Home » Cashless Payments Knowledge Hub » What’s the Best Way to Send Money to Your Home: Effortless Money Transfers in UAE

While the expat population comprises almost 88.52% of the country’s population, it is no wonder why the UAE is the second largest contributor in the world in terms of foreign remittances.

While many of you think that exchange houses offer a cheaper rate or that online banking is the most convenient way to transfer money, the reality is that the former could be more convenient while the latter is way too costly.

So, which one is the best way for international money transfers?

Let’s analyze the most popular international money transfer methods from the UAE and understand their pros and cons.

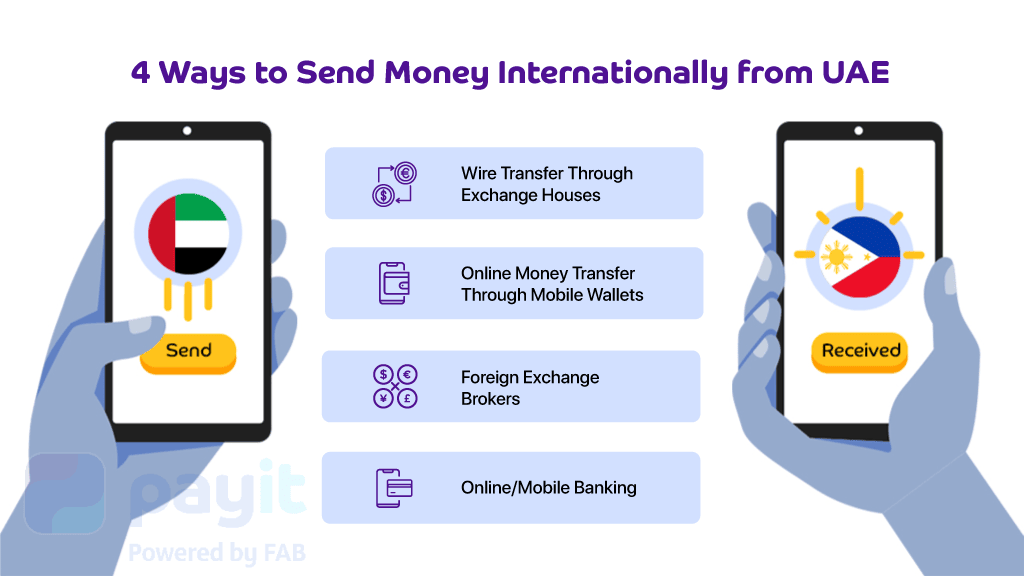

The UAE’s expats prefer four ways the most to send money to their home countries: wire transfer, mobile wallet transfer, transfers through foreign exchange houses, and online banking.

Here’s an explanation as to how each method works.

A wire transfer electronically transfers money from one entity or person to another, often across different banks or financial institutions. The bank acts as an intermediary for the payment process when using a wire transfer.

The sender first sends the money to their bank, then forwards it to the recipient’s bank. Finally, the recipient’s bank releases the funds to the intended recipient.

Most money exchange houses, such as Al Ansari, Al Rostamani Exchange, etc., use wire transfers to send your money from UAE to India. However, these exchange houses charge certain fees that are costlier than the online money transfer service through mobile wallets.

Also, read 5 Best Ways to Send Money from UAE to India.

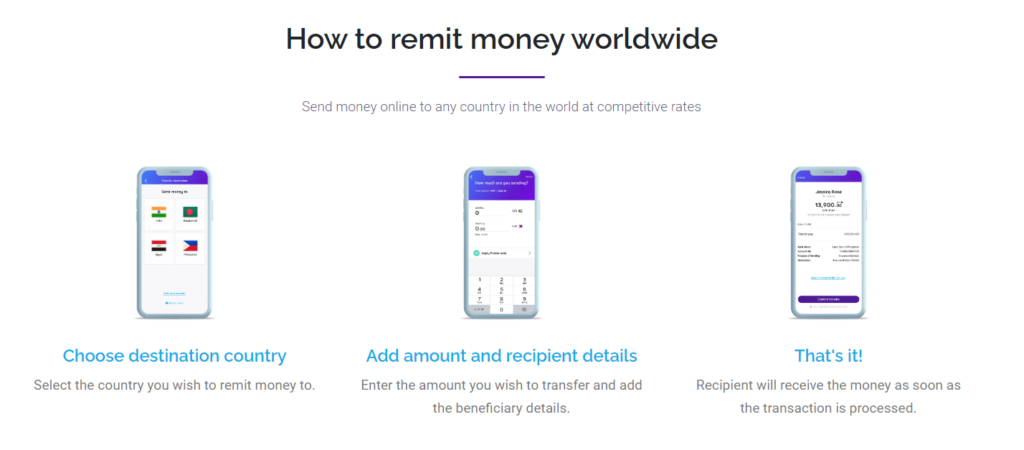

Mobile wallets facilitate electronic money transfers through various methods, including bank-to-bank transfers, wallet-to-wallet transfers, wallet-to-bank transfers, and even wallet-to-cash services.

These transfers are typically initiated and completed online or through mobile applications, making them convenient and accessible.

Mobile wallet transfers offer a digital alternative to traditional wire transfers or in-person cash transactions. They allow users to send and receive money electronically, enabling transactions with speed and efficiency, whether for domestic or international transfers.

Additionally, mobile wallets may offer features like bill payments, mobile recharge, and peer-to-peer money transfers, further enhancing their versatility and utility.

For example, through Payit mobile wallet app, you can send your money to India with zero fees and within a few taps.

Foreign exchange brokers in the UAE are regulated by the Government authorities such as the Central Bank, DIFC (Dubai International Financial Center), or ADGM (Abu Dhabi Global Market). They typically offer foreign exchange (Forex) trading services; however, you can send money to your home country using these services.

To send money through a foreign exchange broker, you must open an account, fill in the necessary details, provide proof of identity, and start sending money.

You must be careful about the currency exchange rates these companies offer since the foreign currency market is highly competitive and volatile. Brokers like OFX, and Saxo Bank, provide foreign exchange services along with foreign currency trading services.

One of the most traditional ways to send money internationally is through a mobile banking service from your bank. You can always remit money to your home country using online banking or the mobile banking service of your bank.

Although it is the most convenient method for international money transfers, it can be five to seven times more expensive than certain other methods. The banks offer their currency exchange rate, including commission fees, which take slightly longer than online money transfer services through mobile wallets.

So, which one of these four methods is the best way to send money internationally? Let’s compare these methods with crucial factors like cost, speed, security, and convenience.

Let’s compare different options for international money transfers from the UAE to your home countries. Overall, mobile wallet transfers are cheaper, more convenient, faster, and safer than the other methods.

| Comparison Points | Wire Transfer | Mobile Wallet Transfer | Foreign Exchange Houses | Online/Mobile Banking |

| Cost | Cheaper | Cheaper | Costly | Costly |

| Speed | 1-2 business days | 0-1 business days | 1-5 business days | 3-5 business days |

| Secure Transfer | Less Secure | Safer | Less Secure | Safest |

| Convenience | Less Convenient | Most Convenient | Complex | Less Complex |

Thanks to technological advancements, international money transfers have witnessed remarkable improvements in convenience, speed, and security. Among the various methods available, mobile wallet transfers are the most convenient option for many.

However, the best-suited method ultimately depends on individual preferences and specific purposes for the transfer. By making informed decisions, you can ensure that your international money transfers are not only seamless but also optimized to meet your unique needs and requirements.

With Payit digital wallet app, you can send money from UAE to anywhere in the world within a few taps on your phone and with better rates.

Experience the convenience and speed of effortlessly sending money to over 200 countries as the world becomes more interconnected.

Skip long queues and unnecessary fees using the payit e-wallet app, offering swift and seamless transactions.

With Payit, you can send cash to your friends or relatives through Moneygram or directly deposit money into their bank accounts.

Enjoy the benefit of zero extra fees when sending money from the UAE to more than 40 countries through Mastercard services.