Home » Cashless Payments Knowledge Hub » 5 Best Ways To Send Money From UAE To India

One of the most important considerations for any overseas worker is how easy it is to send money home. Indian expats are some of the most prolific overseas workers and represent a significant majority in the UAE.

If you’re wondering which money transfer method is the best to send money from UAE to India?. Then we have only one answer, through the payit app.

This blog explains how you can send money to India from the UAE using the payit app most conveniently without visiting a money exchange or a bank.

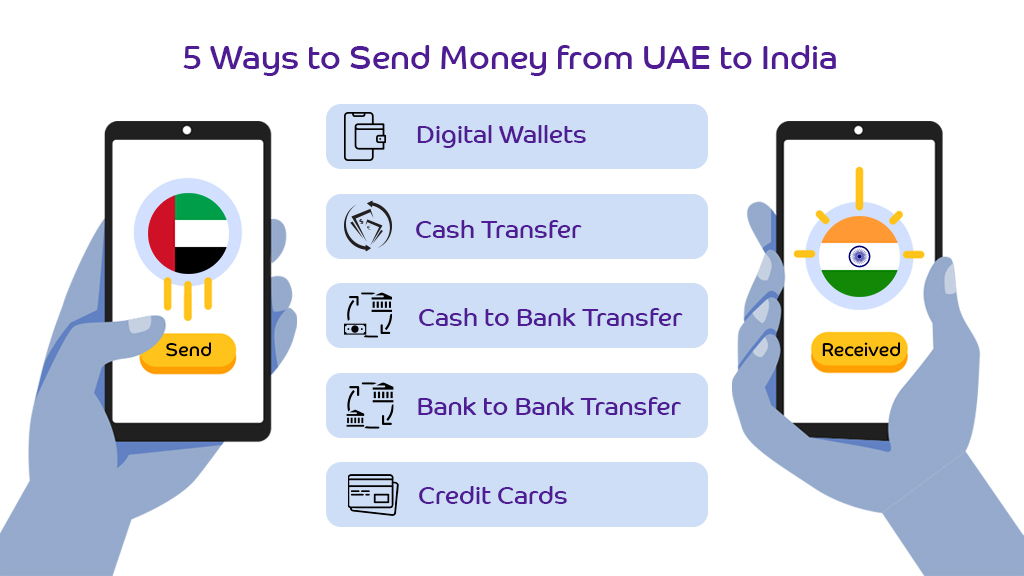

Let’s look at other ways you can send money from the UAE to India.

Digital wallets are starting to emerge rapidly and are quickly becoming one of the best ways to send money to India from the UAE. A digital wallet or an e-wallet is a software-based system that securely stores payment information and passwords for multiple payment methods and websites.

Also, read How to Use an E-wallet?

payit is quickly emerging as the digital wallet of choice for people in the UAE. It’s prevalent among overseas workers for one particular reason. Transferring money through a payit wallet is super easy and cheap.

Using a digital wallet is arguably one of the most affordable ways to send money from the UAE to India. While another service might levy small processing fees, transferring money through payit has no fees. So if you want to transfer money online from UAE to India, using payit makes a lot of sense.

The most traditional and long-standing way of transferring remittance from the UAE to India is through cash transfer. In a cash transfer, the sender deposits the cash, and the receiver receives it in the form of cash itself. Obviously, there are mediums known as exchange centers in the UAE that handle cash transfers.

The sender can visit these centers with the cash they’d like to send the receiver and make the deposit. However, there are some requirements. Senders must provide details like the receiver’s name, complete address, and government ID proof.

Only if the sender provides all the necessary information and documents will they be able to deposit the cash. Then, the exchange center will convert the currency according to the exchange rate between AED and INR. After the conversion, they’ll send the money to the destination.

The exchange centers also employ a processing fee, which will take a few days for the receiver to get the cash.

Aside from a straight cash transfer, exchange centers also offer senders the ability to transfer the amount to the recipient’s bank account. Get the necessary details like the receiver’s name, account number, swift code, etc.

After making the deposit, it’ll take 2-3 business days for the cash to be credited to the account. The sender will also have to pay a currency exchange fee on the transaction.

Aside from relying on exchange centers, banks also provide remittance facilities. For example, most prominent banks in the UAE allow clients to enter the beneficiary details straight through their internet banking facility.

After adding the beneficiary, the account owner can transfer the desired account directly from their bank account. Generally, this is one of the fastest methods of sending money online from the UAE to India.

While it might be super convenient, most banks charge remittance fees on the transfer. However, some banks in the UAE, like FAB, provide free monthly international remittances to their bank account.

As a result, this is one of the cheapest ways to send money to India from the UAE. Take a look at what remittance services banks offer before opening an account.

Most credit cardholders in Dubai can use their cards to send money to India from their accounts. However, credit card providers tend to charge extra fees on international fund transfers. The bank will recognize the transfer as a cash advance or a purchase.

To transfer money through a credit card, senders must take their credit cards to an exchange center. The exchange center will perform a cash transfer after charging the credit card.

| Comparison Points | Digital Wallet | Cash Transfer | Cash to Bank | Bank to Bank | Credit Cards |

| Can it be done online? | Yes | No | No | Yes | No |

| Requires a physical visit? | No | Yes | Yes | No | Yes |

| Cost comparison | Cheapest | Costly | Costlier | Very expensive | Very expensive |

| Complexity | Most convenient | Complex procedures | Complex procedures | Fairly convenient | More complex |

While there are many different ways to transfer money from the UAE to India, consumers need to know which method is the best. Some people prefer using money exchange agents because it’s what they’ve always known. At the same time, others might rely on their bank accounts.

Some big banks, like FAB, offer account holders the opportunity to send remittances without additional cost. However, most banks will levy a charge for transferring remittances online.

These methods can also often take a few days to transfer the money. However, digital wallets tend to stand out in every aspect. Using a digital wallet is the cheapest and fastest way to transfer money from UAE to India or other countries.

Digital wallets like payit currently allow you to transfer money online to more than 200 countries. They even offer MoneyGram services without making you wait in long queues and worry about potential delays.

If you want to transfer funds from UAE to India, digital wallets are your choice!

If you want to avoid processing charges on money transfers from UAE to India; you must use the payit e-wallet app to send your money from UAE to India since payit does not charge fees when you transfer your money to India.

While other money exchange centers and banks charge commission on your transfer, remitting money through a digital wallet like payit makes it more convenient yet cost-effective.

The world is becoming much smaller. It makes it possible to send money to over 200 countries conveniently and rapidly.

Unlike money exchange centers, with the payit e-wallet app, you won’t have to wait in lines for long hours or pay any unnecessary fees.

You can transfer money directly to the recipient’s bank account. Currently, payit offers direct bank transfers to India with zero additional fees. As a result, it’s now one of the cheapest ways to send money from the UAE to India.

More than 40 countries enjoy zero extra fees while sending money from the UAE, thanks to Mastercard services.

You can also send cash to your relatives’ or friends’ places using the ‘MoneyGram’ feature on the app.

A MoneyGram feature that allows quick international money transfers to more than 200 countries. Again, the service has a few additional benefits, including instant transfers, no waiting in lines, 24×7 services, and competitive interest rates.

payit users can transfer money to friends and family through their digital wallets, and they’ll be able to get the money from the closest money exchange agent.

To transfer money even faster, you can send money from the payit wallet to any other digital wallet anywhere in the world.

Thus, payit has it all to make your money transferred to India, whether in a bank account or through a wallet, or in cash.

Let’s understand how you can transfer money using the payit e-wallet app.

Hence, when you transfer your money to India through payit, it takes hardly a few seconds to send your money to the recipient.

With technological advancements, it’s become more accessible than ever for overseas workers to send money back home. That’ll encourage more people to seek jobs overseas and bring us towards a more global economy.

Digital wallets like payit are leading the charge toward a more cashless society. Get access to your payit digital wallet and start sending funds back home with the click of a button!