Home » Cashless Payments Knowledge Hub » Digital Currency in the UAE: Way to Becoming a Global Cryptocurrency Hub

The United Arab Emirates (UAE) is the third largest crypto market in the world as per Chainalysis in October 2021. While the Middle East makes 7% of the global trading volume for cryptocurrency markets, UAE, among all, runs an extra mile toward becoming a global digital asset hub.

But, what is so special about the UAE, and why is it called the gold mine for the crypto exchange companies?

Let’s deep dive into the recent digital currency trends in the region and find out what factors contribute to making the UAE an attractive place for crypto lovers.

These trends signal that the country has taken active and serious steps toward making the UAE a global cryptocurrency hub.

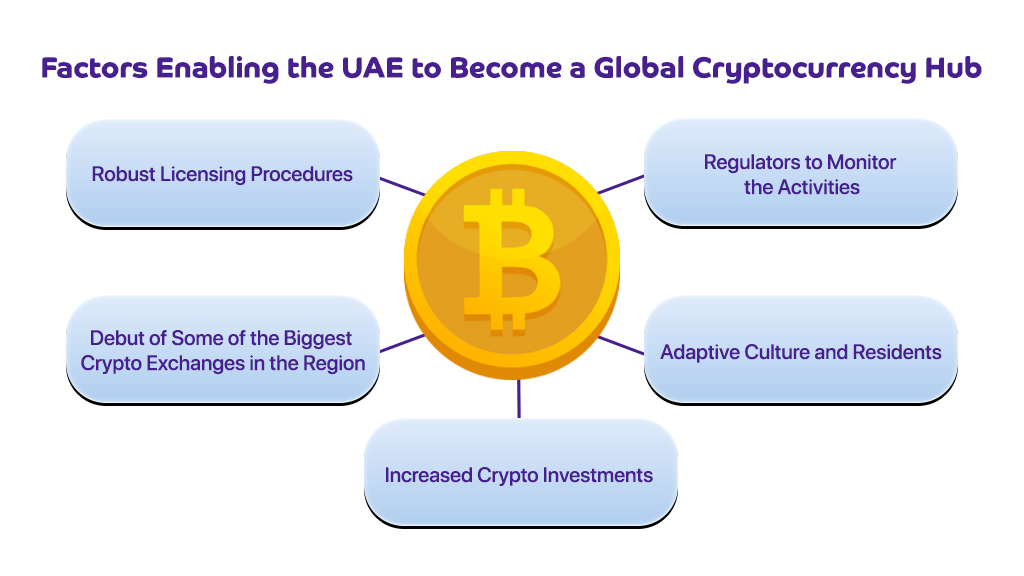

Let’s look at the factors that enable the country to make a powerful impact in the digital asset or virtual asset world.

From adaptive residents to stronger regulatory laws on virtual assets, UAE has set clear targets to enable the country’s growth by innovating virtual assets. Let’s see why UAE is able to attract crypto and virtual asset companies to its homeland.

While the most developed countries like the USA and the UK have taken a restrictive approach towards crypto trading companies, the UAE is set to issue federal licenses to cryptocurrencies.

Thus, UAE has adopted a hybrid approach to regulating the virtual asset transaction while also enabling them to grow exponentially.

To create a global virtual economy, the UAE has taken decisive steps by allowing the regulators to monitor and supervise virtual asset activities. VARA and the UAE’s Securities and Commodities Authority (SCA) regulate these transactions.

| Virtual Asset Regulatory Authority (VARA) | Securities and Commodities Authority (SCA) | Financial Services Regulatory Authority (FSRA) | Dubai Financial Services Authority (DFSA) |

| It is based in the DWTCA and issue licenses to the companies who wish to establish their crypto or a digital currency company in Dubai.While VARA applies to Dubai and its free zones, it does not apply to the DIFC financial free zone. | Itis a regulatory body that regulates the financial markets in the UAE. The SCA issued Crypto Assets Activities Regulations (CAAR) to supervise and manage crypto transactions in the UAE. However, the SCA regulations do not apply to DIFC and the free zones in the UAE. | It is a regulatory body in Abu Dhabi governing ADGM and controls the license issuing process to the crypto exchanges. The FSRA is an independent authority that requires the fulfillment of certain conditions for the companies registered under it. | It is a governing body regulating the DIFC free zone in Dubai. It monitors virtual asset transactions, including investment, trading, operating, etc., of the companies registered. It is also an independent body that regulates the activities of the companies registered in DIFC. |

The UAE has welcomed many significant cryptos and virtual asset companies with arms wide open. It has already signed agreements with Binance, FTX, Kraken, Crypto.com, Bybit, etc., as its founders have seen umpteen opportunities to grow their regional firms.

The UAE has seen a sudden spurt in the private wealth held by the residents in 2021 as more than 5,600 millionaires moved to the UAE. The young adults have shown the utmost interest in the country to invest in virtual assets like Bitcoin and Ethereum.

Moreover, the culture of the UAE itself is highly adaptive, and Dubai has always welcomed diverse cultures and innovations to always look for sustainable growth for the country.

UAE-based grocery delivery service firm YallaMarket accepts cryptocurrencies as a form of payment while it also announced an option to receive salaries in cryptocurrencies. These developments are clear signs of increased crypto investments in the UAE.

The crypto business in the UAE is likely to double by the end of 2022 with the constant increase in investors month-on-month basis.

Thus, be it regulatory support, a rise in crypto transactions, or the residents’ keen interest in virtual assets, the UAE is set to become a global cryptocurrency hub in the coming years. Download the payit e-wallet app to make international transfers hassle-free, secure, and more convenient