Home » Cashless Payments Knowledge Hub » UAE’s Digital Payment Trends to Look for in 2023

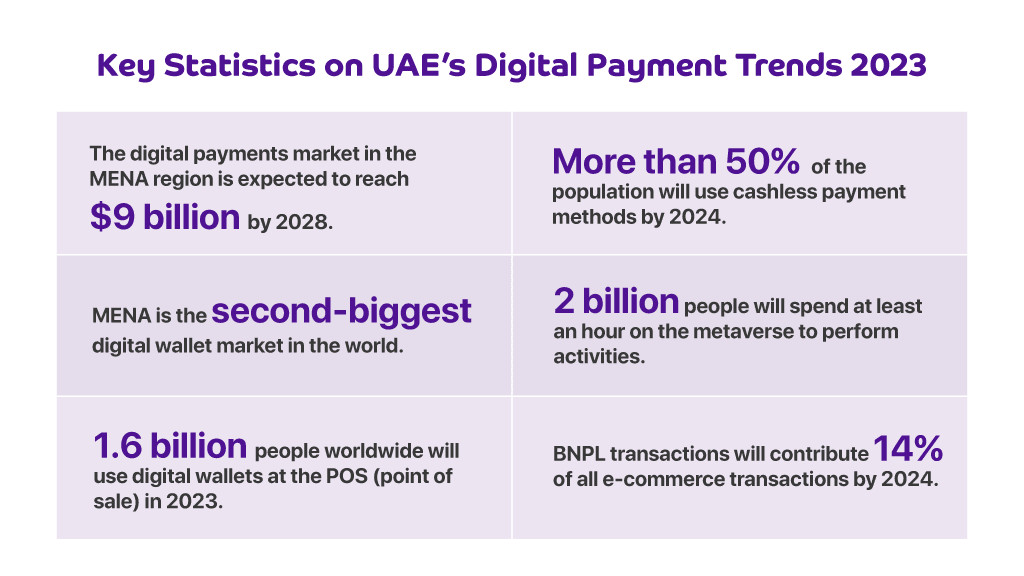

The digital payments market in the MENA region is expected to reach $9 billion by 2028 (124% up from 2021). Although the UAE population still relies on cash and credit cards for payments, the new generation and the millennials have already started exploring emerging digital payment methods.

In fact, more than 50% of the population will use cashless payment methods by 2024, which sets a strong foundation for emerging digital payment methods.

This blog explains the drivers of the key trends in the UAE’s digital payment industry and popular trends to look for in 2023.

Thus, speed, convenience, and a better customer experience are the most important key drivers for digital payments for this year.

Let’s see what are the key trends in 2023 for digital payments in the UAE.

Metaverse gets more popular as it creates a virtual world for users. They can perform many activities, from shopping online to finding jobs and working for companies. In fact, a study revealed that by 2026, 2 billion people would spend an hour on the metaverse to perform these tasks.

Moreover, Web3 technologies such as decentralised finance (DeFi), decentralised identity, and decentralised autonomous organisations (DAOs) will also trend this year. Gen Z has become a more virtual-friendly population; hence, the future lies in the virtual world.

Digital wallet companies continued adding more features to their offerings in 2022, resulting in more people using mobile wallets and making one-tap payments. A study reveals that 1.6 billion people around the world will use digital wallets at the POS (point of sale) in 2023.

Be it utility payments, e-commerce purchases, or money transfers, more consumers will adopt mobile wallets as their first preference due to the convenience, security, and speed they offer.

Also, read How are Digital Wallets Shaping the Future of Digital Payments in UAE?

Not only individuals but businesses in the UAE also consider adopting digital wallet payments to boost their online business. Companies need to offer their customers preferred payment methods to make payments easy; hence, digital wallet payments will be one of the most popular payment methods for merchants.

Buy now pay later companies to offer the flexibility of making payments to consumers by providing a small short-term credit facility where customers can pay later on for their purchases.

BNPL transactions will contribute 14% of all e-commerce transactions by 2024, making it one of the year’s most popular trends. With more players entering this market, the quality of the BNPL offerings will increase.

For merchants, adding the BNPL option as one of their e-commerce website’s payment methods is essential. McKinsey’s survey revealed that more than 25% of consumers would not have bought products online if the BNPL arrangement wasn’t available.

Certain regional players have made the BNPL option available in retail stores through their POS terminals. It is a revolutionary move to offer flexible payment options at physical stores.

Soft POS is a virtual POS terminal through which you can receive payments on your mobile with a single tap. Retail stores in the UAE demand soft POS terminals since they can reduce the cost of setting up physical POS terminals.

While consumers demand contactless payment options, merchants also plan to set up POS terminals on their phones. BNPL players have also arranged the availability of the scheme on the POS terminals. Thus, soft POS terminals will also include a buy now, pay later option to provide flexibility in the payment to the consumers.

The card network companies like Mastercard, Visa, and Amex have introduced ‘click-to-pay’ checkouts where users simply make payments with one click using their credit/debit cards.

Click-to-pay uses card tokenisation to store customers’ card details, including name, card number, and expiry date, by encrypting the details into secure tokens or identifiers. Thus, it allows online shoppers to make single-click payments without entering card details every time.

While consumers demanded simplicity, speed, and security for digital transactions in 2022, UAE started seeing an upward trend for digital payment methods such as NFC-enabled (Near Field Communication) payments and QR (Quick Response) payments.

However, this year we will see a boon in the digital payment industry in terms of more adoption of payment methods, better placement of the industry players, and more innovative products to allow simple and secure payments.

Download the Payit digital wallet app to send/receive payments, split bills with friends, and make international money transfers instantly.