Home » Cashless Payments Knowledge Hub » 7 Things to Consider While Selecting a Payment Processor for Your Business

Whether you are a small business owner or a big giant in any industry, almost everyone requires payment processing services to run their businesses smoothly. Moreover, nearly 88% of the payment transactions were contactless in 2021, which justifies that customers are moving toward making payments digitally.

While there are many payment processors available in the market, which one should you select to enable smooth transactions for your business?

Let’s understand the key aspects you need to consider before selecting a payment processor for your business.

Let’s understand what a payment processor is and what it does. A payment processor is a mediator that communicates the payment transaction among you, your customer, your customer’s bank, and your bank.

In other words, your payment transaction moves among different parties (you, your bank, the customer, and his bank) through a system, and the payment processor manages that system.

Telr, CashU, CCAvenue, etc., are some of the payment processors in the UAE providing payment solutions to businesses. Thus, payment processors make it possible for you to incorporate different payment methods for your online as well as in-store business transactions.

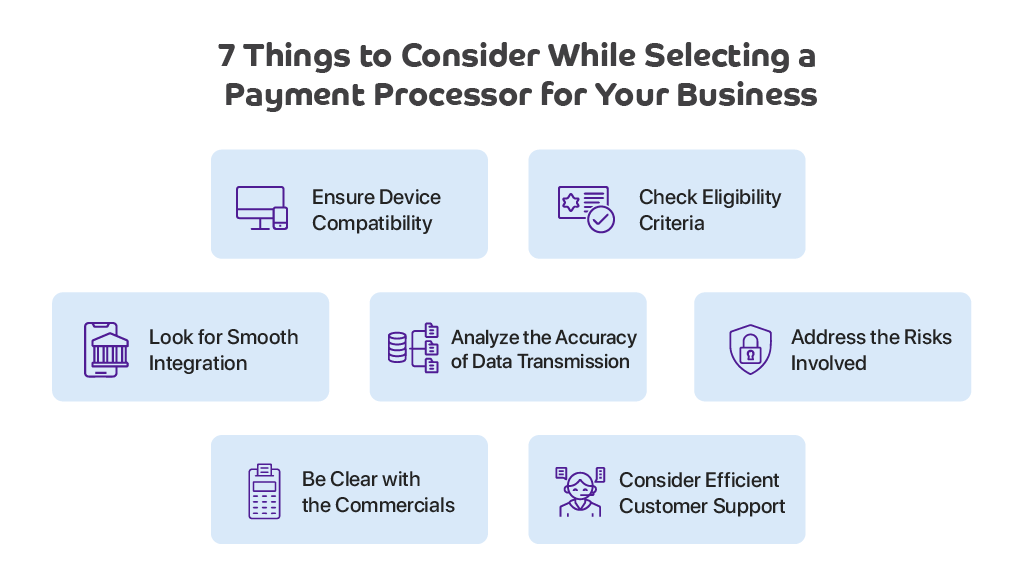

So, how do you select one? Let’s see a checklist that you should look for as a minimum for a payment processor you want to work with.

Almost every payment processor will have standard services to offer you. However, it is essential to understand and check before you enter into any service agreement with them. Let’s quickly jump onto a checklist you must consider before you select a payment processor.

Your customers’ preferences are the key to selecting your payment processors. Your customers might be making payments using different devices, browsers, and operating systems. You must ensure that your payment processor is compatible with almost every device or browser your customers use.

Several payment processors don’t offer their services to certain businesses. Check if your business falls under that list. In that case, you cannot work with that payment processor. Most payment processors do not offer their services to gambling or gaming businesses.

One of the most crucial aspects of selecting a payment processor is to check if the payment processor can smoothly integrate data with four key players in the payment transaction:

Select the one that offers more convenient methods of connecting with all the key players involved in the transaction.

Another primary concern is to ensure the accurate data transmission of the customers’ payment details. When you collect their information for the payments, customers’ privacy and security are of the utmost responsibility to you.

Thus, go with the one that accurately transfers customers’ payment details without tampering with them in the process.

While performing online financial transactions, many risks such as data privacy and security, cyber attack, fraudulent transactions, etc., prevail to a greater extent. You need to be careful to use the highest security standards that encrypt your customers’ details in a secure manner that does not compromise the privacy of your customers.

Once you have decided on the primary qualities of an ideal payment processor for your business, determine whether the pricing policies fit your business model. Be clear with the pricing techniques so that there is no hidden cost added later on.

Decide precisely on the service deliverables and what fee structure you would like to go with (monthly, project basis, etc.).

You may come across many challenges while processing the payment transaction of your customers. Most customers leave shopping carts if they find difficulties in processing the payments.

To avoid unnecessary delays in payment processing, you need to select a payment processor with more excellent customer support.

You may like: Factors may affect your online store

Many payment gateways and payment aggregators today use a payment processing system that provides you with almost all essential features. However, it is advisable to go through the minimum checklists you must be careful about to be on the safer side.

Partner now with Payit to get your business online through Pay it marketplace that gives your business an edge with its comprehensive payment solutions.