Home » Cashless Payments Knowledge Hub » Salary Advance Vs. Payday Loans – Which Is Better?

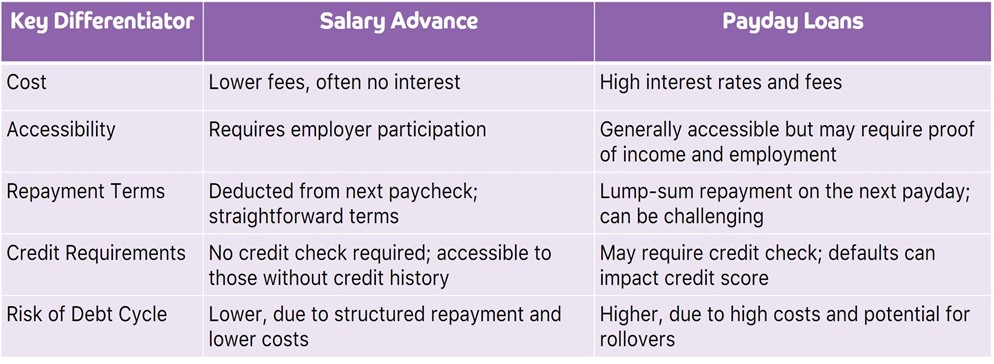

If unexpected expenses looked at our bank balance before knocking on our doors, you’d not be here reading this article. You can take care of big expenses via regular loans, but what about small, sudden requirements before your salary drops into your bank account? You’d turn to salary advances or payday loans. But what’s the difference between the two, and what’s the best for you in any given situation? Let’s understand that in detail here.

You have the option of a salary advance if you’re an employee. It’s early access to the upcoming salary you receive in advance. Usually, it works through a partnership between the employer and a financial provider. You request a portion of your salary before payday, and a bank or digital platform helps process and deliver the money quickly and securely.

Eligibility: You must meet eligibility criteria to use this service. These conditions may include things like being a full-time employee, working with the company for a minimum period, or having a regular monthly salary. You’re eligible for up to 50% of your salary in advance.

Application Process: Typically involves a straightforward request through a platform like Payit. Check your eligibility, enter the desired amount, review the associated fees, and receive funds directly into your account.

Repayment: The advanced amount and any applicable fees are usually deducted automatically from your next paycheck.

Payday loans are short-term, high-interest loans to provide quick cash before your next paycheck. Usually, independent lenders offer this service and not your employer.

Application Process: You can apply directly with payday lenders. Providing proof of income and employment is necessary. The application process is usually quick, and you get funds quickly.

Loan Amounts: Payday loans typically offer small amounts. They’re often up to 50% of your monthly salary.

Repayment: Repayment is usually due on your next payday with the loan plus interest and fees. You ought to furnish a post-dated cheque or approve automatic bank withdrawal.

If you don’t want to get into the hassle of advances and loans, and need instant cash, then onDemand Payit is the best alternative. With this option, eligible users can receive instant cash straight into their Payit wallet that can be used to pay bills, school fees, recharge SIM cards, or just withdraw the cash.

Here’s how to apply for onDemand Payit:

Download the Payit mobile wallet app, register yourself, and just tap on onDemand Payit to check your eligibility. If you are a Payit Plus user, watch this video to see how to apply for instant cash.

When financial crunches hover over your head, you want to select the fastest and most cost-effective option. OnDemand Payit is a practical alternative to high-cost payday loans in such a situation. You get immediate access to funds with favorable terms.

You can check your instant cash eligibility directly through the Payit app.

The available amounts range from a few hundred Dirhams to several thousand Dirhams, depending on your income and eligibility criteria.

Payit offers short-term credit through onDemand Payit to meet immediate financial needs.

Payit is one of the best apps in the UAE for instant, low-cost cash needs without credit checks.