Home » Cashless Payments Knowledge Hub » Save Big in Dubai – 5 Tricks You Need to Know

Many people dream of living in Dubai, drawn to its luxurious lifestyle, modern amenities, and vibrant culture. However, to sustain a comfortable life in Dubai, you must manage your finances wisely.

While it may seem complex initially, with a disciplined approach to saving and investing, you can quickly achieve your financial goals in Dubai. This article will cover 5 tricks for saving money in Dubai.

Here are 5 secret tips and tricks that you can follow to secure your financial future.

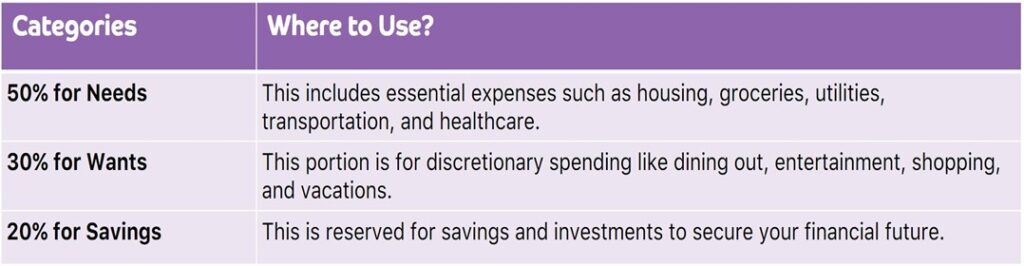

The 50:30:20 rule is a golden budgeting technique that allocates your income effectively. This rule suggests using your income through categories to save money:

For instance, if your monthly income is AED 20,000, you would allocate AED 10,000 for needs, AED 6,000 for wants, and AED 4,000 for savings. Sticking to this rule ensures you cover your essentials without compromising your leisure activities while building a financial cushion.

Investing and diversifying your portfolio is crucial for growing wealth over the long term in Dubai. Diversification involves spreading investments across various asset classes to reduce risk and enhance potential returns. For Dubai residents, there are several attractive investment options to consider, such as real estate, stocks, bonds, and gold.

Real estate is a popular choice due to the city’s thriving property market and opportunities for rental income and capital appreciation. Stocks and bonds offer another avenue, with access to both local and international markets providing a balanced mix of growth and stability. You can also invest in Gold, which remains a traditional store of value, often seen as a hedge against inflation and currency fluctuations.

By diversifying across these assets, investors can mitigate risks associated with market volatility and economic downturns. For instance, while real estate might be subject to market cycles, stocks and bonds can offer liquidity and dividend income.

You can use various coupons as well as discount programs to reduce your expenses in Dubai. Buying in bulk or value pack deals can save you a considerable amount per month.

For example, the Letsgo Payit Card has many discounts and offers on dining, shopping, entertainment, and more. If you plan an outing, you can enjoy up to 50% off on local activities and attractions with Rayna Tours or get 10% off at Brands For Less on web and app purchases with the Letsgo Payit card.

You can also use the Payit mobile app to monitor your spending and manage your finances effectively. The app’s user-friendly interface allows you to keep track of your transactions, check your balance, and ensure that you stay within your budget.

Excessive debts with high interest, especially credit card debt, can easily become unmanageable. Consolidating your debts can lower your interest rates and simplify your repayments.

You can combine multiple debts into a single loan with a lower interest rate. Also, use credit cards wisely by paying off the balance in full each month to avoid interest charges.

By controlling your debt and using credit responsibly, you can avoid unnecessary interest payments and keep your finances in check.

Adopting a do-it-yourself (DIY) approach can lead to significant savings on everyday expenses. From meal preparation to household maintenance, taking matters into your own hands can cut costs.

By incorporating these DIY practices into your routine, you can reduce your reliance on costly services and products.

Saving money in Dubai requires a strategic approach and a willingness to be disciplined with your finances. By following the tricks mentioned in this article, you can effectively manage your finances and enjoy a comfortable lifestyle in this vibrant city.

Download the Payit mobile wallet app and manage your expenses like never before. Make monthly transactions of AED 1,000 and get 1% cashback on your card.