Home » Cashless Payments Knowledge Hub » Personal Finance Tips for UAE’s Working Expats

The United Arab Emirates (UAE) has a whopping population of 9 million expats, which comprises 88.52% of the total population. Attractive package, lap of luxury, and the dash & dunes of the country have gathered more expats to work for them.

However, living in this country from a financial perspective is not smooth sailing if you haven’t planned your finances. This blog is your go-to guide for personal finance tips if you are a working expat in the UAE.

The lifestyle in this country is a bit too high and mostly different from your home country’s lifestyle. From renting a house to buying groceries, everything is expensive. In fact, UAE residents are famously known for their spending-friendly behavior, where they spend more than what they earn.

Let’s find ways how you can manage your personal finances at a macro level if you are an expat in UAE.

You might be overwhelmed by the luxury items your neighbors or friends might be buying, but you need to set limits on your income for these products.

| Note: UAE’s luxury goods market is $2.789 billion, which is expected to increase yearly with a CAGR of 3.07%. |

It’s not wrong to buy luxury items, but it is dangerous to your financial health if you buy it without considering your income proportions. Hence, define a limit (luxury proportion) to buy luxury items to your income.

For example, you can spare 4% of your income to buy luxury items, and the rest you can spend to pay for monthly obligations and savings.

Before you spend your money, ensure you keep a portion of your income aside to save on investment instruments. Moreover, if your funds are sitting idle in the bank, they generate quite a low amount of interest.

Hence, invest your money in instruments that can offer you better returns, such as national bonds, mutual funds, stocks, etc. When you consistently invest, you will have little extra money to spend on luxury items, leading to better financial health.

Also, read Budgeting Tricks for New Parents in UAE

Although the petrol/diesel prices are way cheaper in this oil-dominated country, you must consider the other hidden costs of owning a car. When you plan to own a car, you should consider the following costs:

Moreover, you may spend a considerable time finding the parking space or reaching your destination from your parking. Instead, public transportation is quite convenient and almost available everywhere.

You may also decide to commute in a cab if you travel in a group which can be a faster and cheaper option than public transport.

Cooking food at home is way healthier than eating outside. Although restaurants in UAE maintain the utmost hygiene, you may not want to put on extra pounds of weight by eating out. It ain’t wrong to dine out with friends and families, but spending money daily on eating out could be quite expensive.

You may plan to eat outside once a week and cook the rest of the meals at home, which will save you money and help you live a healthier lifestyle.

Many expats dream to own a house in the UAE, but let’s talk about the other side of owning a house. When you plan to own a house, you may have to consider taking housing loans. Once you obtain a housing loan and buy the house, you won’t be able to change your location.

The advantage of renting a house is that you only pay monthly rent and can live in different parts of the country. Additionally, you may have to change your locations frequently when your job is moving.

Thus, renting a house makes more sense in terms of saving money than owning a house.

Also, read No Credit History? 4 Ways to Get Money Without a Credit Check

From supermarkets to payment apps, everywhere, you will have discounts and offers. Use these offers and great deals to save extra amounts of cash. Sometimes, you may consider buying items in bulk since bulk purchases have mostly reduced rates than the rate for individual items.

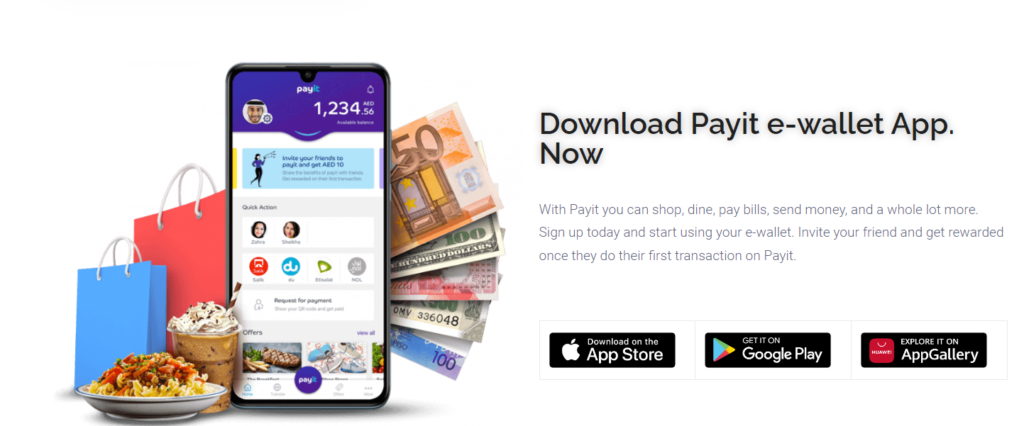

Save money on the go with the Payit mobile wallet app, and check out offers and promo codes.

Companies in the UAE do not provide pensions to expat employees; hence, you may not earn any pension income after retirement. Hence, invest in pension funds to receive regular income after you retire from your company.

National Bonds (an entity owned by the Investment Corporation of Dubai) has recently launched a Golden Pension Scheme for the expat working population. It would be wise to invest in a pension scheme to secure your retirement.

Despite rising inflation rates, UAE residents’ spending capacity remains stronger in 2023, and lack of financial planning can make it difficult to maintain the same standard of living. More online shopping, dining out with friends, and luxury goods purchase remain the most popular spending trends in the UAE.

Plan your finances wisely to secure your future in the UAE and send more money to your home country.

Send/receive money in your mobile wallet and make faster international money transfers with Payit digital wallet app.

Original Blog URL:https://payit.ae/blog/financial-tips-for-the-working-expats-in-uae/