Home » Cashless Payments Knowledge Hub » How to Open a Payit Plus Account?

Opening a UAE bank account isn’t straightforward since it requires a minimum AED 5k monthly salary. It means those who earn less than AED 5k per month will have to wait for their salaries to be deposited through the WPS system and withdraw their salary from a dedicated kiosk or exchange house by physically visiting there.

This has posed some critical challenges for employees to open a salary account in the UAE, leaving them unbanked and unable to avail of many digital banking services.

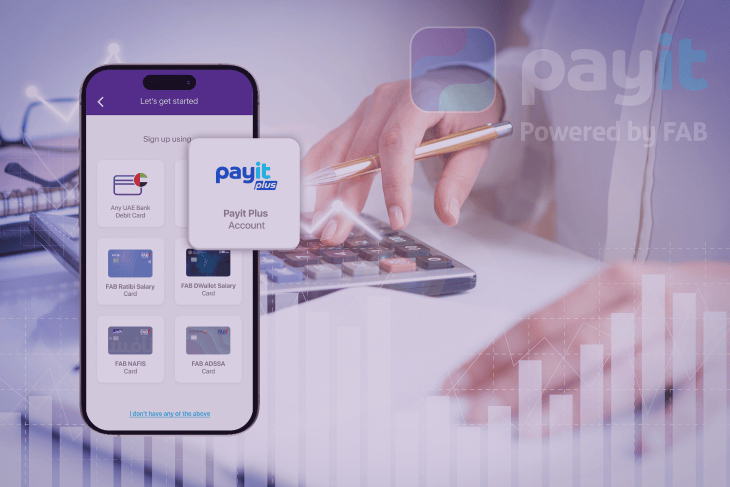

However, the advent of Payit Plus brings a revolutionary solution, offering employees the ease of receiving salaries in their mobile wallet. Let’s see what it is and how to open a Payit Plus account.

Payit Plus introduces a groundbreaking alternative to the WPS method, providing employees with a Payit Plus account. This account enables direct salary deposits into the mobile wallet account within the app. Thus, employers can meet their WPS guidelines and pay their employees instantly.

The employees have their own account within the Payit digital wallet app that they can use to receive their salaries, make bill payments, recharge phones, and transfer money internationally.

A significant benefit of opening a Payit Plus account is that it doesn’t require employees to earn a minimum salary, and it doesn’t charge any account management fees from the employees.

With Payit Plus, you can instantly receive salaries without delays or uncertainties, ensuring timely payments.

Payit Plus ensures swift and hassle-free onboarding for employees, making registration onto the platform quick and seamless. This user-centric approach aims to eliminate any potential barriers during the onboarding process.

You don’t need to maintain a minimum monthly balance for Payit Plus accounts, ensuring the accessibility of the financial management.

You aren’t charged for Payit Plus account services, meaning you don’t need to pay fees to receive e-statements, transactions, and account balance alerts.

You can efficiently manage payments directly through the Payit Plus account. This feature consolidates all financial transactions within one platform, giving users a centralised and organised view of their payment activities.

Payit Plus allows you to access cash withdrawal facilities using the app. You can withdraw cash from any FAB ATM near you.

Seamlessly recharge SIM cards and transportation cards within the app, enhancing the overall mobile wallet experience. Payit Plus goes beyond salary management, offering a one-stop solution for various financial needs.

You get access to multiple shopping deals and offers, making your Payit Plus shopping experience invaluable with discounted prices.

Facilitate faster international money transfers, expanding financial capabilities globally. You can send your salaries to your hometown to more than 200 countries globally at a highly competitive rate.

You can also send eGift vouchers internationally and eGift cards locally to your friends and family, making gifting accessible with just a tap on your phone.

Payit Plus | Open a Payit Plus Account Using Account Number and Mobile Number | EN

Once you complete the NFC validation, the Payit app converts you to the ‘Full KYC Salary Segment’.

Now, you can have your own digital account in an app on your phone without any minimum salary constraint and enjoy certain digital banking services with Payit Plus. This innovative solution addresses the challenges of opening a salary account and empowers employees with a comprehensive mobile wallet experience, redefining financial accessibility for all.