Home » Cashless Payments Knowledge Hub » Remit Like a Pro: Avoid These 5 Common Mistakes When Sending Money Abroad

Sending money home from the UAE isn’t just a financial transaction. It’s life-changing, heartfelt, and sometimes a little stressful. It’s a sentimental, life-altering, and occasionally stressful experience. Every transfer counts- paying for school fees, medical expenses, or a family’s dream. However, common remittance errors are surprisingly easy to make, even for seasoned senders. Though they may seem insignificant, a misspelt account number, failing to check transfer limits, and hidden fees can cause serious problems.

The great news? You can send money with complete confidence and prevent money transfer errors if you have the correct information and a trustworthy partner like Payit Remittance.

Let’s examine the top five mistakes people make when sending money overseas, and we’ll teach you how to avoid them like a pro. We’ll also cover common queries along the way, such as how to send money securely, what to do in the event of an issue, and how to ensure a seamless transfer.

Ever finished a late-night transfer only to realise you sent your hard-earned Dirhams to the wrong account, or misspelt a name? You might be surprised to learn how common it is! Inaccurate recipient information entry can result in unsuccessful remittances, delays, or even funds ending up in the wrong account. This can include anything from an outdated IBAN to a typo in the account number.

If you enter the wrong details, your transfer may fail, get delayed, or, in rare cases, go to the wrong person. Don’t panic! Contact our provider’s customer support immediately at help@payit.ae. Payit’s system is designed to catch most common errors before your transfer is processed. But double-checking yourself is always best!

How to avoid this:

Always pause and re-read all details (recipient name, account number, IBAN) before sending.

Save verified recipient templates if you send regularly.

Take a breath, especially after long breaks between transfers.

With Payit Remittance, every transaction is verified in real time. The system checks recipient names, IBANs, or suspicious info, nudging you to review if something seems off. This extra layer drastically reduces human error.

Ever sent money overseas thinking it was zero-fee, only to notice your family received less than expected? Often, hidden fees and poor exchange rates are to blame. Many people focus on the up-front fee, not realising the real cost is in the exchange rate margin and backend charges.

Always look at the total cost of sending money abroad in the UAE: that’s both any visible fee and the exchange rate you’re being offered. The best way is to check the amount your recipient will actually receive, and not just what you’re sending.

How to avoid this:

Use providers that show a transparent, all-inclusive cost before you send.

Compare transfer options: sometimes a higher up-front fee comes with a much better exchange rate, saving you more overall.

If a deal sounds too good to be true, check the rate carefully.

With Payit Remittance, you get transparent, up-front pricing, including the real, live exchange rate. What you see is what you (and your family) get, so you don’t have to guess how much will land in the recipient’s account. This clarity is one of the top remittance tips for expats in the UAE.

Did you know the FX rate (foreign currency exchange rate) can change by the hour, and timing your remittance can make a real difference in how much your family receives? Plus, transfers sent right before weekends or public holidays may get delayed because banks aren’t processing them.

With Payit, your transfers are processed instantly and securely—no waiting for the next banking day. Even around weekends or public holidays, your money moves right away, giving you full peace of mind. For added convenience, you can still plan ahead by checking your destination country’s banking hours and public holidays, especially if the receiving bank has its own processing schedules. Also, use Payit’s handy exchange rate alerts to get the best value for your transfer.

How to avoid this:

If you’re adaptable, keep an eye on the foreign exchange market and attempt to transfer when rates are low.

Steer clear of last-minute transfers before holidays or weekends.

To assist you in selecting the ideal time, use Payit’s app notifications for real-time FX alerts (if enabled).

Payit will notify you of current FX rates through app alerts so that you can seize the most favourable time. That means more savings, less stress, and quicker delivery for your loved ones.

Disregarding local regulations and transfer limits. The amount of money you can send or receive on a daily or monthly basis varies by country and financial service, including banks. Your transfer may be blocked or delayed for additional checks if you inadvertently go over these limits.

Two frequent reasons: sending above the legal or provider-imposed limits, or missing documentation for compliance (like ID proof). If your money doesn’t arrive, check your transaction status, and contact Payit’s support.

How to avoid this:

Verify in advance how much you are permitted to send or receive each day or each month.

Make sure your ID documents and account verification are up to date.

If required, try dividing larger transfers into smaller ones.

Payit Remittance is fully regulated by the UAE Central Bank and abides by all legal rules in both the UAE and your recipient’s country. Payit clearly states monthly transfer limits: AED 3,500 initially, rising to AED 25,000 after full verification.

In today’s digital world, not every money transfer app is equal. Some apps or services look tempting but may not be licensed or secure, putting your funds at risk of delay or loss. Worse, support might be impossible to reach if things go wrong.

Always use a provider that’s licensed and regulated by the UAE Central Bank (like Payit), with visible security protocols and helpful customer support. Never send money through unofficial apps, especially if you can’t find precise contact details or reviews.

How to avoid this:

Look for regulatory certifications and check for user reviews.

Make sure your platform offers customer support via calls, chat, or email.

Trust only brands with a solid reputation and transparent fee structure.

Payit is not just licensed, it’s backed by First Abu Dhabi Bank and overseen by financial authorities. Your international money transfer is protected at every step, right from encrypted login to bank-level security and comprehensive tracking.

Why choose Payit Remittance?

Beyond avoiding common remittance mistakes, Payit offers:

Real-time exchange rates: so you know exactly what your family will receive.

Multi-country support: transfer funds quickly to 200+ destinations.

Trackable transfers: real-time notifications so you’ll never wonder where your money is.

Friendly support: responsive help if you ever need assistance.

Add to that transparent fees, convenience, and a human-first approach, and it’s easy to see why Payit is among the best ways to remit money from the UAE.

How can I avoid remittance delays in the UAE?

Be sure to send early in the week, keep your documents up to date, and use a licensed provider that understands both UAE and recipient country rules. Always check for holidays that could impact transfer times.

Mistakes happen to all of us. But with these simple, practical steps, you’ll be prepared to remit like a pro every time. And with Payit Remittance, you gain peace of mind, knowing your loved ones receive every Dirham quickly, safely, and with no surprises.

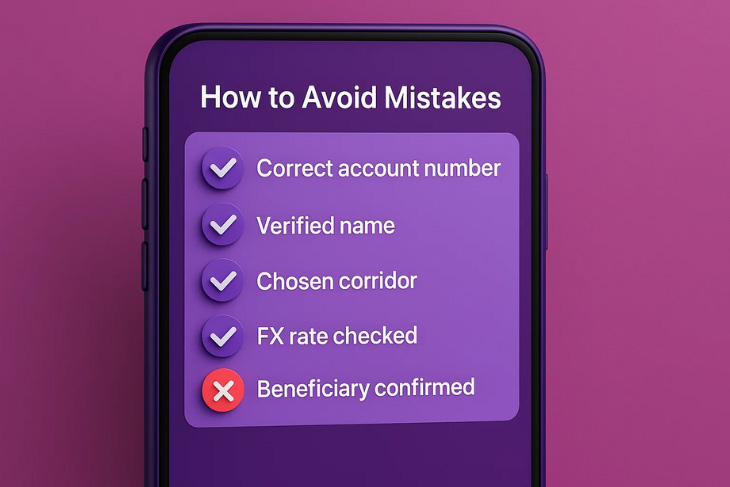

Remittance Pro Checklist: 7 Things to Double-Check Before You Send

Before you hit “Transfer,” run through this list:

Correct recipient name and account details

Accurate transfer amount and correct currency

Clear understanding of total costs and recipient amount

Checked current FX rate

Aware of your and the recipient’s transfer limits

Using a licensed, trustworthy platform

Saved your receipt and tracked your transaction

Ready for Stress-Free Remittances?

Gone are the days of mystery fees, delays, or anxious phone calls. With Payit, you enjoy:

100% transparency on fees and rates

Real-time transfer updates

Bank-level security and regulatory assurance

Try Payit Remittance today, because every Dirham, and every moment, counts.