Home » Cashless Payments Knowledge Hub » Best Way to Secure Payments as a Freelancer in the UAE

Freelancing offers more flexibility and potentially higher earnings, but timely and secure payments can be challenging when working with multiple clients. Therefore, having a secure payment system in place is crucial. This article covers the best payment method to receive funds in the UAE without opening a bank account.

As per a report, the UAE witnessed a 42% increase in freelancers in 2020. This is also a positive outcome of the initiatives the UAE government took, such as the New Freelance Permit (2020), which lets freelancers work in the country even without sponsorship.

Securing payments is crucial for you as a freelancer to maintain a sustainable income and lifestyle. By ensuring you receive payments on time securely, you can focus on your work, leaving the worries of uncertain or delayed payments.

Here are the top four popular methods of receiving payment as a UAE freelancer.

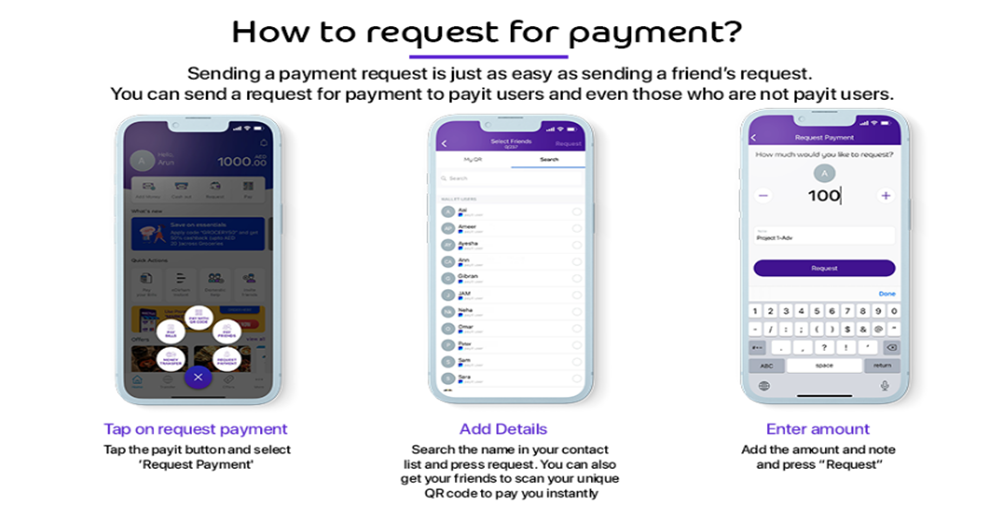

For receiving freelance work payments in the UAE, the Payit mobile wallet is one of the most secure and convenient methods. Payit is the UAE’s first-ever fully-featured digital wallet powered by First Abu Dhabi Bank (FAB). Payit allows you to send or receive funds at your convenience without any bank account registration. The fund transfer is almost instantaneous, and this facility is available in over 200 countries.

This eliminates the need for physical cash transactions and reduces the risk of non-payment or loss of funds. With Payit Wallet, you can easily track your payments and have peace of mind knowing that your earnings are safely stored in your digital wallet.

Bank transfer is a prevalent mode of payment for freelancers in the UAE. You must provide your bank account details for transfer, and the contracted amount gets transferred directly to your account.

While this payment method is reliable and secure, you must provide accurate bank account details. Also, you must ensure that your client has fed the correct information to avoid delays or errors in crediting your payments.

You also have the option to use peer-to-peer transfer platforms available in the UAE to receive freelancing payments. Some examples of such platforms include PayPal, Venmo, etc. These platforms allow you to send and receive money directly by linking your bank account or card details.

However, these platforms often charge high fees and currency conversion charges (for international payments). Thus, you need to evaluate different platforms for making a decision.

With digitalisation, cash payments have become relatively uncommon. Cash payments can require you to visit a location, i.e., the client’s office, or may require more time to deliver cash payments.

Also, you need to keep a record of the cash transactions and it lacks safety compared to receiving payments via Payit Wallet or bank transfers. This method is only suited if you have local clients.

Among the various online payment options available in the UAE, Payit stands out as the best option for freelancers to receive payments securely. For example, in a bank transfer, you need to provide details of your bank account, but with Payit, there is no such need.

Payit also provides real-time transaction notifications and allows you to track your payment history. Here are the top reasons why Payit is the best option to get paid as a freelancer in the UAE.

Choosing Payit as your payment partner for freelancing work in the UAE allows you access to multiple benefits under one roof. It is convenient, secure, faster, and easy to use.

Freelancing allows you the flexibility to work at your convenience and choice. To ensure that your journey as a freelancer in the UAE remains stress-free, select a payment method such as Payit Wallet. Payit is completely secure and helps you receive funds instantly so that you can focus on your work and thrive with a global client base.