Home » Cashless Payments Knowledge Hub » 6 Steps to Set Up Your Business in Dubai

From a business perspective, Dubai is the “city of opportunities”. The best of the seven Emirates, it has shaped itself from a humble trading port into a global business hub. So a business Setup in Dubai means you practically have the world at your fingertips.

If you plan to set up a business in Dubai we will hold your hand and guide you all the way to starting your business in Dubai successfully such as we did before in our 101 guide for a business formation in UAE.

The leaders of Dubai have always been visionary. From the late Sheikh Rashid to his successor Sheikh Mohammad and his son Sheikh Hamdan, Dubai is always coming up with new business ventures to lure risk-takers and opportunists. Your company formation in Dubai can propel you to new business heights.

If you are still contemplating Dubai for your business setup, think about this:

Your new company in Dubai also gives you another advantage. It comes with an investor visa. This means you can bring over your family and live with them in the UAE. Additionally, as you gain the residence visa of the UAE, you become the tax domicile of the UAE and “non-resident” in your home country.

Although the UAE has been one of the most attractive places to set up a business, you may find it challenging to start your own business if you are not fully aware of the process. Below are the factors you need to consider before you set up your business in the UAE:

The process of how to start a business in Dubai is pretty straightforward if you have all your documentation in order. In fact, Dubai has established several online services like “Instant License”, “Basher” and “Invest in Dubai” to lure business enthusiasts and investors. Additionally, the government is constantly amending and introducing new reforms to make the setup process as smooth and easy as possible.

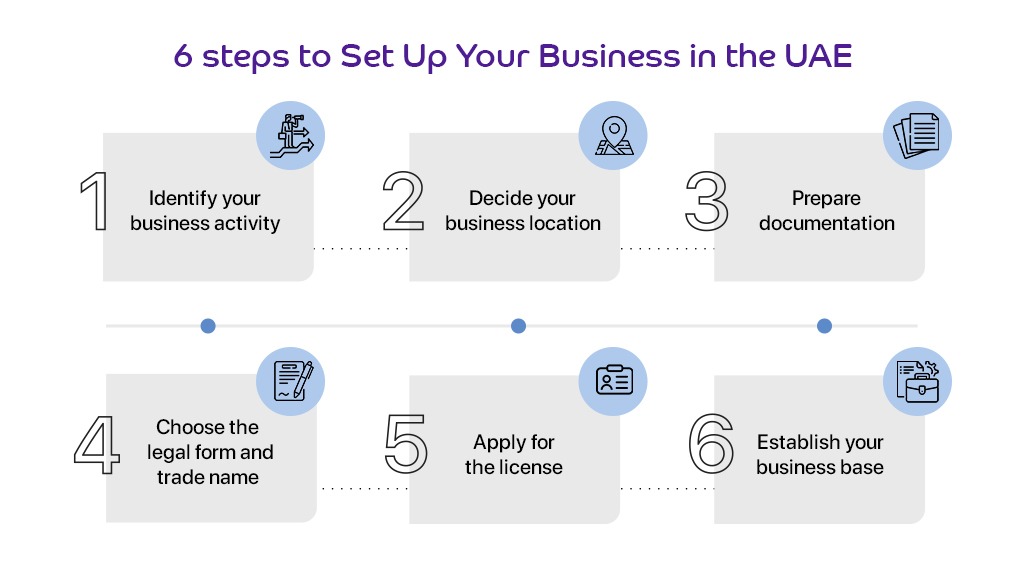

To set up a company in Dubai, you need to follow these steps:

The type of business license you get has a direct correlation to your business activity. To register a company in Dubai, you need to make the right choice for the initial approval stage. Fortunately, due to Dubai wanting to provide more value to your business venture, you have the option to have more than one business activity within your business.

Just to give you an overview of some of the popular business activities you can choose to setup your new business in Dubai:

Your business activity will define the business location you should have from three types of locations such as mainland, free zone, and offshore companies.

Mainland businesses are located in the main territory of the UAE which is not designated as a free zone. Moreover, in 2021, the Dubai government allowed 100% foreign ownership in businesses with certain conditions.

Free zones are low-cost areas that have their own set of rules and regulations, with separate tax laws, customs, and import export-related provisions.

Offshore areas allow you to do business outside of UAE without having office space in the UAE.

Once you have decided on the business activity and the location of your business, you must get the necessary documentation ready. Depending on which regulations are applicable to your business and the location of your business, your documents will vary.

Your business legal form helps other businesses understand the nature of your business activity. In Dubai, you can choose legal forms like:

Trade names for businesses have to be carefully chosen as they give you your local brand identity. You can register the name with DED, but do keep a few things in mind like:

Before starting a business in Dubai, you need the Memorandum of Association (MOA) that shows company formation information. It includes the names of the board members, the percentage of shares each member holds, the type of business activity undertaken, the legal form of the business, and so on. This is in accordance with the decree by the UAE Federal Government that states the MOA is a mandatory requirement for a Dubai company setup.

If your business activity falls under the 100% ownership business clause, you need to establish a local service contract. This is basically an agreement between you and a local representative that acts on your behalf in government dealings. You need to hire an Emirati employee of your business who gets paid yearly for their services.

Usually, the business setup cost in Dubai includes the fees for the MOA or local service contract such as:

Once all necessary documents are ready, you can apply for business license registration. The business license is essential as it will allow you to conduct your business in the UAE.

For a business setup in Dubai, you need a trade license. Dubai has four varied options for business trade licenses, the normal license, instant license, the DED trader license, and the Intelaq license. The cost for each of these licenses also varies due to the need for approvals and documentation.

Normal Licenses

Most mainland businesses come under the normal license heading. If your documents are all in order and you have the initial approvals, you can actually get the license in Dubai within 10 minutes. So, make sure all your documents are correct, as that is the only reason you face delays.

Under the normal license, you get options like:

Instant Licenses

This is a fairly new service that the Dubai Economy has announced. It aims to make the business setup process in Dubai faster. With just one step, you can announce your company opening in Dubai within five minutes. You don’t even need the MOA in the first year of establishment.

The following businesses’ legal types are approved for this service:

Also read, Start working as a freelancer in the UAE

DED Trader Licenses and Intelaq Licenses

Dubai governances value business owners who have an online presence and need a license that meets those requirements. The DED trader license is for start-ups and businesses whose business activities are conducted online or through social media accounts. The license gives you an official status with a trading name.

Finally, the Intelaq licenses are for those business entrepreneurs who want to start a home-based business. Whether you are an expat or a local Emirati, the license opens up new business opportunities. It takes just one hour to get the license, which can be renewed annually.

A physical location is necessary for all mainland businesses. You have to sign a rental agreement for office space, a warehouse, or a shop. The rent price depends on the location, which is also one of the reasons the cost of your business setup may increase.

Once you have signed the rental agreement, this document then needs to be registered with the Dubai Land Department (DLD). Ejari is the online platform to register or renew rental contracts. If you are doing the registration yourself, you pay a service fee of Dhs. 175. If a real estate agent does the registration, the fees are Dhs. 240 approx.

The final cost of a business setup in Dubai depends on the type of business you plan on establishing. DED offers plenty of opportunities for setting up a business in Dubai. While the exact cost isn’t possible, an approximation can help you understand the initial investment to set up a company in Dubai.

Thus, setting up a business in the UAE is an important decision and you should consult a business setup expert to understand the process better.

Download payit digital wallet app to make all your governmental payments easy and quickly