Home » Cashless Payments Knowledge Hub » Unlocking Money on Demand Feature Through Ratibi Salary Cards

When you use your credit card for most of your purchases, you may want to withdraw some cash using it. However, they may charge hefty fees if you don’t repay them on time. But, in times of emergency, you need urgent money without interest, and the best way to solve the problem for a while immediately is a cash advance.

Many banks, financial institutions, and fintech companies offer cash advances in some way or another. However, when you would like to get immediate money, you must review fees charged by different providers and the related terms.

Let’s explore what exactly is a cash advance and how you can get faster and more convenient cash on demand with no credit history needed.

Mainly cash advance refers to a loan offered against a credit/debit card that you can use for your personal needs and emergencies. Some cash advances are payday loans, cash advances on credit cards, and merchant cash advances (MCA).

Thus, cash advances also include salary advances, often called payday loans which means you get part of your salary in advance from the loan provider, and you can repay the money as per the terms of the provider.

Let’s jump on to see what you should do when you need money.

When you urgently need money/cash, you have many options, such as cash on demand, salary advances, small loans, etc. Salary advances and small loans are not as straightforward as cash on demand since they involve documentation and lengthy application processes.

Whereas money on demand is simple, secure, faster, and the most convenient way to secure cash in times of emergency.

Want to dig deeper into how you can get one? Let’s see how Payit can offer you up to 50% cash through their ‘Money on Demand’ feature.

The Ratibi card holders can request advanced cash up to 50% of their salary directly deposited to their Payit wallets. You can request money on demand on Payit app to:

When you request cash, the fees are already deducted from the funds you asked for. You will get the balance amount in your wallet.

You don’t need to worry about the repayment since it is automatically deducted from your account as a one-time repayment. Thus, you are free from remembering when to repay and how long to keep repaying the amount.

When you hold a Ratibi salary card and need cash, you need to check the following eligibility criteria:

Thus, Payit mobile wallet app offers small cash amounts to meet your emergency requirements and makes it extremely simple to request, receive, and repay money.

Also, read Ratibi Salary Cards: All You Need to Know

Payit e-wallet lets you receive your salary without a bank account in UAE via linking your Ratibi card with it, it also offers you as a cardholder the availability to have instant advance cash through its ‘money on demand’ feature.

Let’s see how money on demand through Payit differs from other ways to get instant cash online.

| Easy Accessibility | No Credit History Needed | Collateral-free | Faster Processing |

| Ratibi salary cards to make it quite simple and easy to request cash up to 50% of your salary. The app lets you skim through the process of requesting cash seamlessly without any hassle. | Whether you have a credit score history or not, as a Ratibi card holder, you are eligible to receive cash from Payit app | You are also not required to provide any security as collateral. Cash on demand on Payit digital wallet is collateral-free. | The cash on demand request processes faster on the app with a few simple steps. |

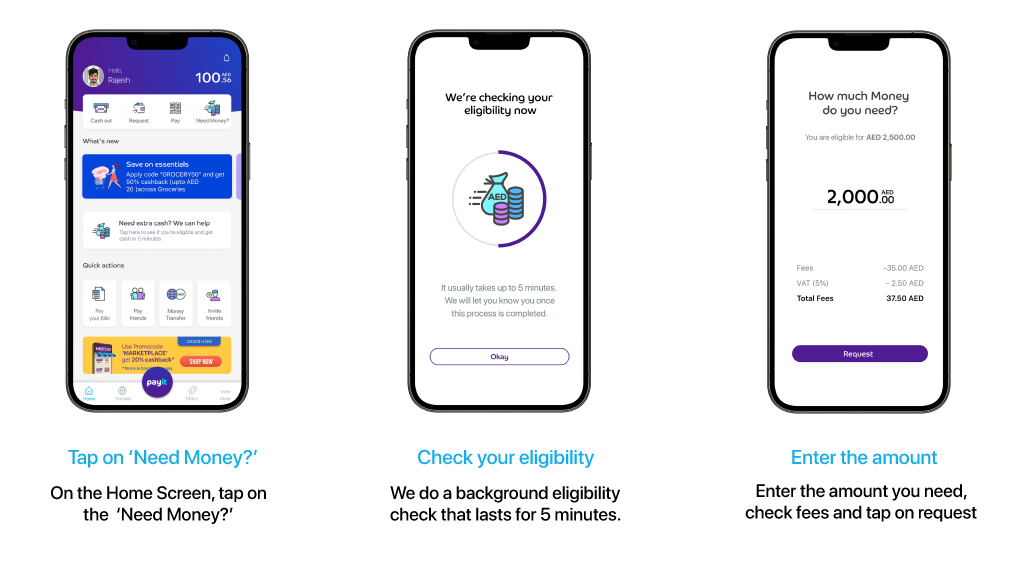

Let’s see how you get quick cash in minutes as a Ratibi card holder from the Payit digital wallet app.

If you are a Ratibi card holder, all you need to do is to download the Payit electronic app, link your card to it, and then you will be able to get instant access to smaller cash amounts with simplified application processes.