Home » Cashless Payments Knowledge Hub » How Much Money Do You Need to Save for Rising Rent in Dubai 2025?

If you’re living in Dubai, you’re certainly enjoying zero tax on personal income. More disposable money in your hands. But at the same time, expenses like rent eat up a major chunk of your salary. And when rental prices are increasing continuously, you don’t have the luxury to go unplanned. But how much money do you need to save for increasing rent in Dubai? Keep reading to know.

Dubai has seen a steady increase in rent in recent years. The average rental prices shot up by 10-20% in key communities across Dubai in 2024, says Engel & Völkers. The trend is continuing in 2025.

The Dubai Land Department’s RERA (Real Estate Regulatory Agency) rental index update lets landlords increase rent up to a permissible limit. Experts estimate a 20% increase in rental value for tenants in Dubai. It will have a lasting impact on long-term tenants. And that makes planning and saving for rising rents unavoidable.

Also, read Renting Vs. Buying Property in UAE – Which is Better?

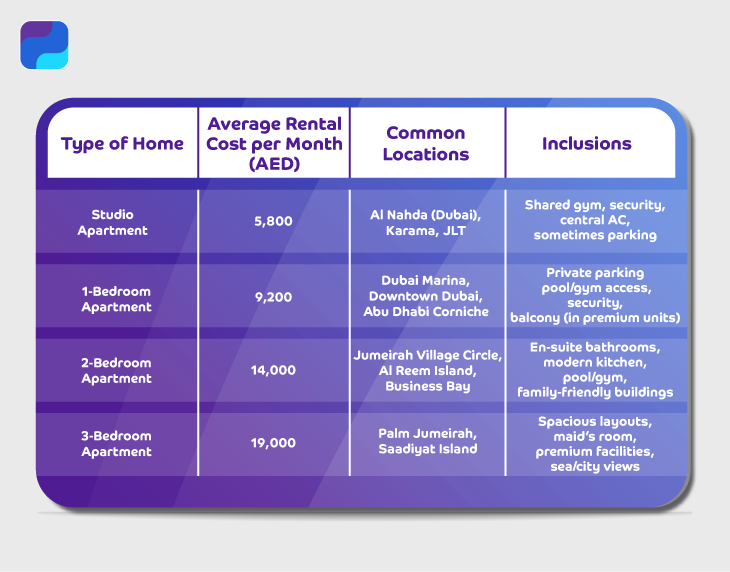

These are the average annual rents in Dubai for 2025:

*“Subject to a yearly contract”

The figures may vary considering location, amenities, and property condition. For instance, picking areas like Downtown Dubai and Business Bay? They tend to be on the higher end of the spectrum.

Your income needs to keep pace to outrun soaring rents. The average salary in Dubai in 2025 is approximately ê 1,85,549 annually, or ê ~15,462 monthly. However, you need to make from ê 2,20,000 to ê 3,60,000 per year if you want to live comfortably. And more so if you have a family.

A simple rule of thumb in finance says that your rent should not exceed 30% of your gross income (which will mostly be your net income as well with no tax).

If we consider that rule, this is how much you need to earn annually to afford the rent:

Consider these saving strategies to stay ahead of increasing rental costs:

Set aside a piece of your income each month only for rent. Automate a fixed transfer right after payday into a separate savings account. It will help cover future rent increases or even unexpected expenses.

Regularly assess your expenses. Identify areas where you can cut back. Start by trimming unused subscriptions, impulse food deliveries, or shopping apps. Use apps like Payit to track where your dirhams go and save with exclusive offers. Reduced discretionary spending frees up funds for rent.

Also, read: Save Big in Dubai – 5 Tricks You Need to Know

Sharing a living space can bring your rental expenses down sharply. Platforms like Dubizzle and Bayut are getting growing listings for shared rentals. It is preferable for you if you’re single or a young professional.

Landlords may offer more favorable rates to you if you are willing to sign longer leases. It provides stability for both parties. Also, don’t hesitate to negotiate renewal terms early.

Areas undergoing development may offer lower rents than established neighborhoods. Look into areas like Dubai South, Arjan, or Dubailand with newer, affordable units. Research and consider relocating to these areas to save on rent. You might also get lucky with better parking, modern buildings, and new facilities.

Beyond cutting costs, it’s smart to explore ways to grow your savings through rewards and incentives. For example, the Payit Dream Draw, where you could win ê 10,000 every month. To qualify, simply be fully KYC-verified and maintain a Monthly Average Balance (MAB) of ê 1,000 in your Payit wallet.

You’ll earn one entry for meeting the MAB and more entries for every additional ê 1,000. It’s a simple way to turn everyday savings into a chance for a big win-while keeping your money accessible and fee-free.

You can’t afford to go without financial planning if you want to spend your money well. Otherwise, you’ll blink, and your money will vanish before you can know. So, understand current rental trends, align your income with housing costs, and implement effective saving strategies.

A landlord can increase rent based on RERA’s rental index. It’s typically capped at 5% to 20%, depending on how far the current rent is below market value.

Yes, rent in Dubai is commonly paid yearly in 1 to 4 post-dated cheques. Though some landlords now accept monthly payments.

Rents are rising due to strong demand, population growth, limited new supply in prime areas, and recovery in the real estate market.

Yes, but only under certain legal grounds, with a 12-month written notice served via notary or registered mail.