Abu Dhabi: Payit mobile wallet, powered by First Abu Dhabi Bank (FAB), has partnered with Mastercard to deliver instant remittances to select bank accounts and wallets internationally. payit is the first wallet in the region to launch this Mastercard service through a push-payments platform that allows for international fund transfers to more than 100 corridors.

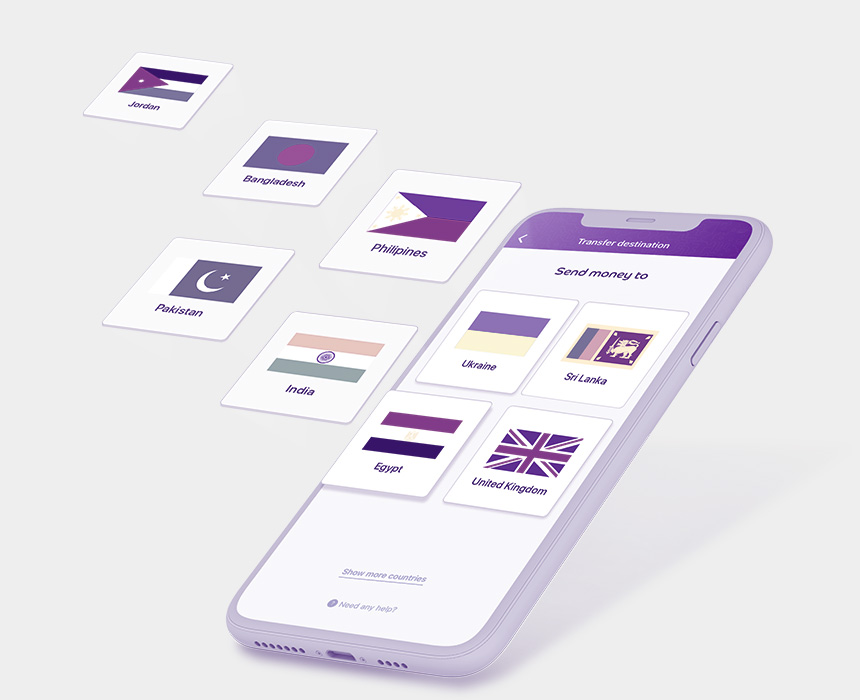

payit customers will now be able to make transfers to their bank accounts, mobile and digital wallets, allowing for secure, predictable and fast delivery of funds internationally with the few clicks on the app.

Commenting on this agreement, Hana Al Rostamani, Group Head of Personal Banking at FAB, said: Bringing this technology to the market as early as possible is crucial now more than ever. It is important to switch to digital channels and with advanced risk frameworks in place, our customers now have an easy option to make fast, frictionless cross-border transfers. Our partnership with Mastercard for cross-border remittance is a testament to our continued commitment to invest in digital solutions to deliver a safe, secure and forward-looking remittance experience to our clients.

We want to drive the cashless objective of the UAE and through Mastercard on payit, we are providing instant transfers to our customers. The customers do not need to stand in queues or pay high fees and carry cash anymore. payit has created an innovative ecosystem for its customers where we provide seamless and unique remittance solutions. This partnership with Mastercard clearly demonstrates our commitment towards a real time, instant and cashless payments ecosystem.

Ramana Kumar, SVP and Head of Payments at FAB

With the platform now live, the new solution will enable FAB’s payit customers to transfer money instantly with zero fees to bank accounts in the Philippines, Bangladesh, Pakistan, Nepal, Kenya, Egypt, Nigeria, Sri Lanka, Vietnam, Ghana with several other countries to follow.