Home » Cashless Payments Knowledge Hub » 5 Reasons to Get Instant Cash Through Ratibi Cards

We live in an era where everything – from renting a car to receiving cash – is just a click away. Digitization has emerged as a complete transformation for any industry – be it financial or agricultural.

However, digitizing financial services has been one of the most revolutionary aspects of the modern digital economy. This blog discusses how you can get instant cash and how it is just a few clicks away.

But before answering how, let’s start with what instant cash is and why you should consider opting for the instant cash option.

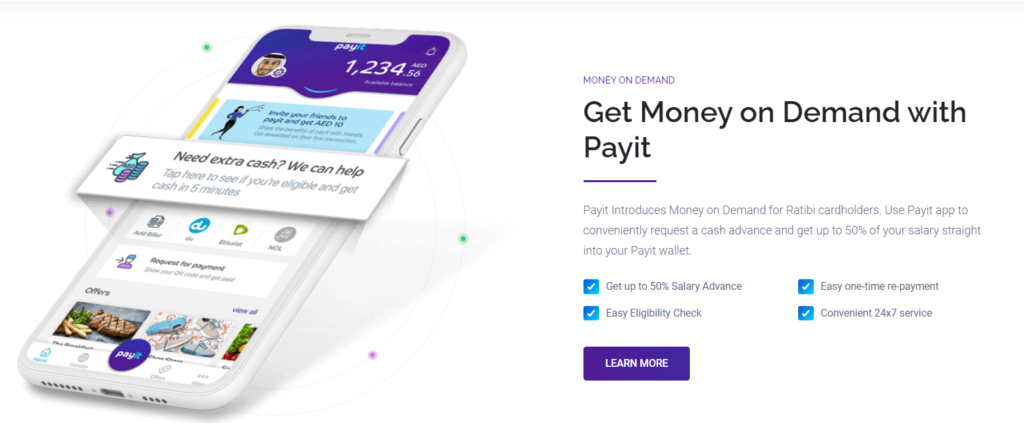

Payit’s ‘Instant Cash’ is an arrangement where you get money on demand to serve various purposes such as meeting financial emergencies, paying a huge repair expense, etc. In instant cash, you get money immediately in your mobile wallet based on your eligibility to receive instant cash.

To know more, read Unlocking the Money on Demand Feature Through Ratibi Salary Cards.

Let’s see how instant cash will be one of the most convenient ways to help you when you need money on demand.

Whenever you are in urgent need of cash or have to incur a considerable expense, you mostly think of the other traditional options to increase liquidity. However, through ‘Money on Demand’ instant cash options, Ratibi cardholders can receive the amount in their mobile wallet within a few clicks.

Let’s see why the ‘Money on Demand’ instant cash option stands out from the other traditional options.

Instant cash provides quick disbursals of the amount you requested. If you are eligible to receive instant cash through ratibi salary cards, you can receive funds in your digital wallet as soon as you submit your request.

Find out if you are eligible to receive instant cash from Payit.

Instant cash, as the name suggests, is a faster and easier way to receive funds in your wallet when needed. You don’t need to submit any form or a document to apply for instant money.

It is because only eligible ratibi cardholders can apply for instant cash. And, while the ratibi salary cards are distributed, detailed documentation is done to ensure the genuineness of the applicant.

You don’t pay any interest on the amount you requested through ‘Money on Demand’ instant cash; it is just a standard instant money request when you are out of cash or want to receive funds in your wallet.

The amount you request through instant cash gets recovered from your ratibi card on the 1st of the following month you requested money on demand (as soon as your salary gets credited).

When you request ‘Money on Demand’ through Payit, you are only charged once, and the applicable fees are automatically applied to the requested amount. Hence, you will receive funds net of the amount you asked for, less the fees charged.

There are no additional or hidden costs on the instant cash you request from Payit. The amount that will be charged will be displayed to you before you submit your request ensuring disclosure of the fees charged before you apply.

Even if you don’t have a bank account, you can have a mobile wallet on Payit that will allow you to receive your salary, send money, and pay bills from your wallet. Thus, even if you don’t have a bank account, you can still receive instant money as a ratibi salary cardholder.

Thus, ratibi salary cards allow you to receive instant money without documents, interest charges, or a bank account. But how can you get instant cash in your digital wallet?

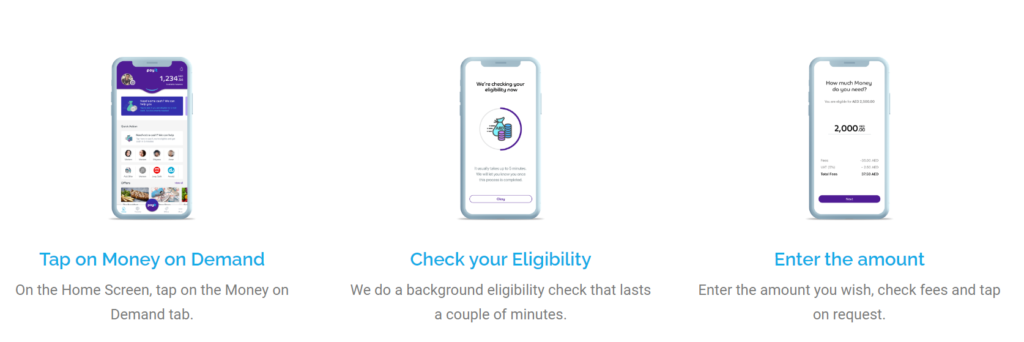

Let’s see how to apply for ‘Money on Demand’ through the Payit mobile wallet app.

Thus, if you are a ratibi cardholder, download the Payit mobile wallet app, link your card to the app, and you are all set to receive instant access to smaller cash amounts with simplified and faster application processes.