure Security and Compliance

A cost-effective solution shouldn’t compromise safety. Ensure the service provider is licensed and adheres to regulations so your money reaches its destination safely.

With so many money transfer apps available in the UAE, finding the right one can be overwhelming. Each app on this list offers unique features tailored to different needs, whether it’s low fees, fast transfers, or advanced security.

Download the Payit app now and enjoy exclusive offers and discounts with the Letsgo Payit Card.

FAQs

What is the maximum money transfer in UAE?

The maximum transfer limit varies by provider, for example, Payit allows AED 25,000 maximum transfer in a month.

Which online money transfer is the best?

The best online money transfer depends on your needs, but apps like Payit, Remitly, and XE are highly rated for speed and ease of use.

What is the cheapest money transfer?

Apps like Payit and Wise (formerly TransferWise) are known for low fees and competitive exchange rates.

Which app has the lowest transfer fee?

Payit offers 0 fee transfers to 40 countries, making it one of the most cost-effective options.