Home » Cashless Payments Knowledge Hub » How to Get Instant Cash Loan in the UAE

Unexpected expenses can throw you off balance. A medical emergency, a car breakdown, or an unplanned bill — finding an instant cash loan in a hurry is tricky at times. Waiting for days or dealing with complex paperwork is a luxury you can’t afford when every second counts.

So, what’s a quick and reliable way out? Instant cash loans are the answer.

And how can you avail that? Let us help.

An instant cash loan is a short-term loan that provides immediate funds for emergencies. Common uses are medical bills, urgent payments, or unforeseen expenses. These loans usually have quick approval processes and minimal documentation.

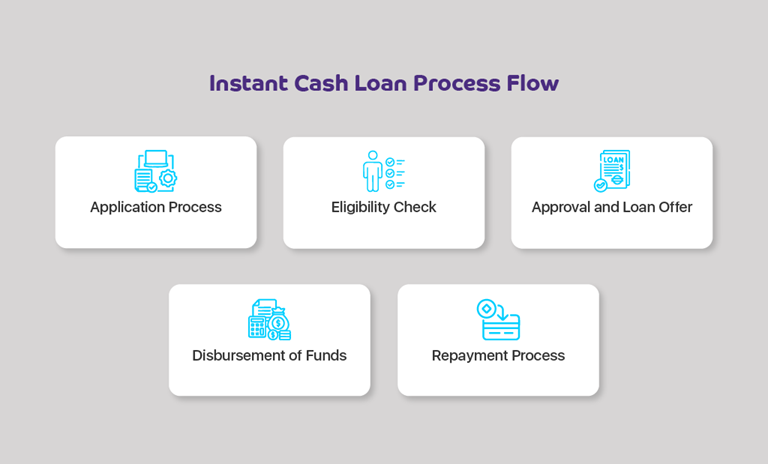

Quick cash loans in the UAE offer fast access to money right when you need it the most. These loans typically have a simple application process and leverage technology to ensure fast approvals and disbursals. Here’s a step-by-step breakdown of how they work:

These are the most popular ways to get instant cash loans in the UAE:

Mashreq’s Flash Cash offers instant funds for travel, school fees, or medical needs. The application requires an Emirates ID and a salary account with any bank.

However, the eligibility includes a minimum monthly salary of ê 5,000, and only UAE residents who are at least 21 years old can apply. This means those earning less than a monthly ê 5k can not use this loan.

Citi’s Ready Credit provides a high-limit credit option with instant cash access, offering up to six times your salary or up to ê 175,000—whichever is lower. Funds are directly deposited into your UAE bank account upon approval.

However, to be eligible, your minimum monthly income must be of ê 8,000 and age 21 or above. However, if your salary is ê 8,000 or less per month, you are not eligible for this loan.

Mashreq’s NEO Credit offers you instant personal loans up to ê 35,000. Repayment terms range from 2 to 18 months. However, you must earn a minimum monthly salary of ê 5,000 to be eligible for NEO Credit, and their interest rates range from 19.49% to 29.49%, which is quite costly.

CashNow is a mobile application that provides instant cash loans. You can get from ê 500 to ê 10,000. To be eligible, you need to be a UAE resident, 20 to 55 years of age, and have a personal bank account. However, they charge a hefty interest of 39.96% per annum.

Each provider offers unique benefits. Let’s break it down which are the features that you must look for in a provider:

However, if you don’t want to get into the trouble of securing a loan and paying interest, then there’s the best alternative to an instant cash loan in the UAE. Payit’s ‘Money on Demand’ service offers instant cash without any interest, and you get it with just a few taps on the phone from anywhere.

Payit, powered by First Abu Dhabi Bank, offers ‘Money on Demand’ for Ratibi cardholders. Eligible ratibi card holders can request a cash advance and receive up to 50% of their salary directly in their Payit wallet.

Your employer must be registered with the Payit app to be eligible for Money on Demand. Not listed yet? Ask your HR department to sign up. If your monthly salary is between ê 1k and 5k, then you can enjoy instant cash from the app and manage your payments seamlessly, along with exclusive offers and deals.

Instant cash loans provide valuable support when you need money fast. Each provider offers unique benefits, but you need to choose based on what works best for you.

If convenience, no interest, and transparency matter most, Payit Money on Demand is a reliable choice for instant cash. Experience quick, hassle-free borrowing with no interest and fixed fees with the Payit app.

How can I borrow instant cash in the UAE?

Payit offers a ‘Money on Demand’ service through which eligible users can get up to 50% of their salary as instant cash.

Can I get a loan with an Emirates ID?

Some providers offer instant loans when you produce your Emirates ID, but you must be careful when selecting the provider.

Does Payit give loans?

No, Payit does not offer loans. Payit is a mobile wallet application, and you can send/receive money, pay bills, transfer money, receive instant cash through a Ratibi card, and do much more.