Home » Cashless Payments Knowledge Hub » 5 Common Mistakes to Avoid While Sending Money from UAE to Philippines

The UAE Dirham (AED) and Philippine Peso (PHP) exchange rate is highly volatile and can change rapidly based on real-time events. Thus, you must be extra careful when sending money from the UAE to the Philippines.

Whether you support your family back home or make other financial arrangements, ensuring your hard-earned money reaches its destination safely and cost-effectively is crucial. This blog explains people’s five most common mistakes when transferring money from the UAE to the Philippines.

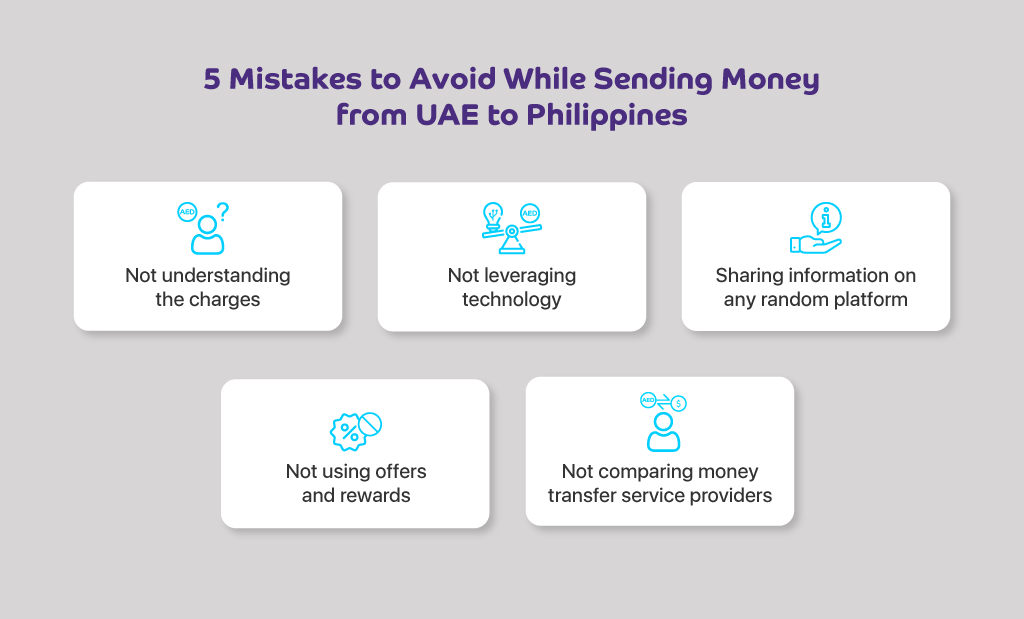

One of the most significant mistakes people make when sending money internationally is needing to comprehend the associated charges. Exchange rates, transfer fees, and hidden costs can significantly affect the final amount received in the Philippines.

Here’s a list of fees that could affect the final amount received in the recipient’s account in the Philippines:

Before choosing a service provider, carefully review these fees, their structure, and exchange rates. It’s often better to opt for transparency and competitive rates over seemingly low fees.

Failing to use technology to your advantage is a mistake. Technologies like mobile wallets offer convenience, speed, and competitive rates. Mobile apps make it easy to track transactions and access historical data. Embrace the convenience of digital solutions for your financial transactions.

Also, read What’s the Best Way to Send Money to Your Home: Effortless Money Transfers in UAE.

Protecting your personal and financial information is paramount when sending money abroad. Avoid sharing sensitive data on unsecured platforms, including public Wi-Fi networks or suspicious websites. Always use a trusted and secure money transfer service provider. Look for encryption and security protocols to ensure your data remains confidential.

Many money transfer service providers offer promotions, discounts, and rewards for frequent users. Ignoring these offers is a mistake that can cost you valuable savings. Keep an eye out for loyalty programs, referral bonuses, and limited-time promotions. Over time, these perks can add up and reduce your overall transfer costs.

One of the most significant mistakes is not shopping around for the best money transfer service provider. Different providers offer varying exchange rates, fees, and delivery options. Take the time to compare several options to find the one that best suits your needs. Don’t settle for the first provider you come across; a little research can go a long way in saving you money.

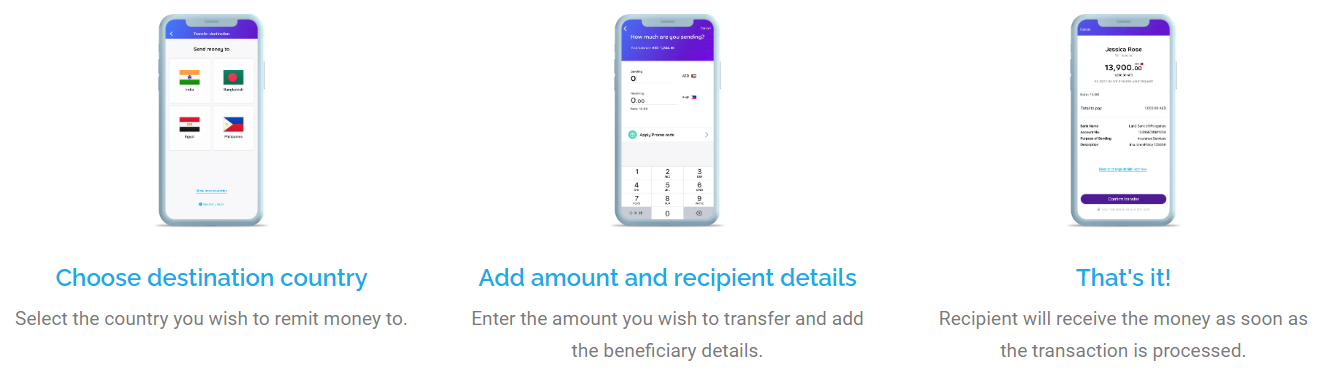

Payit mobile wallet app enables you to send money from your account or digital wallet to an account in the Philippines with just a tap. With the Payit app, you can

Follow these steps if you wish to use a money transfer service by Payit:

Succinctly understand various rates related to international money transfers, and research about the money transfer service providers to safely transfer your hard-earned money to your family staying in the Philippines.