Home » Cashless Payments Knowledge Hub » Types of Financial Frauds – How to Stay Safe

Digital life in the Emirates is moving fast. Nine in ten adults bank on their phones. Contactless payments are routine. Online transfers settle in seconds. Yet the same speed that delights honest customers also attracts fraudsters.

In 2024 alone, more than 40,000 UAE residents lost money to scams of every kind, from bogus investments to fake courier texts, according to a joint study by the Global Anti-Scam Alliance and BioCatch. But how to protect yourself? Let’s learn.

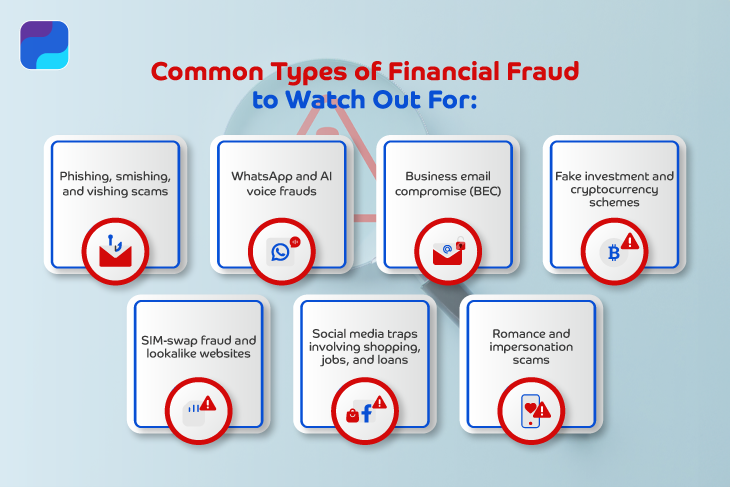

New scams are entering the market fast. Here are the main scam types:

Scammers send fake emails (phishing), SMS (smishing), or make calls (vishing), and pretend to be from banks or the government. Their goal? To fool you into sharing your PIN, OTP, or card details.

Also, read 10 Ways Scammers Can Scam You in the UAE

You may get a message from a ‘friend’ or ‘official’ on WhatsApp. They’d ask for urgent money. Sometimes, they even use AI to clone voices. So, the call sounds real. It’s not.

Hackers break into a company’s email system and send fake invoices or payment requests. The email looks genuine. But the money ends up with criminals.

Fraudsters promise you high returns through “exclusive” forex or crypto plans. They show fake profits early on, then disappear with your money.

Criminals get a copy of your SIM card and access your OTPs in SIM-swap fraud. And in other cases, they create websites that look like Etisalat or banks. They steal your login info once you enter it there.

Instagram or Facebook Ads might offer cheap electronics, fake jobs, or instant loans. They ask for upfront payments or personal information. Later, vanish.

Scammers pose as needy families or fake charities during Ramadan or crisis events. They tug at your emotions. Then, misuse donations for personal gain.

Someone builds a bond with you online. Later, pretends to face an emergency. They ask for money for surgery, a visa, or a stranded situation. It’s all fake.

Cards and ATMs: Cover the keypad. Enable transaction alerts. Deactivate overseas usage when you travel inside the GCC.

E-wallets: Keep your device OS updated. Jailbreaks remove critical security layers.

Crypto accounts: Use hardware wallets for long-term storage. Whitelist withdrawal addresses.

Work e-mail: Deploy multifactor authentication. Teach staff to confirm account changes by voice call before releasing funds.

Family phones: Etisalat’s Kids SIM offers built-in parental controls for ê 49 per month. Cheap insurance against accidental clicks.

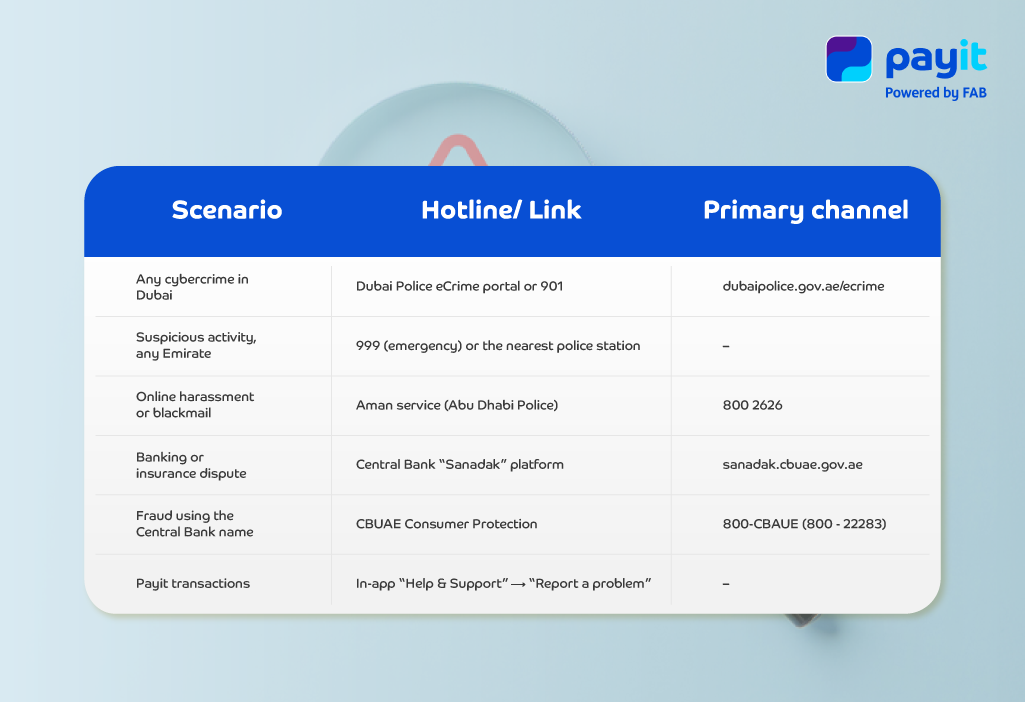

You can also file complaints via the federal portal u.ae, which aggregates links to every police cyber-safety unit. Why delay? Faster reports mean increased chances of fund recovery.

We can’t stop financial frauds but we can take measures to avoid these scams.

Fraudsters evolve each quarter. But good habits? Timeless. Just a few extra steps to secure your payment channel can save your hard-earned money. Trust your skepticism. Double-check every message. Keep the Payit Protects checklist within reach.

Stay Smart. Stay Safe. Spot Scams Before They Spot You.