Home » Cashless Payments Knowledge Hub » Comparing Money Exchanges in UAE – Best Way to Transfer Money to India this Diwali

Diwali is just around the corner, and with that, many individuals are looking for ways to send money to India. This can be a gift or financial support to the loved ones. However, finding the best way to transfer funds can be tricky, especially when there are many money exchange services available in the market.

To help you with this, in this article, we will compare the top five money exchange options in the UAE for sending money to India. Let’s get started.

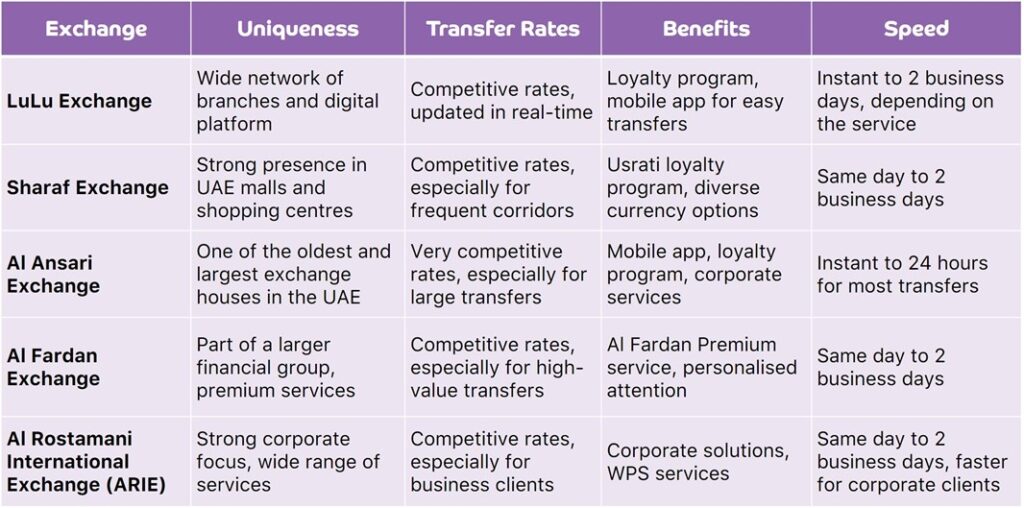

Here are the top money exchange providers in the UAE that you can use to transfer money to India this Diwali.

With over 140 branches across the UAE and 350 worldwide, LuLu Exchange is a popular choice in the UAE. LuLu Exchange serves more than 15 million customers globally, providing currency exchange and international money transfer services.

Sharaf Exchange is known for its competitive rates and high service standards. They offer instant money transfers through a wide network of correspondent banks. Sharaf Exchange also provides a unique ‘destination currency’ concept, helping you save time and money on conversions.

Also, read Understanding Exchange Rates and Fees: Cheapest Way to Send Your Money Home

As a leading exchange company in the UAE for almost 60 years, Al Ansari Exchange has the largest branch network in the country. They offer online and offline remittance services, foreign exchange, and more. Their mobile app allows for easy money transfers and bill payments.

Established in 1971, Al Fardan Exchange has grown to include over 70 branches across the UAE. It partners with more than 150 global correspondent banks and financial institutions, ensuring secure transactions. Al Fardan Exchange offers money transfer, foreign exchange, and value-added services.

Established in 1979, Al Rostamani International Exchange (ARIE) is a leading exchange in UAE that facilitates electronic fund transfers worldwide, and issues demand drafts in over 40 currencies. The company has partnerships with over 80 correspondent banks and global brands, including MoneyGram, Ria Money Transfer, and TransFast.

When choosing a service to send money from the UAE to India, it’s recommended to compare current rates, fees, and transfer speeds as these can vary over time.

Although the money exchanges have been the most common ways to transfer money to your home countries, mobile wallet apps like Payit is the best way to send your money to India this Diwali. As a digital wallet app, Payit offers quick, cheaper, and more efficient way to send money to India.

With Payit, you can send money to India without visiting a money exchange or bank, and simply complete the transaction from anywhere from your phone. Their competitive exchange rates also benefit you.

Here is how Payit stands compared to other money exchanges:

If you are looking for an easy and convenient way to transfer money, Payit can be your go-to solution. With competitive rates, no fees, and instant transfers, Payit helps you transfer funds quickly to not just India but other countries, too.