Home » Cashless Payments Knowledge Hub » Budgeting Tricks for New Parents in UAE

Once you become a parent, everything changes, and one of the most significant things that will change is your expenses. While raising a child is one of the most fulfilling experiences in your life, many people conveniently forget to mention the impact on your budget.

One of the studies found that the cost of raising a newborn can exceed $21,000 in the first year. However, it changes based on your demographics and how you want to raise your child. Here are a few budgeting tricks that can help you if you are a first-time parent in the UAE.

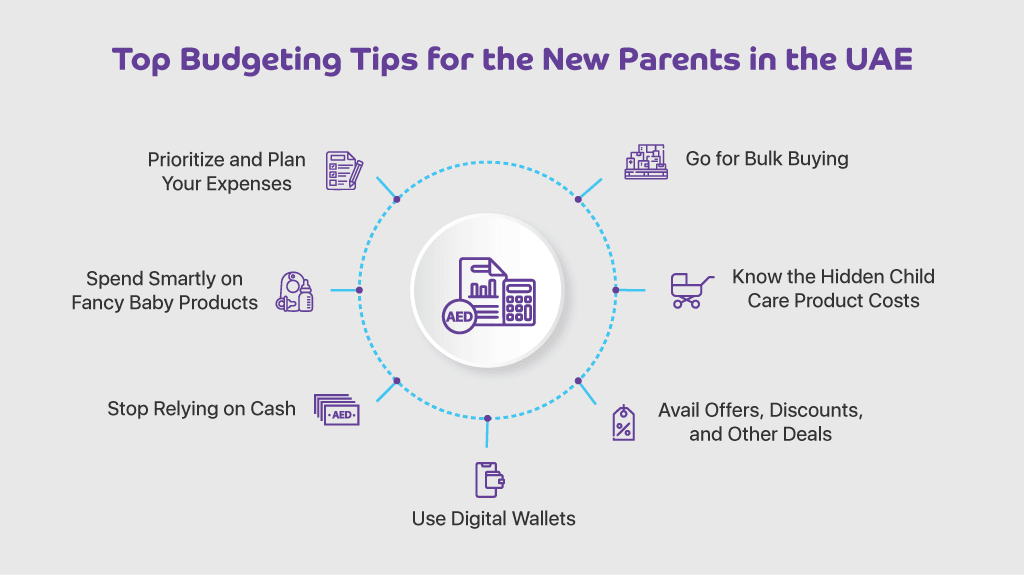

Budgeting has to do a lot with planning and prioritizing your spending since it gives you a limit within which you should spend your money. If you don’t prioritize your expenses, you will fall short of money when you really need to spend on an essential item such as baby care.

Your newborn has just stepped into the world, and you would want to give the best of all products, but you need to prioritize what you need for your child and what expenses are gratuitous.

When budgeting, many parents make mistakes, including a lot of stuff they don’t need.

Sure, when you’re waiting for the baby and creating a wardrobe, it’s easy to get carried away.

What happens with those clothes is that they barely get any use, and your baby will outgrow them. Babies grow up ridiculously fast, and a pro-parenting tip is to buy clothes that provide growing room. You never know when your baby or toddler will go through a sudden growth spurt.

Evaluate your spending for the newborn in terms of its value and usage by your child. For example, a nappy is an essential item, whereas an animal costume for a photo shoot would be an unwanted expense for your child.

Also read, 5 Common Mistakes Most Parents Make While Making Financial Decisions

When cash is your predominant means of spending, it becomes much more difficult to manage finances. It’s harder to keep track of every transaction. If you genuinely want to manage your budget, a service like a digital wallet can help you make a lot of savings.

The service provides a more accurate means of tracking your spending, and you’ll also find deals on pretty much everything. When you consider savings, every little bit matters.

digital or mobile wallets allow you to perform transactions from an app on your smartphone. You don’t need cash for that, and the transactions can be done from anywhere, anytime.

Use digital wallets to shop online, make QR code payments, split bills with your partner, pay school fees, etc. Since all your transactions are recorded, you can check how much money you spent purchasing baby products.

One of the most effective ways to stay within a budget and even manage to remain under budget is by shopping when there are deals and discounts!

Many baby products and items go on sale regularly, so if you do your research correctly and look for the right deals, you might be able to buy almost everything at a discount.

Digital wallets like Payit offer their customers plenty of deals on consumer goods and services.

On top of that, you can access all the deals available to you in one convenient location.

If you and your spouse both are working, and you can’t rely on family, then there’s no other option but to go for professional childcare services.

In such cases, you can hire a maid to babysit your child or admit your child to a nursery.

Both costs will spare a significant portion of your monthly budget, and you can’t just avoid those.

Moreover, when hiring a maid or selecting a nursery, remember that it is not a one-time expense and may add other expenses.

For example, if your maid takes your child to a particular theme park, then entry costs for your maid will become an unplanned expense. You should also consider such hidden fees.

When you buy wholesale, you save money on many aspects, including shipping costs. Baby care products such as baby lotion, baby shampoo, nappies, and baby oil are frequently bought for new parents.

See, if you buy in bulk, does it make your purchase price cheaper?

In most cases, it will save you a significant amount of money.

While budgeting for a child, it’s essential to remain realistic and consider your new lifestyle. A proper budget will let you enjoy your precious years with your baby without worrying about finances.

A well-planned baby budget will help you buy all the dream products you want for your newborn baby.