Home » Cashless Payments Knowledge Hub » Understanding Exchange Rates and Fees: Cheapest Way to Send Your Money Home

Transferring funds back home is often a routine financial task, yet it can become expensive without the right know-how. While the fundamentals of exchange rates and fees are generally understood, a more nuanced understanding can lead to substantial cost reductions.

This post digs into those advanced aspects. It’s tailored for individuals with a foundational understanding of international money transfers and looking to optimize their financial decisions. The discussion will cover the intricacies of exchange rates, the actual costs behind so-called free transfers, and the pivotal role of timing in financial transfers.

The exchange rate mechanism refers to the system that countries use to determine the value of their currency in relation to other currencies. This mechanism significantly impacts international trade, as it affects the cost of goods and services across borders.

The exchange rate is determined by the supply and demand for a particular currency in the global market, and it can fluctuate based on various factors such as economic growth, inflation, political stability, and market speculation.

For example, in the UAE, the central bank decides the exchange rates of various currencies, considering relevant factors.

These factors influence the buying and selling rates of currencies:

Market Demand and Supply: When there is high demand for a particular currency (e.g., UAE Dirham), its buying rate tends to increase, and the selling rate decreases, and vice versa.

Economic Indicators: Key economic indicators like interest rates, inflation rates, and overall economic stability play a significant role. Higher interest rates in one country can make its currency more attractive to investors, affecting the exchange rates.

Political Stability: Political events and stability in source and destination countries can influence rates. Political turmoil can lead to decreased confidence in a currency, causing its value to drop.

Central Bank Policies: Actions and policies of central banks, such as interest rate changes and monetary policy, can have a direct impact. For instance, a central bank raising interest rates may strengthen its currency.

Global Events: Events on the international stage, like natural disasters, geopolitical tensions, or economic crises in one part of the world, can lead to fluctuations in currency exchange rates.

Speculation: Traders, investors, and financial institutions speculate on future currency movements, affecting current rates.

Trade Balance: If one country exports more to another, there’s greater demand for its currency, pushing up the buying rate.

Currency Pegs: Some countries peg their currency to another (e.g., the UAE Dirham is pegged to the US Dollar). In such cases, exchange rates are controlled to maintain the pegged rate.

Brokerage Fees: Currency exchange service providers also factor in their own fees and commissions, which can impact their buying and selling rates.

Market Sentiment: Overall, market sentiment and perception of a currency can influence rates. Positive news and investor confidence can lead to a stronger currency.

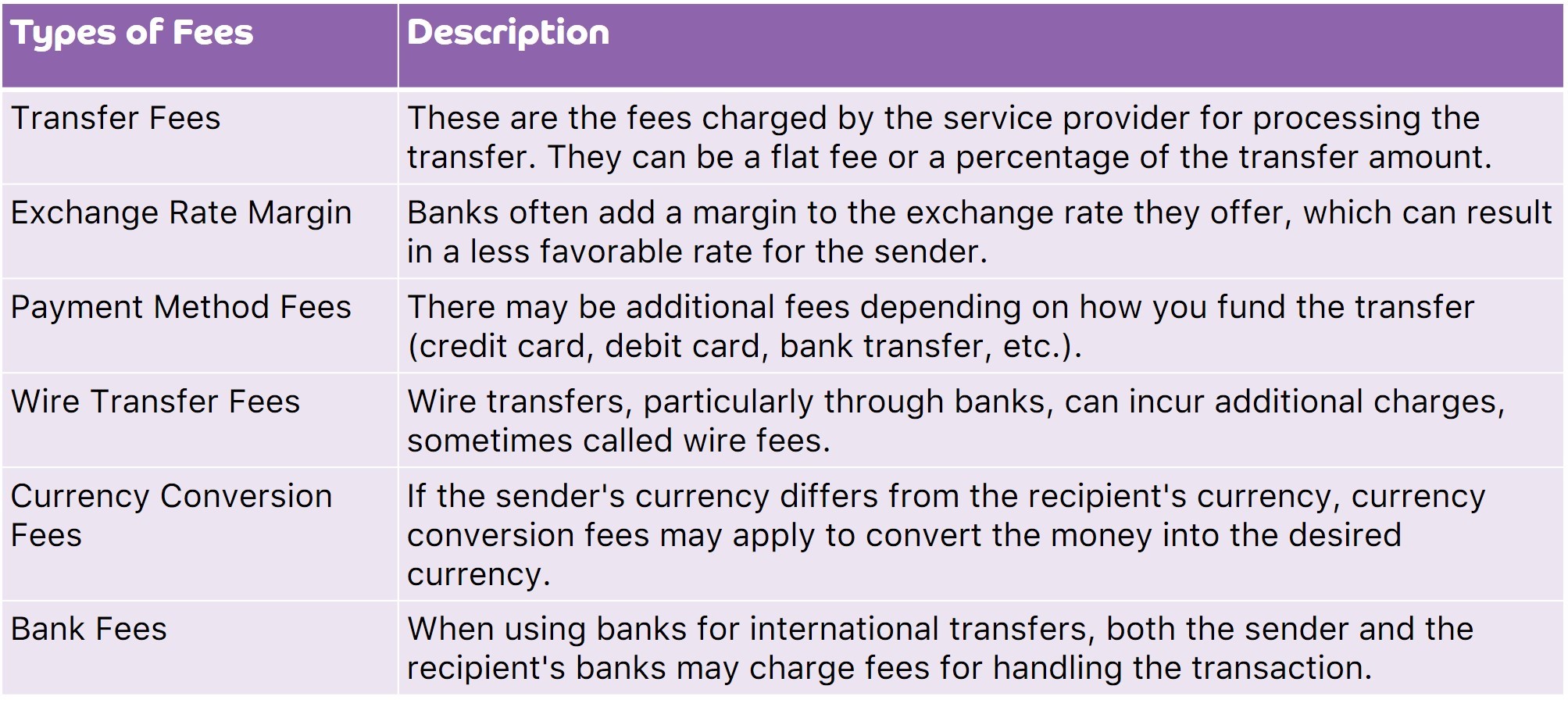

When you transfer your money internationally, you pay several fees in terms of currency exchange, service fees, transfer fees, bank fees, etc. Let’s understand the different types of fees or costs that you pay when you exchange money internationally.

Regarding global money transfers, terms like anti-money laundering (AML) and know your customer (KYC) aren’t merely industry jargon. They’re mandated legal standards that financial services must comply with. And yes, these rules often bring their own set of varying fees.

These regulations often come with additional fees varying from one service to another. For instance, some services might charge a flat $10 compliance fee, while others could take a 1% cut of the total transfer amount. Understanding these costs is essential for anyone looking to know how much a transfer will truly cost you.

Choosing services that charge a flat fee for compliance is advisable to keep such extra costs in check. This becomes especially important for larger transfers, where a percentage-based fee can quickly escalate the total cost. So, before initiating a transfer, it’s wise to inquire about any compliance-related fees and how they are calculated.

Mostly, bank transfer to send money internationally is the costliest way since they add many types of fees (exchange rate margin, recipient fees, etc) for the transfers due to following a specific channel to send money. However, as technology has emerged, many alternative methods exist to transfer money safely and with less fees. Let’s see which are those.

You can open a multi-currency account with a bank and keep all kinds of money, like dollars, euros, and yen, in one place. You don’t need to jump through hoops with multiple accounts or get tangled up in conversion rates. It’s straightforward but versatile, a real asset for anyone dealing with multiple currencies regularly.

However, this option is only feasible for those who transact frequently in multiple currencies, like multinational corporations. For individuals like us, it may not be that apt.

Peer-to-peer platforms are akin to a matchmaking service for currency exchange. Two parties looking to swap currencies get connected, bypassing traditional financial mediators. It’s a straightforward way to get a better rate, but caution is key.

Always vet the other party involved in the transaction. Trust is good, but verification ensures the money lands where it should since peer-to-peer platforms are highly prone to risks and fraud.

Certain mobile wallet companies like Payit offer international money transfer services from one mobile wallet to bank accounts. Mobile wallet transfers are cheaper for sending money home since you don’t pay multiple fees for your transaction.

‘’ For those residing in the UAE with financial ties to India or the Philippines, Payit offers a compelling advantage: no fees on money transfers. That’s correct—zero fees ’’

To sum up, here’s a checklist of actionable steps for optimizing the cost-effectiveness of international money transfers:

Sending money across borders can be complicated and costly due to several factors. It is crucial to have a good knowledge of exchange rates, carefully examine the actual cost of “free” transfers, consider regulatory fees, and explore alternative methods. With this information, individuals can make better financial decisions, save money, and successfully navigate the often confusing world of international money transfers.

Download the Payit mobile wallet app to send money to your home country at cheaper rates and manage your payments more efficiently with safety and security.