Home » Cashless Payments Knowledge Hub » Offer Instant Cash in 1 Minute to Your Employees Through Ratibi Cards

While it is crucial to incentivize and reward your employees for their excellent work, they also require urgent cash, sometimes in financial emergencies.

Unfortunately, most large organizations have lengthy procedures to follow while applying for instant cash requirements.

Moreover, the bank transfers take some more time to get the money deposited in the account finally, and by the time the employees receive the money, it becomes pointless.

So, is there a way to transfer money instantly to your employees’ accounts?

Let’s talk about the ‘Money on Demand’ feature for the ratibi cardholders and how you can offer instant cash to your employees within a minute following five simple steps.

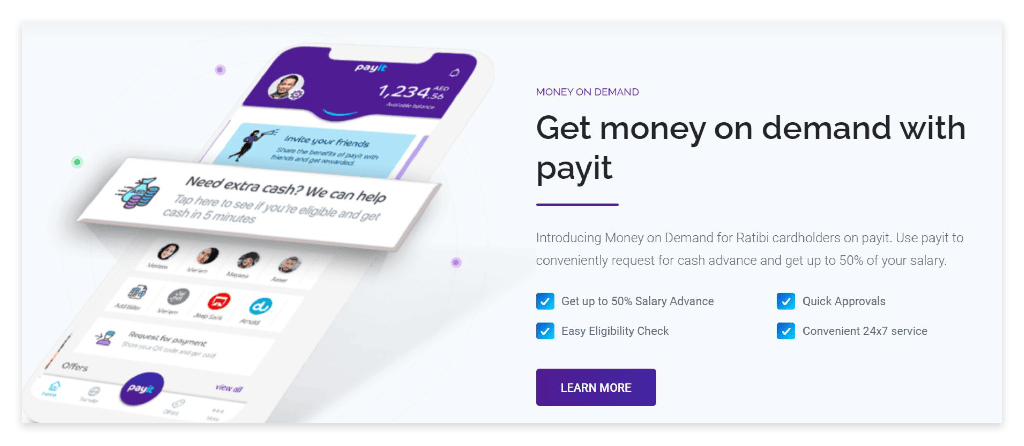

Money on Demand is an exclusive feature of the Payit digital wallet app that allows ratibi cardholders to get instant cash without going through lengthy documentation procedures.

As an employer, you can issue ratibi salary cards to your employees to directly deposit their salaries in their mobile wallets.

Moreover, through ratibi cards, you can also provide instant cash for up to 50% of the employees’ salaries when they are in financial difficulty or in urgent need of cash.

Also read, Unlocking Money on Demand Feature Through Ratibi Salary Cards

So, how do you offer money on demand to your employees instantly?

Let’s see five simple steps to getting urgent money through ratibi cards.

To offer instant cash to your employees when they are in financial difficulty, your employees need to request it through the Payit app on their phones.

When you have already issued ratibi salary cards to your employees, they can download the app to receive salaries to their mobile wallets and make payments from the same.

Let’s see how your employees can receive instant cash on their mobile wallets through their ratibi cards.

Before requesting money from the Payit app, your employees need to link their ratibi accounts with the app to check their balance, send cash, and request urgent cash.

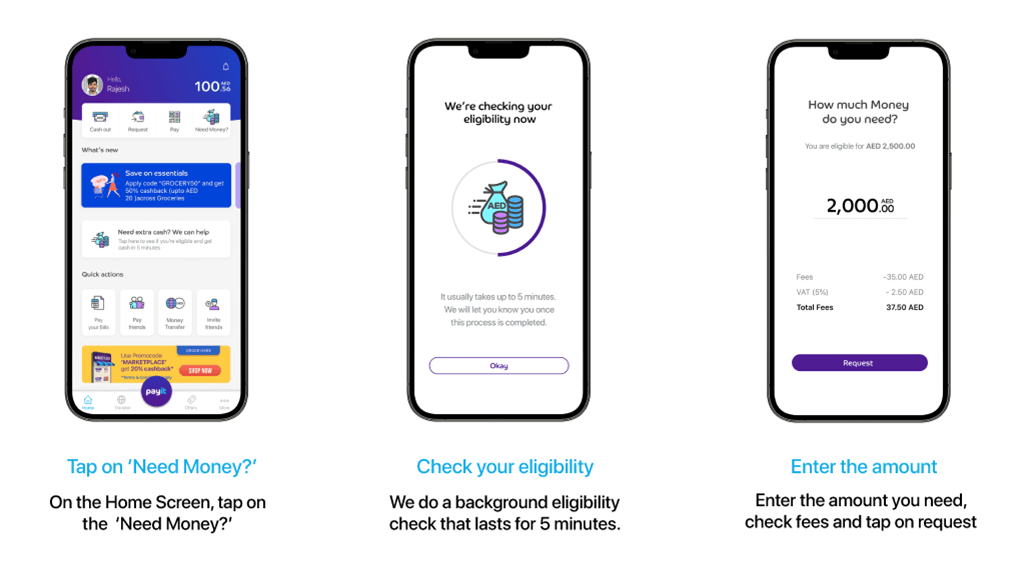

Once the ratibi salary accounts are linked, your employees can tap on the ‘Need Money’ button.

Once you click on ‘Need Money’ on your app, the app will quickly run a background check to verify your eligibility to receive instant money.

When you, as an employer, issue ratibi salary cards to your employees, the bank receives the necessary KYC documents to verify your and your employees’ identities.

Moreover, the salary proof of your employees is also submitted when applying for the ratibi salary cards for your employees.

Thus, it becomes much easier to provide urgent money to your employees through ratibi salary cards since the necessary documentation is already done before.

The eligibility criteria for ‘Money on Demand’ for the ratibi cardholders are as follows:

Thus, if your employee is eligible to receive cash on demand, he can receive up to 50% of his salary as instant cash.

Once your employee is eligible to receive urgent cash, he can proceed further to enter the requested amount.

Remember, he can only request up to 50% of his salary as instant cash through ratibi cards.

Once you enter the amount and proceed further, the app will provide you with the fees applicable to the transaction.

Thus, you will get an idea before you request money on demand how much you will pay for the money you need.

Review your charges and tap on the ‘Request’ button on the app to confirm your transaction.

Note that the amount charged as fees will be automatically applied to your requested amount. Hence, you will receive money net of the applicable charges.

For example, if you requested AED 2,000 and the charges applicable are AED 10, then you will receive AED 1990 (net of AED 2,000 less AED 10) in your mobile wallet.

Once you confirm the amount and fees, you will receive a confirmation message about ‘request processed successfully’ on your screen.

You can download the transaction receipt on your phone as a record. And, within a minute, your requested money will be shown on your mobile wallet.

Thus, Payit makes it highly convenient to offer instant money to your employees through ratibi salary cards.

Can I borrow money from Payit?

You can use ‘Money on Demand’ to receive instant cash in your mobile wallet for up to 50% of your salary.

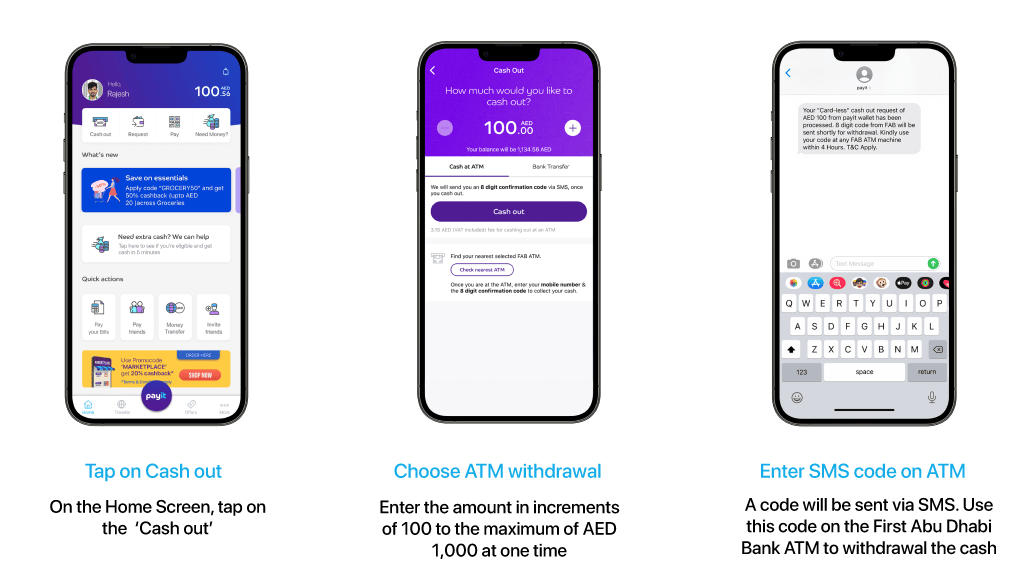

How do I cash out my Payit?

How can I get instant money online in Dubai?

Use Payit digital wallet app to receive instant money online in Dubai through ratibi salary cards.

Which is the cheapest option to receive instant cash in Dubai?

Payit mobile wallet app offers affordable instant cash options in Dubai through ratibi salary cards. It also provides exciting offers and rewards codes to shop from your favorite outlets in Dubai.