Home » Cashless Payments Knowledge Hub » How ‘Cash Now, Pay Later’ Schemes Can Cost You More Than You Think

Needs are endless, and thus, immediate access to cash is tempting. Be it a last-minute expense, a medical emergency, or just an impulse purchase, more money is always welcomed. ‘Cash Now, Pay Later’ (CNPL) schemes offer quick funds with the promise of easy repayment. But are they as beneficial? Let’s find out.

‘Cash Now, Pay Later‘ is a financial service that allows you to receive immediate cash, which you can repay over time through installments. Unlike traditional loans, CNPL schemes often offer quick approvals, minimal documentation, and sometimes zero interest fees.

These services serve people who may not qualify for standard credit options, often bypassing stringent credit checks. For consumers with limited options, it’s a fast and accessible solution.

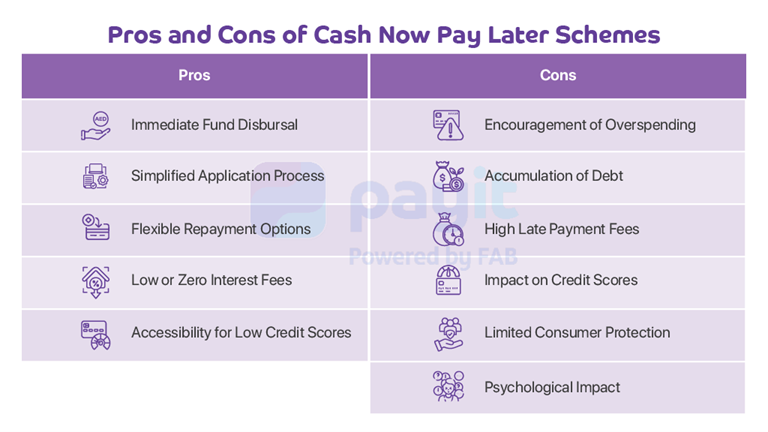

These are the advantages of CNPL service:

Need cash urgently? CNPL provides quick access. Perfect for unforeseen expenses like medical bills, car repairs, or even everyday purchases.

Traditional loans require detailed documentation and credit history. However, CNPL schemes have a streamlined process. Some providers approve loans within minutes.

You can repay in easy-to-manage installments. This allows you to align payments with your income cycles. Thus, it becomes less daunting to repay large amounts at once.

Many CNPL services market themselves with ‘zero interest’, especially for short-term repayment plans. This makes them seem more attractive than credit cards or personal loans, which have higher interest rates.

You can access CNPL services even with poor or no credit history. The absence of rigorous credit checks opens the door for financially excluded individuals.

Despite their advantages, CNPL schemes come with risks. Many of these pitfalls remain hidden in the fine print, including:

CNPL stimulates impulsive decisions. CNPL makes purchases feel affordable in the short term, but the long-term financial strain often goes unnoticed.

With CNPL, it’s easy to lose track of multiple repayments. Each installment might seem manageable, but the debt can snowball when combined with other expenses. Often, this leads to a vicious cycle of borrowing to cover previous debts.

Did you know missing a single payment can cost you more than the original purchase? Late fees in CNPL schemes are notoriously high. Sometimes, it even exceeds credit card penalty rates.

While CNPL providers often skip initial credit checks, they report defaults to credit agencies. Failing to make payments or making them late can harm your credit score. It makes it harder to secure traditional loans in the future.

Traditional credit products, such as loans and credit cards, come with strong consumer protection. CNPL services, however, often lack such safeguards. The resolution process might be unclear or inadequate in case of disputes or fraud.

Many CNPL users report anxiety and stress from juggling multiple repayments. The constant pressure to meet due dates might disrupt mental well-being.

If you’re not interested in obtaining a loan but are looking for alternative ways to access cash immediately without borrowing, consider these options that may help you.

Payit’s ‘Money on Demand’ service is the best alternative to cash now, pay later, where you get instant cash access with just a few taps. Eligible Ratibi cardholders can instantly access money through the ‘Money on Demand’ feature in the app.

Also, read How to Get Money on Demand without a Credit Score?

If you decide to use a CNPL scheme, follow these tips to stay on track:

‘Cash Now, Pay Later’ schemes offer convenience. But the cost? Hidden fees, mounting debt, and poor mental health. Know these pitfalls and explore alternatives, and you will make informed financial decisions.

Ask yourself – Do I really need this now? If the answer is no, it’s better to wait, save, and avoid the debt trap. Remember, financial freedom begins with small steps.

Alternatively, you can get instant cash access through ‘Money on Demand’ through the Payit mobile wallet app and meet your emergency needs with a few taps from anywhere.

FAQs

How to get cash now and pay later?

With Payit’s Money on Demand service, you can get instant cash, and the money will be deducted from your next month’s salary deposit.

How can I get emergency cash in the UAE?

You can get emergency cash in the UAE from Payit’s Money on Demand service. If you are a Ratibi card holder, you can access this service.

What are the pros and cons of Pay Later?

Pros: Convenience and flexibility; Cons: Potential debt and high interest if payments are delayed.

What are the negative effects of Cash now pay later?

Encourages overspending, leads to debt accumulation, and may harm credit scores if payments are missed.

What are the risks of cash payments?

Risk of theft, lack of proof of transaction, and inconvenience for large amounts.

What is the limitation of cash payment?

Limited to in-person transactions and lacks security compared to digital payments.