Home » Cashless Payments Knowledge Hub » Breaking Barriers: How Women are Taking Charge of their Finances – Payit Event Recap

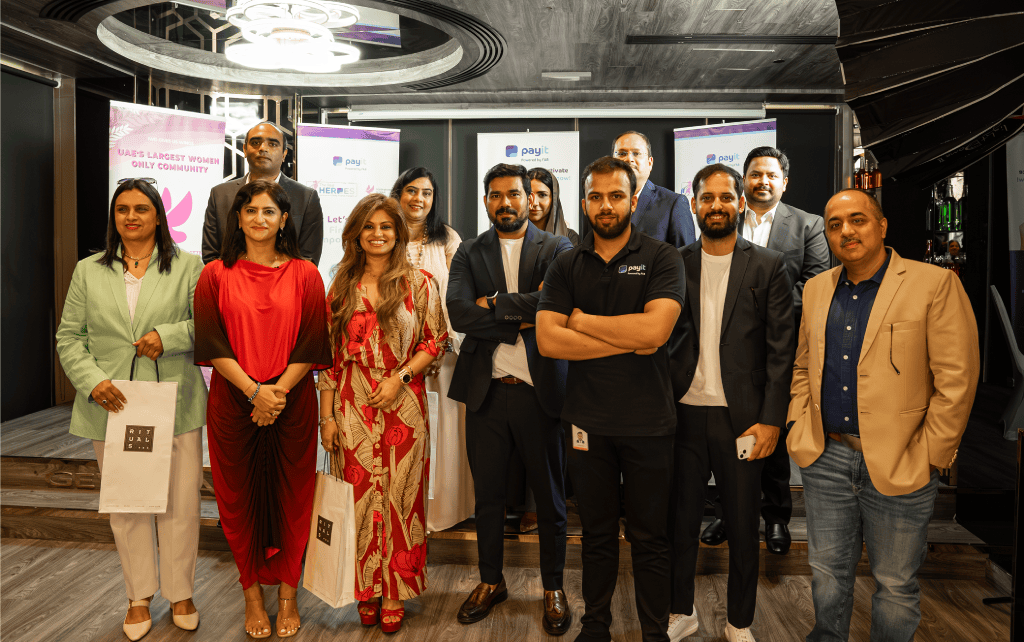

On July 18th, Payit collaborated with Indian Women Dubai (IWD) to host a panel discussion on financial independence for women. Three guest speakers, including Fatima Marting, Principal of Gems New Millennium School, Mitun De Sarkar, Clinical Dietician and Founder of Simply Healthy, and Dr. Rajul Matkar, Obstetrician, and Gynecologist, shared their insights on how women can educate themselves about personal finance and take control of their finances.

The event was part of Payit’s new initiative, “The Real HERoes,” which aims to inspire and bring together homemakers, career women, and homepreneurs. This article summarizes the discussion on financial independence, including tips from the panelists on how women can achieve it.

Financial independence is crucial as it grants them autonomy, empowerment, and the ability to shape their destinies. At the event, panelists shared inspiring stories and best practices.

Fatima Martin, the principal of Gems New Millennium School, demonstrates the importance of disciplined saving and wise investing. Her story highlights the crucial steps of personal finance: earning, saving, budgeting, planning, and investing. Fatima’s journey proves that with proper financial strategies, women can secure a stable future.

Mitun De Sarkar, a Clinical Dietician, learned the value of financial literacy the hard way. Despite a lack of financial education in her childhood, Mitun faced setbacks but bounced back by investing in herself, becoming an entrepreneur and nutritionist, highlighting the importance of financial knowledge and resilience to build a strong foundation.

Dr. Rajul Matkar, an Obstetrician and Gynecologist, gained early financial wisdom through childhood exposure to PPF (Public Provident Fund), setting her on the path to financial security and emphasizing the empowering impact of financial awareness from a young age.

In conclusion, these practices empower women to achieve financial independence, pursue dreams confidently, and inspire future generations, driven by their financial knowledge and determination to script their own success stories.

The speakers at the event aimed to empower women to take control of their financial futures by offering valuable insights into key considerations for personal finance. Let’s take a closer look at their advice.

Educate yourself about budgeting, saving, investing, and managing debt to make informed financial decisions and gain control over your money.

Define clear and achievable financial objectives to stay focused and motivated on your financial journey, such as saving for emergencies, retirement, or pursuing a dream.

Utilize modern tools and apps for budget tracking, automatic savings, and investment management, leveraging technology to optimize your financial planning.

Prioritize spending on valuable experiences and assets while being mindful of unnecessary expenses, enabling you to grow your wealth and increase savings.

Strive to become self-reliant in financial matters, ensuring you have the means to support yourself and make independent choices that align with your goals and values.

Watch Video: Payit & IWD Celebrate the Real Heros

We offer many features that help women manage their money effectively. With our focus on saving money, making payments efficiently, conducting international transfers, and implementing innovative gifting strategies, Payit mobile wallet is an essential tool for women who want to take control of their financial futures and achieve their success goals.

We encourage women to save money through exclusive offers and discounts on top brands and e-commerce websites, spanning travel, lifestyle, and home decor. By leveraging these deals, women can make smart purchases while maximizing their savings.

With features like Split Bills, Education Fees, and Bill Payments, we streamline payment management for women. This simplifies the process of handling various expenses, ensuring smooth financial transactions.

We facilitate convenient international transfers with just a few taps on the phone. Notably, transfers from UAE to India are offered at zero cost, allowing women to save more.

We offer a unique gifting experience by allowing customers to send e-gift vouchers through the app. This feature promotes effective money management by providing liquidity to the sender while allowing the recipient the freedom to choose their desired gifts.

We empower customers with greater financial control by enabling them to set card limits and manage their spending efficiently. This feature ensures that women can responsibly adhere to their budgets and achieve financial goals.

In the end, the esteemed guest speakers leave us with invaluable advice to further empower women on their financial independence and success journey.

The speakers stressed the significance of instilling respect for women in young boys. By nurturing an environment of equality and support, we can pave the way for future generations to embrace and encourage women’s financial independence.

Learning the art of investing is essential for women. By gaining financial literacy and taking calculated risks, they can capitalize on opportunities, grow their wealth, and secure their financial future.

The speakers emphasize the importance of proactive financial planning. Women should envision their long-term goals and lay the groundwork today, ensuring they are well-prepared to navigate life’s uncertainties and aspirations confidently.

In conclusion, the event taught us the essential aspects of budgeting, saving, and investing. With Payit’s support in money management, you can amplify your path to financial independence. By embracing these teachings and taking charge of your financial destinies, you can thrive, break barriers, and emerge as a powerful force.

Let’s work towards being financially independent. Let’s Payit!