Home » Cashless Payments Knowledge Hub » Want to Buy a New Car? Why the 20/4/10 Rule Should Be Your Go-To Guide

Buying a new car is a dream come true for many people. It is not just a means to commute but also a major milestone. However, one common mistake that people often make when buying a new car is spending more than they can afford and it results in a spiral of large EMIs. If you are wondering if there is any way to avoid this, the answer is yes.

It is possible by following the 20/4/10 rule. In this article, we will cover this rule in detail to help you make the process of buying a new car more enjoyable while avoiding financial burdens.

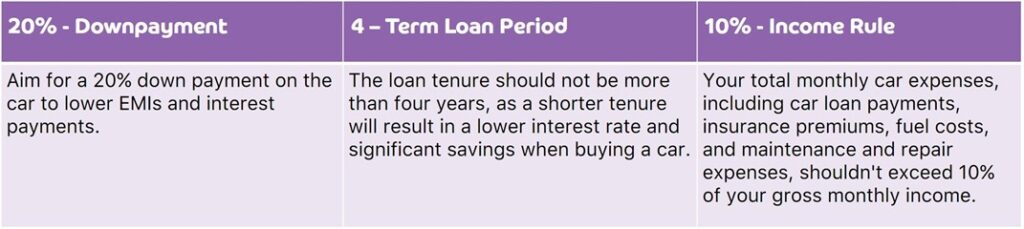

The 20/4/10 rule is made of three components.

The 20% rule suggests that you should pay at least 20% of the car’s purchase price as downpayment. This is helpful in the long run as the larger the amount you pay upfront equals lower EMIs and interest payments.

For instance, if you pay a 20% down payment on a car costing AED 150,000, you spend AED 30,000. This significantly reduces the EMI amount per month. Take it as you have a tenure of 36 months; the EMI for AED 150,000 per month would be AED 4,166.66. However, with a 20% down payment, it reduces to AED 3,333.33.

This lowers your overall debt payments and helps you manage your monthly bills better.

The second component of the rule is related to the overall tenure of the loan. It says that the tenure should be more than four years. Short tenure means a lower interest rate and even a 1% lower rate can result in significant savings when you are buying a car.

For instance, if the interest rate on an AED 150,000 car for a 5-year tenure is 6% (AED 9,000), and for a 4-year tenure, it is 5% (AED 7,500), you still save money.

If you wish to reduce the interest payments, you can also work harder towards saving a hefty sum for a down payment. This way, even a shorter tenure would not financially burden you.

The final part of the rule suggests that your total monthly expenses for the car should not be more than 10% of your monthly income. This includes:

Limiting car-related expenses to 10% of your income ensures that your vehicle drives you to your destination without a financial burden. You can also save more by managing your payments more efficiently with smart apps such as Payit mobile wallet.

Let’s consider an example to see how the 20/4/10 rule works. Aliah earns AED 20,000 per month before taxes. She is interested in a car priced at AED 130,000.

Following the 20/4/10 rule:

According to the 10% rule, her total monthly car expenses should not exceed AED 2,000. However, her car loan EMI itself has crossed this limit, which means she either needs to buy a less expensive car or increase her down payment amount to follow the 20/4/10 rule and live a comfortable life.

Following the 20/4/10 rule offers various advantages for you if you are buying a new car.

When you make a large down payment, this means you have already been disciplined to save this amount. It gives you a sense of responsibility and also helps you reduce your EMI amount. The 20/4/10 rule helps maintain a healthy balance between your car expenses and other financial obligations.

A shorter loan term and larger down payment mean you will have a lower debt. This can be particularly beneficial if you are aim to achieve other financial goals, such as creating an emergency fund or saving for a home.

Following the 20/4/10 rule can help you to save more over time. Lower interest costs, reduced insurance premiums (due to a smaller loan amount), and a more manageable payment schedule result in more savings.

If you are looking to manage your monthly payments efficiently and save money, Letsgo Payit Card can be a useful resource for you. With Letsgo Payit, you can make online payments for utility, travel, dine-outs, and much more while enjoying discounts with leading brands such as Agoda, the ENTERTAINER, Jumeirah Hotels, Namshi, DUBZ, Reebok, and more.

The 20/4/10 rule helps you experience a smoother car buying experience, especially if it is your first car. Focus on saving for a large down payment as per the rule and do not keep the loan tenure more than 4 years.