Home » Cashless Payments Knowledge Hub » Ratibi Salary Card: What is It, How to Use, Benefits, and More

The United Arab Emirates is the second-largest country in the world for remittances which means a large population of the country sends money internationally across countries. However, the majority of the workers in the UAE do not even have a bank account.

So, what is the simplest way to pay workers their salary when they don’t have a bank account? One of the best options is to issue them a ratibi salary card. It is one of the most convenient ways to pay salaries to the employees and allows them to use the card for multiple purposes.

Let’s see what a ratibi salary card is, how it works, the benefits and how to apply for one.

Ratibi card for salary is a bank prepaid card through which you can pay salary to your employees, and they can use the card to withdraw money, remit money to any other country, make bill payments, etc. It is issued to those employees whose salary is not more than AED 5,000 per month.

If you want to apply for a ratibi card for your employees, you need to have met the following eligibility criteria:

Thus, the ratibi cards for salaries are issued by a company to its employees, and the employees must have a valid residency visa.

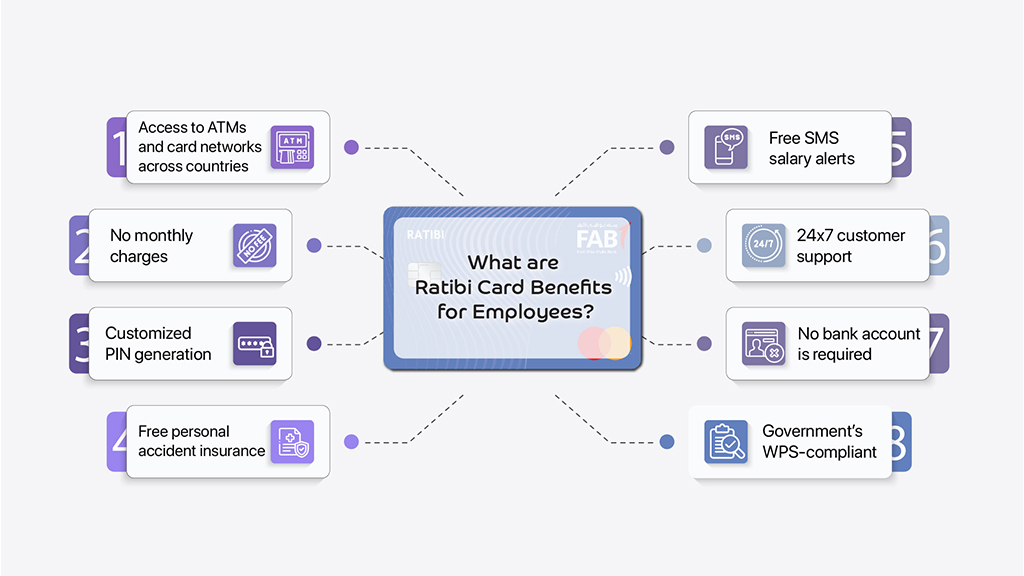

Let’s look at the benefits your employees will receive with the ratibi cards:

Since the ratibi prepaid card is one of the WPS-approved methods to make salary payments, it allows you to pay salaries to your employees hassle-free. Apart from that, it also provides your employees with other benefits, as mentioned below:

Thus, a ratibi payroll card allows your employees to not only withdraw the money but also send it to their bank account in their native place, pay bills and use it for many other purposes, as provided below.

You can issue ratibi card for your employees from the First Abu Dhabi bank by completing the easy 4 steps procedure mentioned below:

Ratibi payroll card is a boon to your employees because when they get them, they become eligible for the multiple advantages it offers and has a smooth banking experience without owning a bank account. The employee can activate the new ratibi card by linking it to the payit mobile app as per this video and enjoy the benefits mentioned next.

You can check the balance on your ratibi card through the Payit mobile application Thus, it merely takes three simple steps for you to check your ratibi card balance.

Using the ‘money on-demand ‘ feature, you can use your ratibi card to receive a salary in advance. It entitles you to receive up to 50% of your salary as an advance from your employer.

You can also use your ratibi card to send money to more than 200 countries. Thus, it saves your time in waiting in long queues at the money exchange centers.

You can use ratibi cards to recharge your phone balance and pay utility bills such as, Etisalat, du, Salik, and Mawaqif.

Ratibi salary cards also enable you to make cashless purchases since it is accepted at 5000+ stores in the UAE.

Thus, with the ratibi prepaid card, you can conveniently transfer salaries to your employees. Your employees will get multiple benefits from cash withdrawal, international remittance to paying their bills.