2025 is a year for financial planning. Why? Global economies are stabilizing post-pandemic, inflation rates are moderating, and technology is transforming markets. ESG investments are surging. Governments are also introducing new tax policies to encourage investment in green initiatives and digital assets.

So, how can you plan financially in 2025 for maximum benefits?

Let us help with that.

What Can be the ROI in the 2025?

Return on Investment (ROI) is no longer just about high returns. It must balance growth and risk. In 2025, inflation-adjusted returns will matter more than nominal growth. Why? Global inflation is expected to hover around 4-5% in developed economies. Thus, real returns will be a critical focus.

Market conditions will remain dynamic. AI-driven stocks may dominate headlines. However, overvaluation risks could impact short-term ROI. Focusing on diversification and smart asset planning will matter more than chasing speculative growth.

Also Read: Personal Finance Tips for UAE’s Working Expats

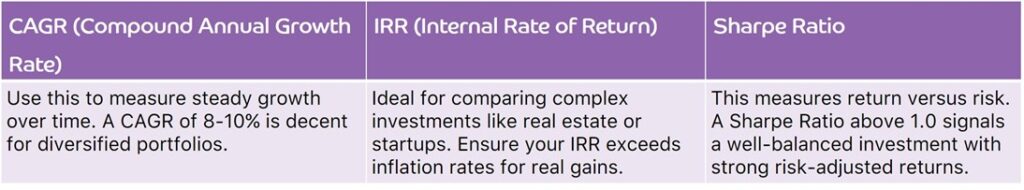

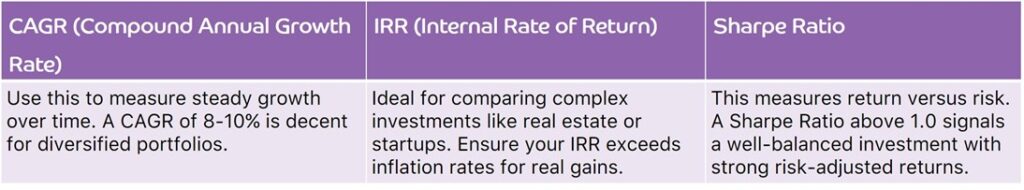

Key Metrics to Track in Financial Planning

Track these metrics to ensure optimum ROI:

Core Strategies for Maximum ROI in 2025

Follow these strategies for maximum ROI in 2025:

Diversify Your Investment Portfolio

- Sectoral Diversification: High-growth industries like renewable energy, AI, and healthcare will be major drivers. Renewable energy funds are expected to grow and are supported by government subsidies. AI and machine learning markets are projected to reach $826.70 billion by 2030, with a CAGR of 28.46%.

- Geographical Diversification: Emerging markets such as India and Vietnam are forecasted to grow 6-7%. They will significantly outpace developed nations. Investing in these regions can provide higher growth potential, especially in infrastructure and technology.

- Alternative Investments: You can consider REITs for steady income, peer-to-peer lending for higher yields, and commodities like gold as a hedge against market volatility. Gold prices have historically performed well during periods of economic uncertainty.

Technology and Data-Driven Decisions

- Use of AI: AI-driven platforms like Betterment and Wealthfront enhance financial planning. These tools provide personalized portfolio recommendations. They also track performance against benchmarks in real-time.

- Blockchain Investments: Tokenized real estate and digital assets offer transparency and liquidity. An attractive option in 2025. Early adoption can put you in a high-growth niche.

- Pick Analytics-Driven Stock: Leverage platforms offering predictive analytics, such as Morningstar or Zacks Investment Research. These tools use historical data and machine learning to forecast stock performance.

Also Read: 5 Financial Decision Mistakes Parents Make

Focus on Passive Income Streams

- Dividend Stocks: Dividend aristocrats like Procter & Gamble or Johnson & Johnson consistently yield 2-4%. Ideal for steady returns. You can receive dividends from the Abu Dhabi Securities Exchange on the Payit mobile application.

- Bonds and Fixed-Income Investments: With stabilizing interest rates, government bonds offer a safe option with around 4-5% returns.

- Rental Properties and REITs: Real estate is a reliable source of passive income. UAE’s real estate market is growing. This trend is expected to continue in 2025 with increasing demand.

Prioritize ESG Investments (Environmental, Social, Governance)

Investors are increasingly prioritizing sustainability. ESG funds are outperforming traditional funds in volatile markets. Funds like Vanguard ESG US Stock ETF (ESGV) provide competitive returns while supporting sustainable businesses.

Risks to Consider

Financial planning in 2025 comes with risks. These are the challenges to watch for:

Market Volatility

Sudden fluctuations can disrupt even the best-laid plans. Diversify assets across sectors and geographies to minimize risks. Protect your investments with stop-loss orders.

Inflation Risks

Even with moderation, inflation can erode returns. Invest in inflation-protected securities like TIPS (Treasury Inflation-Protected Securities) or assets like gold.

Overinvestment in Trends

It’s tempting to follow hot sectors, but overexposure is risky. Conduct thorough research and balance high-growth assets with stable investments.

Also Read: Financial Planning Tips for Newcomer Housewives in UAE

Tips for Financial Success in 2025

Follow this step-by-step guide to maximize ROI:

- Assess Your Goals: Define short-term and long-term financial objectives. Determine your risk tolerance.

- Diversify Smartly: Allocate 40% to high-growth sectors (AI, renewable energy), 30% to stable assets (bonds, dividend stocks), and 30% to alternative investments (REITs, commodities).

- Use AI Tools: Use platforms like Betterment or Morningstar for data-driven insights and automated portfolio management.

- Review Regularly: Rebalance your portfolio every quarter to align with market conditions.

Bonus Tip: Automate your investments through SIPs (Systematic Investment Plans) or recurring deposits to ensure consistency and discipline. |

Summing Up

Financial success demands planning, discipline, and informed decisions. Diversify strategically, leverage technology, and focus on real returns. Starting early gives you a distinct advantage. Remember, consistent effort outperforms impulse decisions.