Home » Cashless Payments Knowledge Hub » How to Invest in Gold in UAE

Did you know that gold prices in the UAE have surged by 26.37% over the last year?

The likelihood of it dropping anytime soon is incredibly low. This could be the perfect moment to consider investing in or purchasing gold in the UAE.

This article explores different investment options for gold in the UAE in 2024 to maximize returns on this safe-haven asset.

Here are seven ways to include Gold in your portfolio in the UAE.

One of the most traditional ways to invest in Gold in the UAE is to purchase gold bars and coins. The Dubai Gold Souk and reputable dealers like Emirates Gold and ARY Jewellery offer a wide range of gold products.

When buying physical gold, ensure you purchase from authorized dealers and obtain proper certification. The Dubai Multi Commodities Centre (DMCC) lists accredited members for safe transactions. Investing in gold bullion involves purchasing gold bars, coins, etc., which benefit investors in terms of price appreciation over the years.

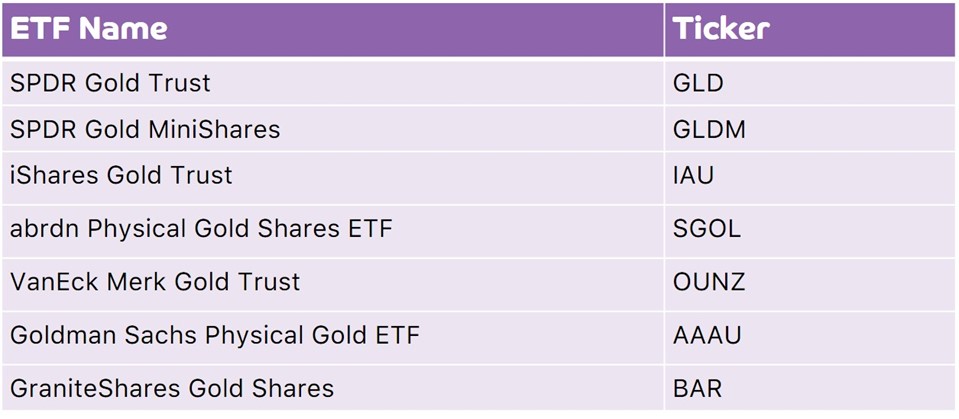

Gold mutual funds offer a way to invest in gold without physically owning it. Gold ETFs are funds that replicate the price of gold and can be traded on stock exchanges. They offer a convenient way to invest in gold without the hassles of physical ownership.

Available Gold ETFs for UAE investors:

Investing in gold mining and production companies provide exposure to the gold market while offering potential dividends and capital appreciation. UAE investors can access gold stocks through local brokers or international trading platforms.

UAE-listed Gold Companies:

International Gold Companies accessible to UAE investors:

Mutual funds focused on gold provide diversification and expert management by investing in a variety of assets related to gold. These funds typically invest in financial instruments related to gold or track changes in gold prices. Gold mutual funds are available through various local banks and financial institutions.

Gold Mutual Funds for UAE Investors:

Some UAE banks offer gold savings accounts, allowing customers to buy, sell, and hold gold without physical possession. These accounts typically allow customers to buy gold in small denominations and provide regular statements showing their gold holdings.

Emirates NBD, Abu Dhabi Commercial Bank (ADCB), and Mashreq Bank are some of the banks in UAE that offer the facility of gold savings accounts.

Read Also: How to Invest Money in UAE for Maximum ROI

Gold bonds are government-issued securities denominated in gold grams. While not widely available in the UAE, some international gold bonds can be accessed through certain brokers. Gold bonds offer interest payments and are backed by gold.

Investors looking to invest in gold bonds should research available gold bond offerings through UAE banks or financial institutions. They also need to compare the available terms, interest rates, and maturity periods to make an informed decision. Note that in this, you receive the principal based on the prevailing gold price on the maturity date.

You can use gold futures to speculate on the direction of gold prices or hedge your current positions.

In the UAE, gold futures can be traded through regulated exchanges like the Dubai Gold & Commodities Exchange (DGCX). However, due to their complex nature, these instruments are generally more suitable for experienced investors.

For Gold Futures, investors have the option of investing in:

The UAE offers diverse gold investment options to suit various investor preferences and risk appetites. While you have a wide range of choices to invest in Gold, ETFs, bonds, and mutual funds are the modern ways to own gold without having to worry about storing it.

Save money with Payit by availing exclusive offers, and you can win gift vouchers by performing monthly transactions.