Home » Cashless Payments Knowledge Hub » QR Code Payments Explained – How They Work and Why You Should Use Them

Carrying cash or waiting for card machines feels like a burden? Modern tech solves that with digital payment services like QR code payment. It is quick and contactless. Buying coffee from a roadside cafeteria, paying for groceries at Carrefour, or tipping a delivery driver — everything with just a few clicks. And it’s growing faster than you can imagine.

Why? QR code payments are fast, secure, and contactless. And how you can use it? Let us show.

A QR code (Quick Response code) is a two-dimensional barcode. It stores information in a pattern of black and white squares. Traditional barcodes hold data horizontally (those vertical lines with different thicknesses), but QR codes store data both horizontally and vertically. Thus, they can contain more information. When you scan it using a smartphone or QR code reader, they quickly direct you to the encoded data — a website URL or payment information.

In the payment systems, here’s how QR codes function:

These contain fixed information that doesn’t change. For example, a merchant’s static QR code. It always directs payments to the same account. You need to manually enter the payment amount before confirming the transaction. Easy to set up. However, they lack flexibility. Also, no support for transaction-specific details.

These codes are generated uniquely for each transaction. They can include specific details like the payment amount and purpose. Benefits? Enhanced security and the ability to track transactions in real time. Merchants can update the information in dynamic QR codes without changing the code’s appearance.

QR code payments are gaining popularity due to several advantages:

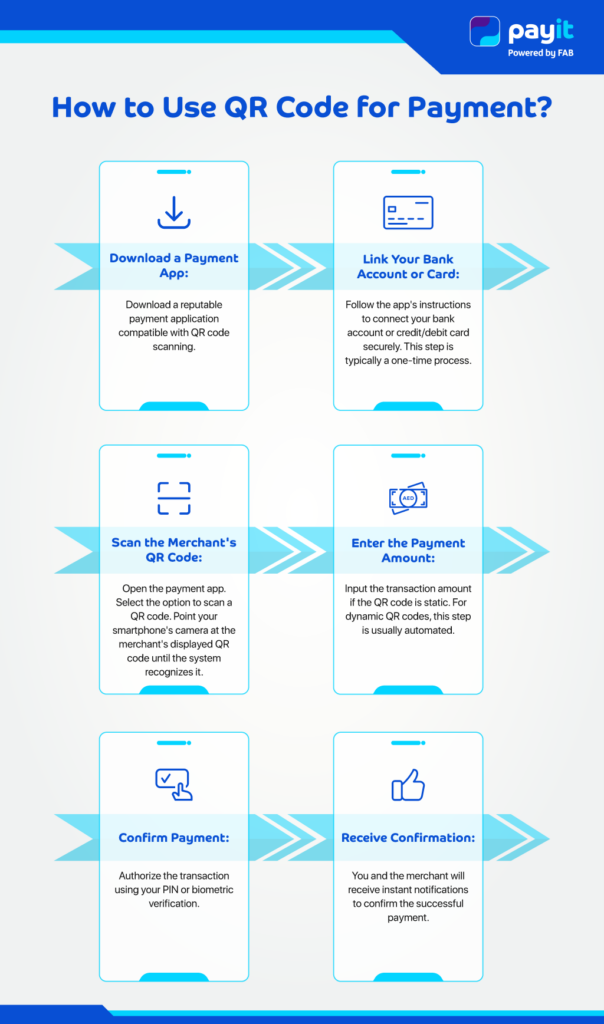

Using QR codes includes a few easy steps:

QR code payments integrate multiple security measures to protect you. They use end-to-end encryption to ensure data confidentiality during transmission. Also, two-factor authentication (2FA), such as personal identification numbers (PINs) or one-time passwords (OTPs), adds extra security.

However, you carry risks like fake QR codes and phishing attacks. How to mitigate these? Place your QR code in a safe place. Scan only trusted codes. Avoid unsolicited links. These steps will significantly reduce potential threats related to QR code payments.

QR code payments are simple and accessible payment methods. Their mainstream adoption speaks volumes about their effectiveness. Just a bit of vigilance and QR payments give you speed, security, and convenience.

Use Payit’s “EasyTransfer” feature for instant transfers.

Open your QR code scanner app, point it at the QR code, and follow the on-screen instructions.

In Payit, select the “Send Money” option, enter the recipient’s mobile number, specify the amount, and confirm the transaction.

Yes, generating static QR codes is free.