Home » Cashless Payments Knowledge Hub » How to Apply for UAE’s Unemployment Insurance Scheme?

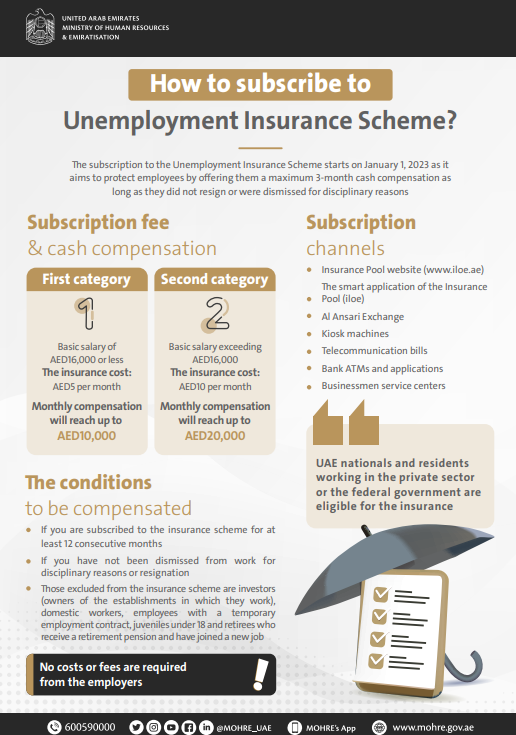

The unemployment insurance schemeannounced by the UAE government is effective from 1st January 2023. The scheme is introduced to offer social security during unemployment and enhance the competitiveness of unemployed people. Already 250,000 people applied to the scheme by 12th Jan 2023.

The government aims to provide an unemployment insurance policy to

Since it is mandatory for government and private sector employees to enroll for the scheme, you should know the unemployment insurance scheme and how it works.

The UAE government announced mandatory subscription to the unemployment insurance scheme for government and private employees, which is in effect from 1st Jan 2023. This scheme provides financial support to those terminated from employment by their employers.

However, if you leave their jobs voluntarily, you can’t claim the insurance amount. The employees need to pay the monthly premium to claim financial support in case of a job loss.

The country aims to empower human capital through economic and social development, and the unemployment insurance scheme is one step toward the goal.

Source: https://u.ae/-/media/Documents-2023/How-to-subscribe-to-Unemployment-Insurance-Scheme.ashx

The Ministerial Resolution No. 604 of 2022 on Involuntary Loss of Employment (ILOE) has all the provisions regarding the Unemployment scheme. The government has created a pool of 9 insurance companies under the leadership of Dubai Insurance Company.

List of Insurance Companies Providing Unemployment Insurance:

Thus, to apply to UAE’s unemployment insurance scheme, you need to check whether you are eligible or not.

All workers (federal and private sectors) are eligible to apply to the scheme, and you will receive an insurance claim amount in case you lose your job only if you have paid the insurance premium for at least 12 consecutive months.

Who are Not Eligible?

The insurance premium amount is purposefully kept minimal considering the economic conditions of the majority of the blue-collar workers. The scheme also allows policyholders to subscribe to any other additional benefits the insurance company may provide.

| Employee Categories | Insurance Premium Amount | Maximum Compensation |

| Employees with less than AED 16,000 monthly salary | AED 5 per month (AED 60 annually) | Up to AED 10,000 monthly |

| Employees with more than AED 16,000 monthly salary | AED 10 per month (AED 120 annually) | Up to AED 20,000 monthly |

The eligible employees are given the grace period within which they are supposed to apply to the scheme.

| Employee Categories | Grace Period to Apply to the Scheme |

| Eligible employees | Within six months (i.e. 30th January 2023) |

| Eligible employees (after 1st January 2023) Change visaStart working in the UAE | Within four months of change of visa or starting new employment in UAE |

The government has also provided a list of subscription channels through which you can apply to the scheme. You can apply from one of the following channels.

Once you have applied to the scheme, you have to pay the monthly premium amount, which you can decide to pay annually or quarterly.

In case of a job loss, you must submit the claim within 30 days of the employer’s termination to one of these approved channels:

You will receive monthly compensation

whichever is earlier.

However, you may be suspended from receiving the claim amount if you fall into any of the following conditions:

Thus, UAE’s unemployment insurance scheme ensures social security for working residents who lose their jobs until they find a new job (max up to 3 months). This is one of the most welcoming moves by the UAE government in 2022 that takes care of its human capital.

Does UAE have unemployment benefits?

Employers in the UAE provide many employee benefits, such as mandatory health insurance, retirement plans, etc. All Dubai and Abu Dhabi residents must hold health insurance, and the employers provide it.

How to get Unemployment Insurance in the UAE?

The unemployment insurance scheme is mandatory for government and private sector workers, applicable from 1st Jan 2023. Eligible employees can apply from one of the following channels:

How much insurance amount do you receive when you lose your job?

Based on your basic monthly salary, you will receive the insurance amount of up to AED 10k monthly for employees earning below AED 16k monthly and up to AED 20k for employees earning more than monthly AED 16k.

Is this scheme mandatory for all UAE residents?

It is mandatory for all government and private sector employees except,

How to claim an unemployment insurance fund?

You can claim the insurance amount from one of the below-approved channels: