Home » Cashless Payments Knowledge Hub » How to Invest Money in UAE for Maximum ROI

To maximize your return on investment (ROI) in the UAE, it’s essential to embrace a strategic and diversified approach. As an investor, you must understand the various asset classes and investment vehicles available and how to leverage them effectively to build a well-balanced portfolio.

Whether you are a seasoned investor or just starting your investment journey, this article will help you navigate the UAE’s investment space and earn maximum ROI.

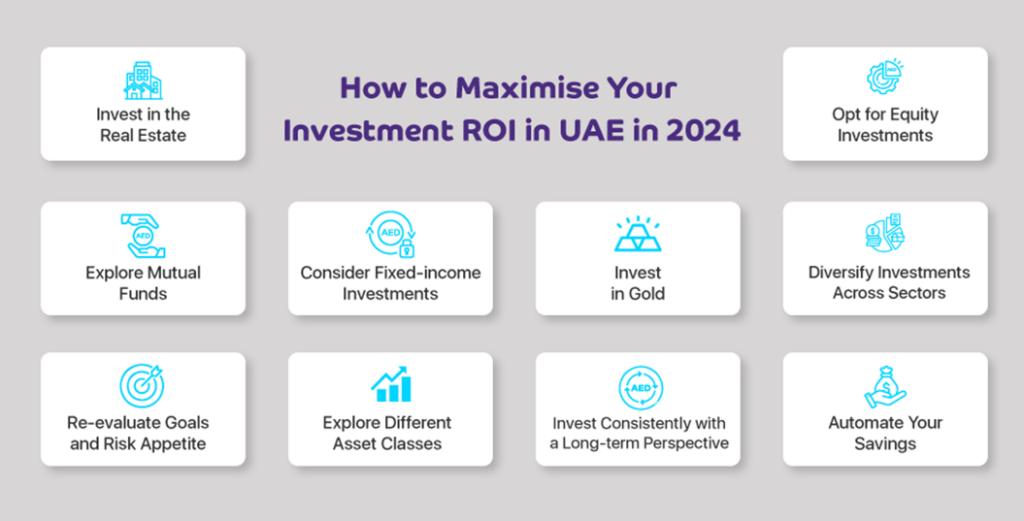

Here are 10 ways to help you get the maximum return on your investment in the UAE in 2024.

The real estate market in the UAE, especially in Dubai and Abu Dhabi, presents appealing prospects for both increasing capital value and generating rental income. To maximize your ROI in this sector, you can research areas with high demand, such as Dubai Marina, Downtown Dubai, or Yas Island in Abu Dhabi.

You can also select off-plan properties that come at a discount and offer significant capital appreciation upon completion.

If you’re not keen on investing directly in real estate, another option is to invest in a Real Estate Investment Trust (REIT).

Equity investments in the UAE stock markets can offer substantial growth potential. To optimize your equity investments:

You can easily tap into professional management and diversification through mutual funds. Before investing, look at historical returns, consistency, and risk-adjusted performance.

Mutual funds also carry certain fees, such as management fees, entry/exit loads, and other charges that can impact your returns. Thus, you need to consider them when investing in mutual funds of your choice.

Regular monitoring and rebalancing of your mutual fund investments can help you maximize ROI over time.

Fixed-income investments can provide stability and regular income to your portfolio. In UAE, you can invest in the below fixed income tools:

Read Also: Simple Saving Tips for Investment Beginners

To incorporate gold into your investment strategy, you can consider the below gold investment options available in the UAE.

Based on your goals and preferences, you can allocate a small portion (5-10%) of your portfolio to gold for stability.

The UAE actively promotes sectors like IT and renewable energy, offering growth opportunities for investors. To capitalize on these emerging sectors, you can select sector-specific companies.

For example, to leverage investment in the rising tech sector, you can use platforms like Dubai Future District Fund to get insights into promising tech ventures. You can also invest in tech-focused ETFs, providing broad exposure to the growing UAE tech sector.

Note that while offering maximum ROI, sector-specific investment also comes with higher risks. Thus, understand your risk appetite before making an investment decision.

Aligning your investment strategy with your financial situation is crucial for long-term success. Your financial goals and risk-taking ability will change over time.

For example, at 25 years, you might be ready to take risk of investing 60% of your funds in equity while at the age of 45, you may want to reduce that to just 25%.

Remember that a well-thought-out investment plan aligned with your circumstances is key to long-term success.

You can spread investments across asset classes like stocks, bonds, real estate, and alternative investments. Here is what else you need to consider:

Consistency and patience are key to investment success. To implement a disciplined approach, set up a regular investment plan. You can use strategies like cost averaging to invest consistently over time.

Also, avoid making knee-jerk reactions to short-term market fluctuations. In the long run, short-term noise has no impact on your returns. Thus, develop a long-term perspective while investing in the UAE for maximum ROI.

Read Also: How to Invest AED 1,000 in the UAE

This is the last one on our list. By automating your savings such as via a Systematic Investment Plan (SIP) in mutual funds or by opening a recurring deposit in a bank, you can invest regularly.

This promotes a disciplined approach to investing and steadily grows your wealth over time. Even if it’s a small amount, it’s important to invest. Starting to invest at an early stage can lead to significant returns through the power of compound interest, even with small initial investments.

Maximizing your ROI in the UAE requires a diversified approach. By carefully considering each of these strategies and tailoring them to your financial situation, you can build a balanced investment portfolio designed for long-term success.

Manage all your payments from the Payit mobile wallet app and get exclusive offers and deals every week.

Disclaimer: This article was last updated on 16th Aug 2024.