As Ramadan is nearing, the UAE is already witnessing a shift in consumer behaviour in a way that more online shopping is anticipated. Starting from the evening of 22nd March 2023, Ramadan this year is all about using digital payments, digital platforms, and online orders.

UAE’s e-commerce will grow by $8 billion by 2025, and digital wallet spending will reach up to $10 trillion by that year. Setting a strong foundation for e-commerce and digital payments, UAE is set to become a digital economy in the coming years.

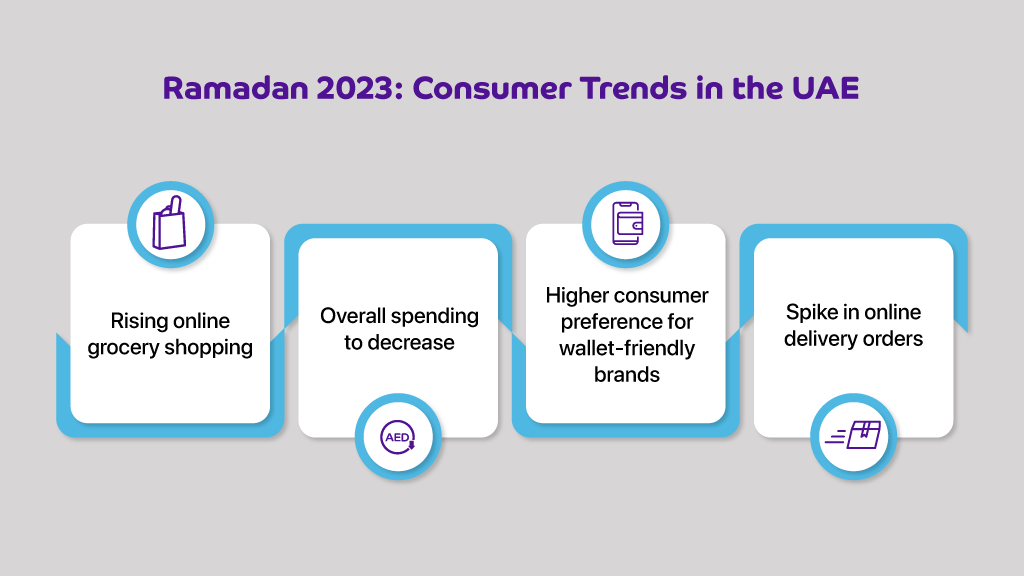

During Ramadan 2023 also, you will see more online shopping and digital payment trends taking the festival to the modern sphere. Let’s see some key trends to look forward to this Ramadan.

Ramadan, the ninth month of the Muslim calendar is famously known for fasting, but it also has its spiritual importance in terms of charity, reflection, prayer, and meeting families and friends. Although during Ramadan, people observe fasting, they also celebrate iftar with families in the evening with traditional food recipes.

While its traditional importance keeps growing year over year, people also shift their shopping behaviour, e.g., instead of buying from stores, they will order items online. Let’s see what the key trends for Ramadan 2023 are.

ًWe are fasting together, celebrating together. Ramadan is a holy month of fasting, but it also connects families to dine together. Hence, they cook a lot of food together and donate the food to the needy.

Online grocery store visits in September 2022 were 28% up as compared to September 2019. This year, you will see a spike in online shoppers who buy groceries online during Ramadan.

Consumers demand to receive groceries at the doorstep has increased, and when they buy food in bulk, they find the online delivery options the most convenient ones.

Also read, Benefits and Spiritual Importance of Ramadan

Rising inflation rates have made UAE residents shop less and save more. Hence, overall consumer spending is expected to be less this Ramadan. Nonetheless, they will continue following their tradition as before with more spirituality.

Consumers may eat out less during iftar and cook food at home. They will keep looking for offers and deals to buy gifting items and buy for themselves. UAE residents this year are also conscious about reducing food waste to celebrate the month in an environment-friendly way.

Mobile wallets allow users to shop online from their favourite brands, and digital wallet apps like Payit always have discounts and promo codes for online shoppers. This year, during Ramadan, consumers will prefer wallet-friendly brands to avail of more offers and discounts to control their overall spending.

Usually, during Ramadan, consumers buy gifts for their friends and families, so online shopping through digital wallets is estimated to shoot during this month.

Consumers are expected to use online delivery services this Ramadan more than in previous years. During fasting hours, since certain places have restrictions on eating food outside in public to respect the fasting traditions, consumers who not fasting are likely to get the food delivered to their places.

Shopping app purchases in 2022 Ramadan represented 64% growth, and a similar rise this year Ramadan will also be seen as more consumers shift towards digital ordering.

This year, Ramadan trends are highly driven by the changing consumer trends in different market segments. Let’s see what those are:

Also read, UAE’s Digital Payment Trends to Look for in 2023

Payit mobile wallet app provides dozens of offers and promo codes to let you keep buying from your favourite brands with just a few taps on your phone. Grab gifts for your loved ones at discounted prices by downloading the app on your phone.