Home » Cashless Payments Knowledge Hub » Ratibi Salary Card Vs. Traditional Payroll Card What’s the Difference?

As we move towards a more digital and cashless society, how we receive and manage our salaries has also evolved. Salary cards like ratibi salary cards have emerged as a popular alternative to traditional payroll systems due to the flexibility to make digital payments.

But what are these salary cards? And how is the ratibi salary card different from the traditional payroll card?

In this blog, we’ll take a closer look at the features and benefits of ratibi salary cards and compare them to the traditional payroll cards.

Ratibi card is a prepaid bank card offered by the First Abu Dhabi Bank (FAB) to employers with corporate accounts to pay their employee salaries, allow withdrawals, international remittances, bill payments, etc.

It’s available to resident employees earning less than AED 5,000 per month. Therefore, it is just like another payroll card for employees who don’t need a bank account to receive salaries, but employees must possess a valid residency visa.

The ratibi prepaid card is a WPS-approved method for salary payments, providing hassle-free salary disbursements and additional employee benefits, as listed below:

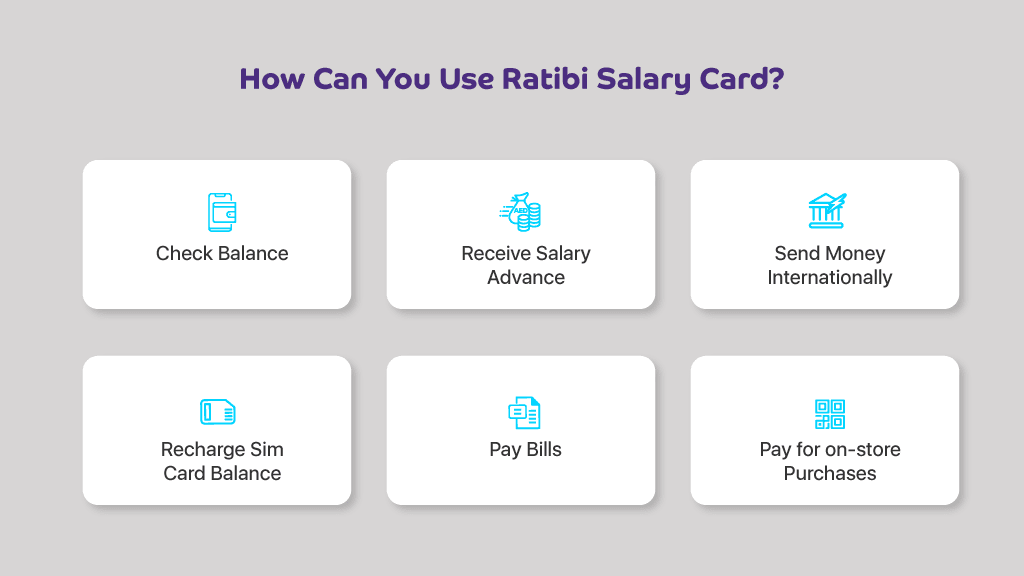

Thus, a ratibi payroll card allows employees to not only withdraw money but also send it to their bank account in their native place, pay bills and use it for many other purposes, as provided below.

You can quickly check your Ratibi card balance in just three simple steps through the Payit mobile application.

With the ‘money on demand’ feature, Ratibi cardholders can receive up to 50% of their salary as an advance from their employer.

Related: Unlocking money on demand feature via Ratibi Card

You can send money to over 200 countries using your Ratibi card, saving you time from waiting in long queues at money exchange centers.

You can recharge your prepaid sim card balance via the ratibi card balance in your Payit digital wallet app.

You can use ratibi cards to pay utility bills such as Etisalat, du, Salik, and Mawaqif.

Ratibi salary cards are accepted at 5000+ stores in the UA, allowing for cashless purchases. Thus, the ratibi salary card enables you to do much more than a traditional payroll card may offer.

Let’s understand a traditional payroll card and where you can use it.

A traditional payroll card is a reloadable prepaid card employers issue to pay their employees. It replaces traditional paychecks, which you can use to withdraw cash, make purchases, and perform other financial transactions.

A traditional payroll card is like a prepaid debit card, with which you can withdraw cash, pay bills, and receive salaries. Thus, the card offers convenience and security by eliminating the need for physical paychecks or cash. It benefits individuals without a traditional bank account and provides an alternative to direct deposit or paper checks.

Now, let’s compare how ratibi salary cards are different and more beneficial than traditional ones.

| Differentiating Factor | Ratibi Salary Cards | Traditional Payroll Cards |

| International remittance | Yes, ratibi cards allow you to send money internationally. | Not all cards allow international remittance. |

| Additional fees | No, you don’t pay any fees to use the card. | Yes, traditional payroll cards usually apply some fees to use the card |

| Salary advance | Yes, you get money on demand with the ratibi cards. | No, traditional payroll cards do not offer salary advances. |

Although both ratibi and traditional payroll cards are similar in many ways, ratibi salary cards offer many more additional features, such as international remittance and salary advance and without any additional fees.

While traditional payroll cards may charge you some fees even to check your balance, ratibi cards do that without any cost from you.

Check your eligibility to apply for the ratibi cards and download Payit mobile wallet app to get a chance to win a gold coin with international money transfers.