Home » Cashless Payments Knowledge Hub » Cashback vs. Reward Points – Which Loyalty Program Is Better for You?

The UAE’s loyalty program market is expected to escalate to $2.2 billion by 2028. And what’s the reason behind this whopping number? It’s simply discounts, free delivery, cashback, and early access to sales. When brands reward customers with all these benefits for good products, they reward them with loyalty, and vice versa.

Customers simply want good value for their money, and what’s better than added rewards? And these rewards majorly come in two models: cashback and points-based rewards. But which one is beneficial for you? Let’s understand it together.

Cashback is a type of loyalty reward. Here, you get a percentage of the money you spend back as cash. Simple. The more you spend, the more cash you earn. For example, you pay AED 500 for groceries using a card that offers 2% cashback. So, you’ll get AED 10 back into your account. Usually, the cashback is credited instantly and sometimes monthly.

Many credit cards, digital wallets, and apps offer cashback on fuel, groceries, utility bills, or online shopping. You have the freedom to use cashback however you like — to pay bills, save, or spend again. It’s perfect for you if you want a clear and direct financial return. No waiting, no complicated redemptions.

A points-based loyalty system credits you with points for every transaction or purchase. You can later redeem these points for discounts, vouchers, gifts, flight miles, or exclusive offers. Spend more, earn more.

Let’s take the same AED 1,000 spending example. It might give you 100 points. Stash 1,000 points, and you might redeem them for an item or service worth AED 100. It depends on the value assigned by the program.

Point systems are popular with banks, telecom providers, supermarkets, and travel apps. Etihad Guest and Emirates Skywards are well-known examples. There, points (or miles) can be used for free flights or upgrades. Points programs often come with tier levels, bonus offers, and partner networks.

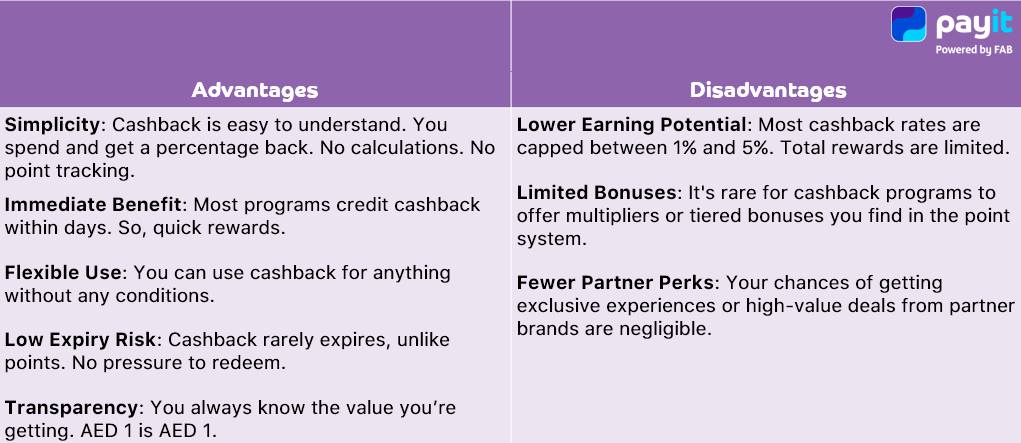

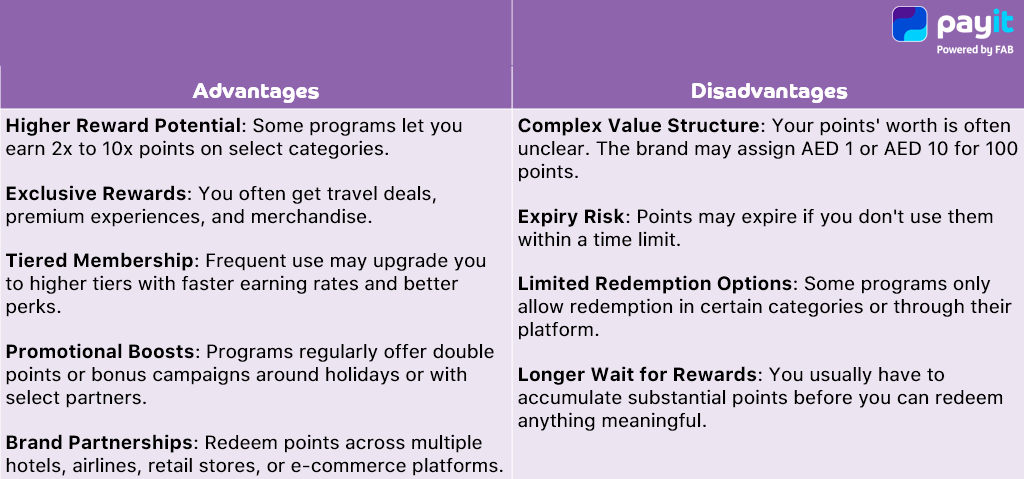

Let’s see how cashback and reward points loyalty programs differ in terms of benefits and functionality.

Cashback programmes allow you to earn a fixed percentage of your spending back in the form of cash. On the other hand, points-based systems reward you with points for every dirham you spend, which you can later redeem for various rewards.

With cashback, the reward is straightforward—it comes in the form of actual cash added back to your account. In contrast, points-based programmes offer rewards in the form of redeemable points that you accumulate over time.

Cashback offers maximum flexibility, allowing you to use the rewards to pay bills, shop, or save. In comparison, points-based rewards are limited to redemption through specific catalogues or partner networks, which may restrict your options.

Cashback programmes are incredibly simple to use, with no extra effort required after making a purchase. Points-based systems require a bit more involvement, as you need to track your points and plan how and when to redeem them.

Cashback rewards are highly flexible, as you earn them regardless of where you shop or what you buy. Points-based programmes are usually tied to specific partners or services, which can limit where and how you earn rewards.

Cashback typically carries a low expiry risk since the cash you earn often doesn’t expire. In contrast, points can come with expiration dates, making it important to use them before they’re lost.

Cashback is best suited for individuals who prefer quick, no-strings-attached savings that they can use however they like. Points-based programmes are ideal for users who enjoy collecting and redeeming points for curated rewards, experiences, or travel perks.

Before jumping into selecting one, consider your preferences. Prefer immediate rewards and straightforward benefits? Want unrestricted use of rewards? Cashback is better for you. Inclined towards accumulating points for larger rewards? Not in a rush for immediate rewards? Points are more appealing.

Want to get exclusive deals and discounts on different payments? Payit got you covered! Download now. What’s more? Stay tuned for our exciting loyalty program.

No, cashback is not entirely free; it’s a rebate on your spending.

In the UAE, cashback is not taxable for individuals.

Some programs let you convert reward points to cash, but it depends on the provider.