Home » Cashless Payments Knowledge Hub » How to Reduce Startup Costs for Small Businesses?

From incorporation to buying office space and furniture and spending money on marketing and distribution, startup costs are no less nowadays if you want to remain competitive. As per research conducted by Shopify, you need $40,000 to start a small business in the first year.

The amount may change depending on what type of business you start and what your priorities are in the first two years. However, starting a business makes you spend hundreds and thousands of dollars from your pocket.

Thus, it becomes crucial for you to spend your money mindfully and reduce your startup costs as much as possible.

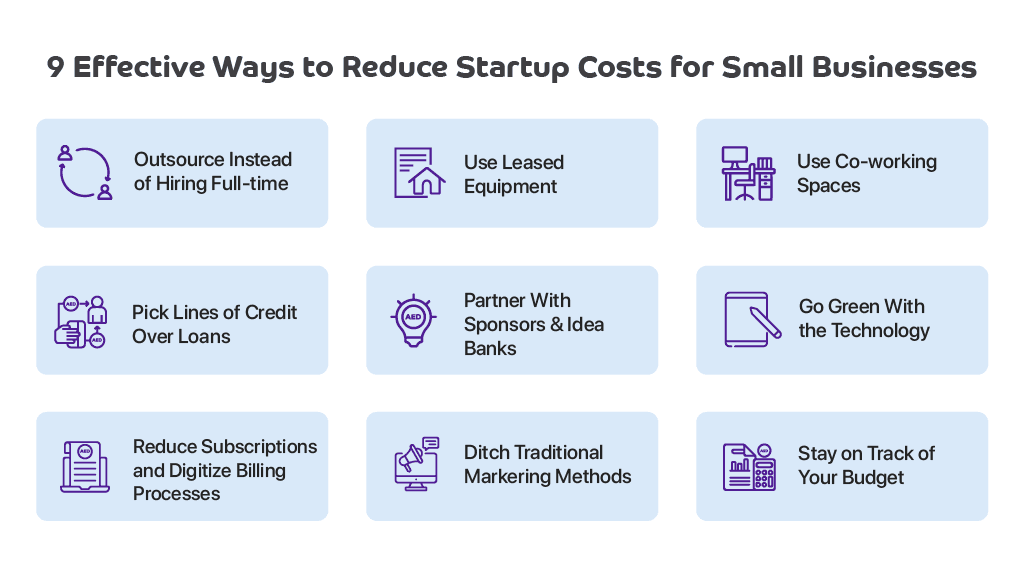

Let’s see what the ways through which you can reduce your startup costs are.

While many startups succeed in getting great investors and using their money to create innovative products, others struggle to build their small world of innovative products and services.

With these smart tips, you can use your investors’ money efficiently; using your own money will also reduce your startup costs.

As a small business, you’re probably getting only a handful of orders each month. You probably don’t need an entire in-house staff for eight hours, five days a week. Thus, you can simply hire freelancers or outsource your work to agencies and pay them for the work they do.

From accounting, and payroll, to marketing and sales, all of these activities can be outsourced instead of hiring someone full-time.

You might be in a business where you may have to invest vast amounts of money in heavy machinery or plants.

Instead of buying your own equipment or factory, you can initially try using leased machinery and plants and later on have your own machinery.

Instead of buying your own office space, in the beginning, you can try co-working spaces where you pay a small rent for using an office space. In fact, many modern businesses can operate entirely remotely, and you can also try working remotely if your business mainly provides IT services or other consultancy services.

You will need to borrow money while you start your own business, no matter how small it could be. Introducing debt in your business will keep you worry-free and help you maintain your working capital requirements when you have infrequent income sources.

Thus, availing of lines of credit instead of obtaining loans will help you reduce your interest costs. The main advantage of a LOC is that you are given a maximum amount up to which you can borrow, but you pay interest only on the amount you borrow instead of the entire principal amount.

Sponsors and idea banks can help you execute your business plan! These individuals and organizations own large amounts of wealth and actively look for business ideas and plan to invest in them.

You can pitch to a sponsor, in which case you’ll explicitly add their name to your brand’s identity, or you can look for idea banks that lend seed money for startup ideas that impress them.

When you have tablets and Styluses, why still go for papers and pens? The former is a one-time investment, while the latter costs a lot, especially when you factor in daily waste.

Replacing your workplace equipment with greener technology majorly helps you cut down on quite a few traditional expenses.

Digital wallets like Payit offer cashless, paperless transactions with secure records in their digital databases!

Landlines, software subscriptions, internet packages, utility bills, and maintenance costs are another massive load on a business’s budget. However, you can cut down on these expenses by analyzing unnecessary ones and using our e-wallet app. to pay them all at once. For instance, a landline is rarely helpful but still requires regular payment.

Similarly, large and fully equipped HVAC systems are relatively expensive for small businesses. If you have full-time, in-house staff, you can try a smart thermostat or any other alternative to reduce these costs, too.

The concept of giant billboards and television advertisements is old and unnecessary. You can use newer and more effective ways of digital marketing, such as social media advertisements, email marketing, text message advertisements, influencer endorsements, etc.

The benefit of using newer marketing techniques is that it will give you a broader reach to your customers and such services are available at quite budget-friendly rates.

Budgeting is an uphill battle when you start it afresh. A poor budgeting plan can deliver a decisive blow to your whole business setup and even cause additional damage if there are still debts, loans, and salaries to pay off.

The best way around this is rigorous budget planning and its execution. If you simply create a budget and forget, it will not help you reduce costs. However, following your budget carefully and taking insights from each comparison and variable will help you plan further expenses to spend them more efficiently.

Every dollar makes a difference when it comes to establishing a business. While every expense may seem necessary and inevitable when you ask your business gurus, you can actually use this ten-point formula to find a cheaper alternative to significant expenses without ever compromising on the quality!

Use Payit solutions for businesses to reduce and digitize your business costs.