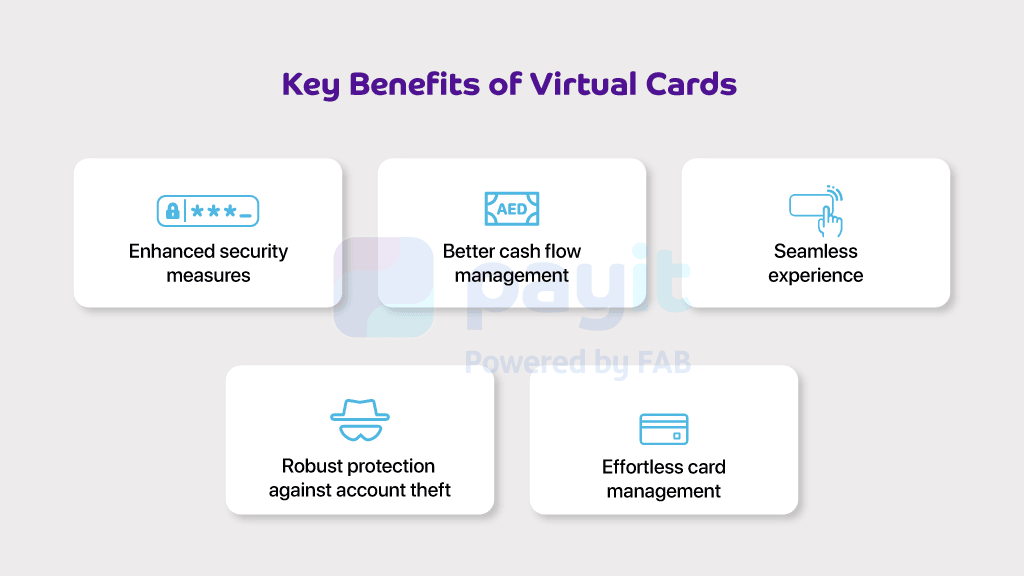

Home » Cashless Payments Knowledge Hub » 5 Key Benefits of Using Virtual Cards

With the virtual cards market projected to reach a staggering $1.3 trillion globally by 2032, experiencing an impressive compound annual growth rate (CAGR) of 12.2%, it’s evident that this digital payment space is revolutionizing the financial landscape.

Being digital payment instruments, virtual cards provide a secure and convenient alternative to traditional bank account cards. They are unique, one-time-use card numbers generated for each transaction, reducing the risk of data breaches.

In this blog, we’ll explore the many benefits of virtual cards, ranging from heightened security measures to seamless cash flow management. Let’s get started!

Virtual cards offer flexibility in managing spending limits and can be easily created and terminated online. Let’s take a look at how it can simplify your financial management.

Traditional bank account cards are susceptible to payment fraud. In fact, one-fifth of customers (19%) have suffered credit card fraud, while almost a quarter of consumers (27%) have experienced phishing. In contrast, virtual cards provide a heightened level of security and tranquility.

What’s more, you can instantly terminate your account with a simple click. This ensures protection against potential data leaks. Furthermore, every transaction is accompanied by a unique, one-time-use bank number.

This feature significantly reduces the risk of data breaches since it cannot be reused even if a number is compromised.

As a result, your financial information remains private and safeguarded during each payment, and this serves as an added layer of protection and peace of mind.

Efficient cash flow management is crucial when dealing with payments to vendors and suppliers, especially with time-sensitive deadlines. In fact, around the world, 61% of small firms experience cash flow problems.

Serving as the solution, virtual cards offer robust tools for tracking available funds through comprehensive data tracking. This also allows transparency and clarity.

Assigning virtual cards to specific individuals, such as vendors or suppliers, facilitates organized transaction monitoring. As a result, the burden of managing receipts and chasing expenses from others is lifted from your accounts payable department.

This way, virtual cards streamline your financial operations. Moreover, this seamless process allows for improved internal efficiency, and consequently, it ensures a smooth payment process and reduces the risk of errors or delays.

In short, virtual cards empower you to simplify and optimize your cash flow management, enabling a more streamlined and productive financial workflow.

Virtual cards offer a seamless and hassle-free experience. For example, they bypass the time-consuming account setup process, which takes 7 to 14 business days. Leveraging technology, these cards streamline financial operations, minimizing paperwork and eradicating manual errors.

This efficiency grants your accounts payable departments more time to focus on critical financial tasks. Eventually, the department can prioritize and optimize its workflow. Simultaneously, you can redirect your efforts toward driving business growth and attaining your objectives.

Since virtual cards simplify administrative processes and eliminate unnecessary delays, they ensure greater efficiency and agility. This provides a smooth and productive financial journey for your organization.

Virtual cards offer robust protection against account theft and e-commerce fraud. Unlike physical cards, virtual cards ensure that criminals cannot access your bank account even if they obtain your card details.

With virtual cards, you won’t have to worry about losing your card or stealing sensitive bank information. Instead, you can confidently make online transactions, knowing your financial data is safeguarded. This advanced level of security is a significant advantage in an increasingly digital world.

Compared to traditional cards, virtual cards offer users greater control and flexibility. For example, rather than being confined to a fixed spending limit imposed by the bank, users can personalize their spending limits and quickly freeze or close their accounts as needed.

Furthermore, the ability to assign single-issued virtual cards to specific individuals for predetermined amounts empowers you with precise control over expenditures. Consequently, this reduces the reconciliation process for your accounts payable department, streamlining financial management.

From enhanced security measures to seamless cash flow management, Letsgo Payit Card provides a secure and convenient alternative to traditional bank account cards.

The seamless experience simplifies account setup processes, streamlines financial operations, and empowers accounts payable departments to focus on critical tasks.

You can also achieve efficient cash flow management through transparent tracking of available funds and organized transaction monitoring.

Moreover, Letsgo Payit Cards offer robust protection against account theft and give users greater control and flexibility in managing spending limits.

With the Letsgo Payit Cards, you can enjoy peace of mind, effortless management, and a streamlined financial workflow. So, download the Payit app to navigate through your financial freedom smartly.