Home » Cashless Payments Knowledge Hub » No Credit History? 4 Ways to Get Money Without a Credit Check

Your loan application in the UAE will be rejected if all your EMIs (equated monthly investments) has reached 50% of your monthly income. Thus, your credit history significantly impacts you when you need money in urgent situations.

So, what should you do when you need cash without a credit check?

Let’s first understand why you need a good credit history and how you can get money without a credit check.

A credit check is your financial behavior which every bank or financial institution reviews before providing you with any financial assistance. Your credit score tells them how financially stable you are to repay their money if they lend you some.

Your credit check is done by reviewing the timeliness of paying different bills (utility, credit card dues, etc.) and observing your repayment pattern for past loans.

But why do you need a good credit history? Let’s find out.

A bad credit score means you are not reliable (read: riskier) to be offered financial assistance since you may have defaulted in the past to repay any loan or have many delayed bill payments or credit card dues.

Thus, a good credit score can lend you money with a preferable interest rate. At the same time, a bad credit score will make it risky for the finance provider and may cost you higher interest rates.

That being said, it is not impossible to avail yourself of cash without a good credit score because many options can offer you instant money without conducting a credit check.

Let’s find out how you can get cash without a credit score.

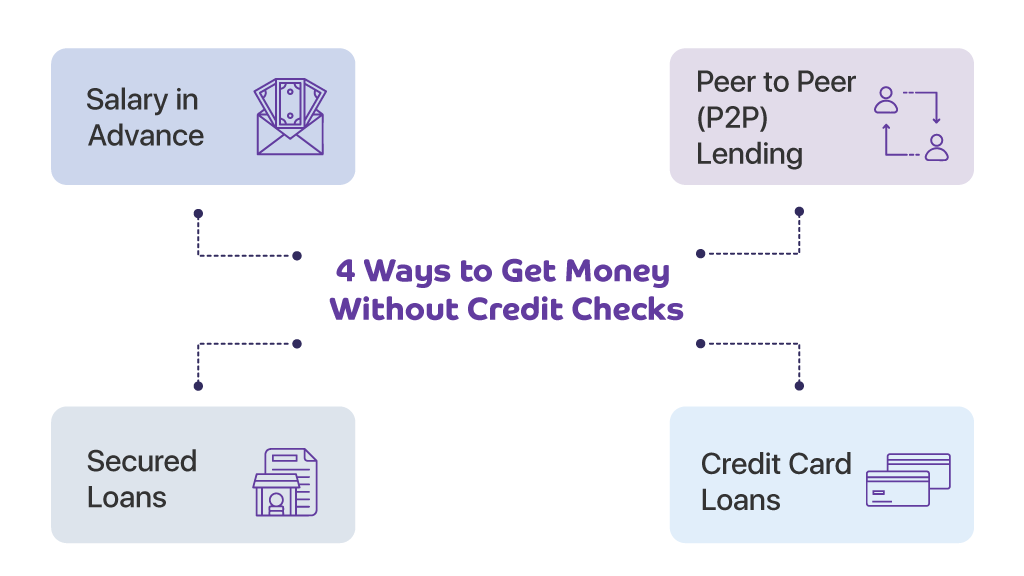

Peer-to-peer lending platforms, salary advances, secured loans, and credit card loans are some of the most convenient options to avail of cash without credit checks.

If you are a salaried individual, then you can receive cash against your monthly salary as an advance. It is a type of payday loan where the finance provider automatically deducts the money on the first day of the month when you receive your salary either in full or in equal installments.

P2P lending is a form of direct lending where individuals can connect with each other and lend/borrow directly from them. P2P lending platforms provide a common platform for borrowers and lenders to connect and borrow/lend money.

However, there are some lenders on P2P platforms, too, who will check your credit history, but you may get one without any credit check.

When you offer security (property or any other valuable item) to the finance provider, you can avail of instant cash against that. A secured loan is one of the most popular forms of availing of money without a credit check since you have already provided collateral.

Hence, the lender can recover the amount from the security you offered if you don’t repay the money.

Your credit cards can allow you to avail of loans against them; hence, it is one of the easiest ways to get money. However, credit card loans carry high-interest rates, and it could be too costly for you to get cash against them.

These options can get you small loans without a credit check; hence, you can consider them if you want a loan. However, you will still have to go through a loan application process.

If you need cash urgently, then you can receive it instantly in your mobile wallet. Ratibi salary cards allow you to receive cash for up to 50% of your salary. For that, you need to be a Ratibi salary card holder.

Related: What is Ratibi Salary Card (All you need to Know)

Download the Payit wallet app to get instant access to the ‘money on demand’ feature as a ratibi card holder.