Home » Cashless Payments Knowledge Hub » The 50:30:20 Rule of Managing Payments and Savings

It’s often tricky to decide how much to spend on essential things, how much to use for fun, and how much to save. That’s where the 50:30:20 rule comes in – it’s like a simple guide that tells you how to split your money. This plan is to make sure you cover all your needs, have some fun, and still save for the future.

Let’s explore the 50:30:20 rule for more innovative and more stress-free budgeting.

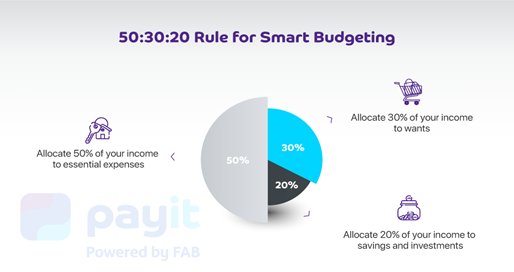

The 50:30:20 rule is a budgeting guideline suggesting you allocate 50% of your income to needs, 30% to wants, and 20% to savings, providing a simple and effective money management strategy.

The first pillar of the 50:30:20 rule allocates 50% of your income to cover your essential needs. This is the money you set aside for must-haves that keep your life running smoothly, including

In the second part of the 50:30:20 rule, you set aside 30% of your money for things you don’t need but want. This part recognises how crucial it is to have fun, pamper yourself a bit, and do things that make you happy. Here’s where you allocate funds for

Now, for the last part of the 50:30:20 rule—it says, take 20% of your money and put it into savings and investments. This keeps your money safe and helps it grow for the future. Here’s where you direct funds to:

The 50:30:20 rule is a good plan, but we’re all different. You can change the rules to fit how you live, what you want to do with your money, and how much you make. Here are a few considerations:

Putting that 50:30:20 rule into action needs a bit of financial discipline. Here are some tips to make it smooth sailing and fit right into your lifestyle:

Dealing with money might seem hard, but the 50:30:20 rule can help as a guide to handling your cash. You just divide your money into three parts: half for things you need, 30% for things you want, and 20% for saving.

Have fun with your money while saving for the future. You can customize the rule to fit your lifestyle and dreams. It’s a simple plan for financial well-being and living life on your terms.

Download Payit mobile wallet app to efficiently manage your payments and save every time you spend money on the app.