Home » Cashless Payments Knowledge Hub » How are Digital Wallets Shaping the Future of Digital Payments in the UAE?

More than 50% of the UAE’s consumers use digital wallets to make payments as it allows convenient contactless payment solutions. Additionally, the United Arab Emirates (UAE) residents have been quite active in contributing to the move toward building the world’s most innovative digital economy in the country.

Digital payment methods such as e-wallets, wearable technology devices, buy now pay later (BNPL), etc., have emerged as some of the most popular payment methods in the region. However, digital wallets have been one of the most used payment methods by UAE residents.

Let’s see the evolution of digital payment methods and how digital wallets are shaping the future of digital payments in the UAE.

Digital payments have come a long way since 1958, and they are the future of payments in the world. Although they have been growing since they were introduced, people started using digital payments more after the global pandemic in 2019 and 2020.

The changing customer demands have also played a massive role in bringing digital payments to the forefront of financial transactions for the public. Let’s see the history of digital payments and what all methods of payments have been introduced so far.

| Credit/Debit Cards | Online Banking | Digital Wallets |

| The first credit card was issued by the Bank of America in 1958. Since then, credit and debit cards have been the main digital payment methods. | Towards the end of 1990, online banking services were introduced, and a whole lot of people still use them. Visiting bank branches have been outdated as more and more features to the online banking services were added. | In 2000 when PayPal merged with X.com, they launched the first electronic wallet that could transfer money through e-mails. Digital wallets or e-wallets gained popularity in the past couple of years as most people find it more convenient to send/receive money with just a few taps on the app on their phones. |

Read Also: In UAE – 5 Key Trends of 2022 in Digital Payments

The UAE has witnessed a sharp surge in digital payments, especially mobile wallets, as the residents move towards making payments through QR codes and payment links. Below are some key statistics that prove the country’s most popular digital payment method has been digital wallets.

Thus, as the country marches towards making the world’s fastest-growing digital economy, the future of digital payment truly relies on the emergence of digital wallets.

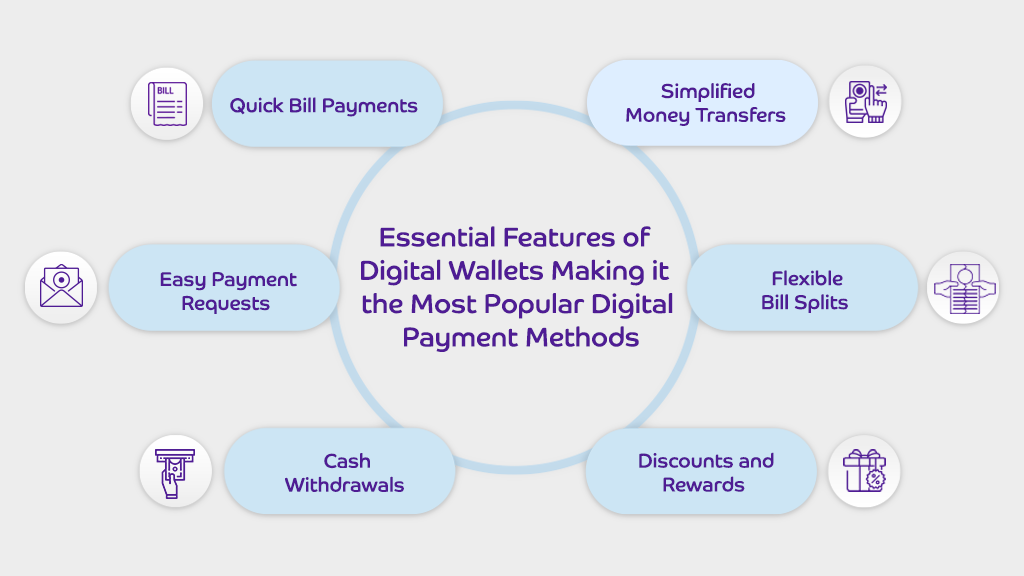

Let’s look at the key features of digital wallets that make them more popular among UAE residents.

One of the most important reasons digital wallets are so popular is because they are more convenient to use as an app on your smartphone. You don’t need to log into any online banking portal; a simple tap on your phone app can simplify your financial transactions faster and safer.

Digital wallets allow you to make quick bill payments, whether Etisalat or du bill payment, DEWA, or any other utility bill payment. The mobile wallets also will enable you to recharge your phone balances with just a few taps.

28% of the respondents of checkout.com’s survey used digital wallets to send money to friends and families. Thus, the digital wallet is the most convenient method to make money transfers internationally or domestically.

You can make payment requests using digital wallets, which has changed how freelancers can get paid, and also small business owners without a bank account. The payment request feature makes it highly sophisticated to ask for payment or money from a client, a friend, or a relative.

The digital wallets can offer you the flexibility to split bills with your friends and relatives. Hence, when you go out for lunch or dinner with your friends, you can split bills on an e-wallet and eliminate the chaos of who will make the bill payment.

Some e-wallets like payit allow you to withdraw cash without visiting an ATM. This is indeed revolutionary in the times when you can’t step out of your house and still need some money; you can do it with e-wallets.

One of the most attractive features of these e-wallets are the discounts and rewards through cash-backs. Most mobile wallets give you discounts and cash-back rewards so that you keep using the wallets and make the most out of them.

Thus, with the evolution of digital payment methods in the UAE, digital wallets can be considered people’s choice to make hassle-free payments.

Mastercard’s new payments index 2022 revealed that consumers are well-aware of the new payment methods and are increasingly using them for daily transactions. Digital wallet spending is going to reach $10 trillion by 2025 worldwide. Thus, digital wallets like payit and many more are shaping the future of digital payments as they offer customers more convenient, faster, and safer payment solutions.