Home » Cashless Payments Knowledge Hub » Virtual Cards Vs. Digital Cards: What’s the Difference?

As more than half of the UAE consumers are set to use cashless payments by 2024, virtual cards have become an emerging trend among the residents. Virtual cards have become one of the region’s most popular digital payment methods, as they offer flexibility, simplified payments, speed, and security.

However, most people confuse them with digital cards. Apparently, both seem synonymous with each other, but let’s understand their true meaning. This blog explains the difference between virtual and physical cards.

A virtual card is an electronic card issued online through an application on your phone with a unique 16-digit card number, CVV, and expiry date.

Thus, a virtual card is similar to credit/debit cards but in an electronic form.

Virtual cards can also be issued as disposable cards, where the company provides a virtual account through which they generate unique 16-digit numbers every time you use the card.

Banks and fintech companies issue virtual cards to customers through an app with smooth customer onboarding, seamless documentation, and instant card issuance.

Once you sign up for a virtual card, you can see a debit/credit card similar to your physical card on your phone with certain hidden digits of the card number. You also get the card controls such as ‘block/unblock the card’, set card limits, etc., in the card settings section.

You can simply tap your phone to make payments at the point of sale or use card details to shop online.

Thus, it makes your payments or purchases faster, more secure, and more convenient. Now, let’s see what a digital card does and how it is used.

A digital card is a physical card whose values are represented electronically through a cloud-based platform. Thus, a digital card is a virtual representation of the physical card that already exists physically.

In fact, memory cards on a camera are also a type of digital card that stores digital content on a small chip. Also, when you save your physical credit/debit card details on any payment app, it becomes your digital card as it is a virtual representation of your existing physical card.

Digital cards use binary values (0 and 1) to store the virtual content of the physical cards. Thus, when you store your digital card on a payment app or use it to make payments, it is encrypted in computer-readable language to store the values securely.

So, are digital cards the same as virtual cards, or are they synonymous with each other? Let’s find out.

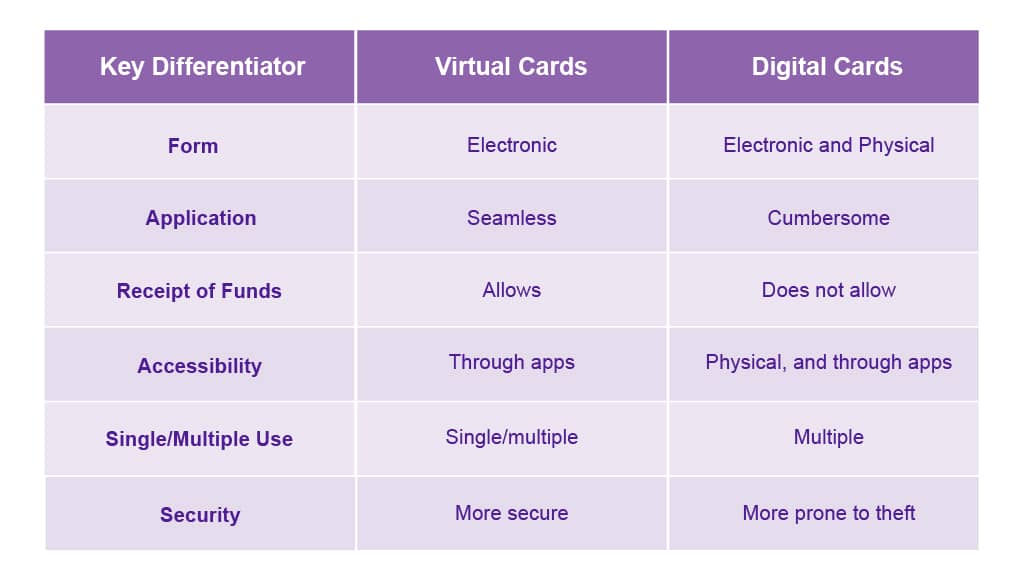

There is a thin line difference between digital cards and virtual cards. Although look similar, virtual cards may only sometimes have a physical presence.

Broadly, virtual cards are issued electronically and used for one-tap payments and online shopping.

On the other hand, since digital cards are the virtual representation of physical cards, they are available in dual forms – physical and digital.

Signing up for a virtual card is a faster, easier, and more convenient process, whereas, for digital cards, you have to first apply for the physical card, which is a cumbersome process.

Virtual cards are designed to act as your mobile wallets, and you can receive funds on the virtual cards. However, digital cards do not allow the receipt of payments; they are only used to make payments.

Virtual cards are available on the apps on your smartphone. Hence, you can use them anywhere, anytime. Digital cards are available on apps and as physical cards.

Certain virtual cards, called disposable cards, can only be used once, and for each transaction, the app issues a new/unique virtual card number. Whereas digital cards do not have such a facility, you can use one digital card to make all payments.

Virtual cards are more secure as the card issuing company allows you to use disposable cards. Such cards use unique numbers for every transaction; hence, chances of card theft are minimal.

On the other hand, digital card details are stored on merchants’ portals/apps that may be prone to theft.

The virtual card is a 100% electronic card and enables you to use your smartphone to make payments, shop online, send/receive money, and make money transfers. On the contrary, digital cards have a physical presence but do not allow the receipt of funds.

Download the Payit mobile wallet app to get instant cash within a minute through Ratibi salary cards.