Home » Cashless Payments Knowledge Hub » What are Digital Wallets? How Are They Changing the Way We Pay in 2025?

You already know that you can book flights online and upgrade to business class using reward points from your mobile wallet app. You can also order groceries online and pay for them within seconds.

Thanks to the revolutionary growth of digital payments, all of these are possible. As we enter 2025, digital wallets will transform the landscape of commerce by providing seamless, secure, and efficient alternatives to cash and traditional banking methods.

In this blog, we will discuss some of the groundbreaking digital wallet payment trends that will shape the payment industry in the UAE in 2025.

A digital wallet is a virtual platform that allows users to store payment methods, such as credit cards, debit cards, and even cryptocurrencies, for secure transactions. These wallets facilitate online and in-store purchases through NFC (Near Field Communication), QR codes, and app-based solutions.

By integrating with mobile devices and wearables, digital wallets eliminate the need for physical cash or cards, offering a streamlined and contactless way to pay.

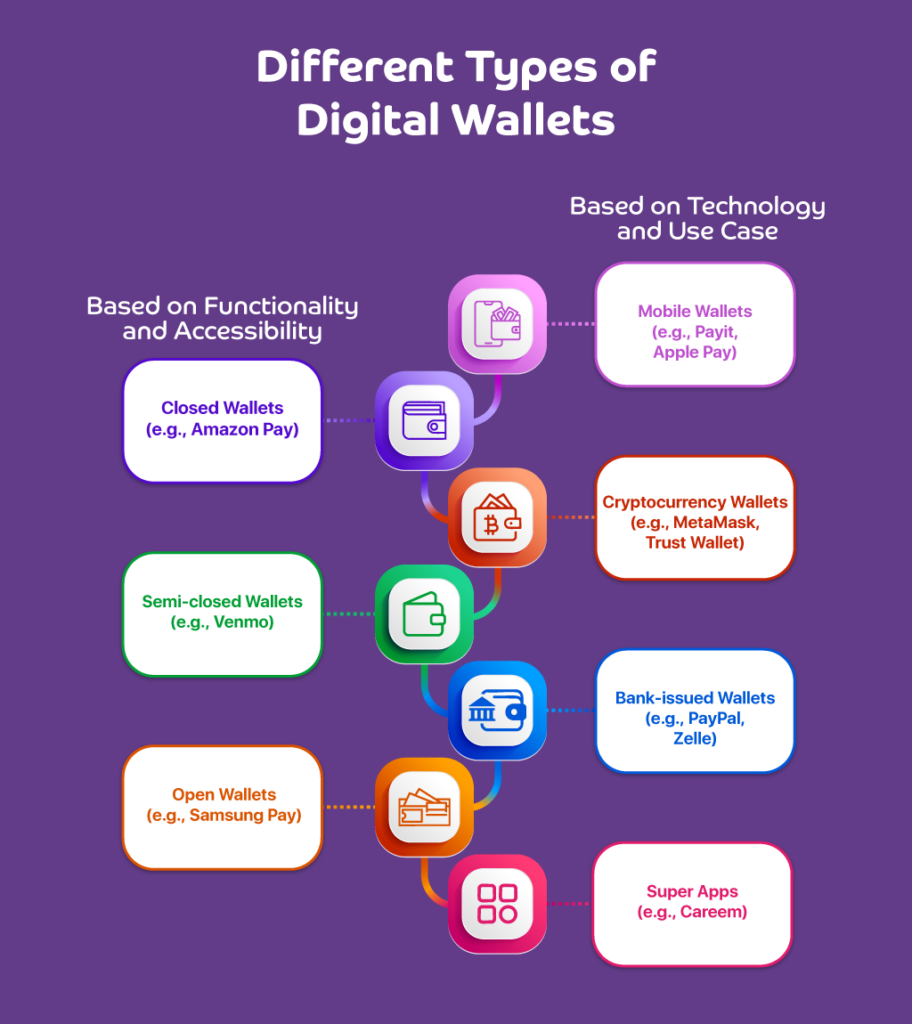

Technically, there are three main types of digital wallets based on functionality and accessibility:

However, based on the technology used and use cases, there are four main types of digital wallets:

The UAE is on track to becoming a global leader in digital payments, and here’s how.

The UAE government has been a significant force behind the digital payments revolution. Initiatives like UAE Vision 2031 and Smart Dubai aim to transform the country into a cashless economy. The Dubai Cashless Framework is designed to eliminate cash transactions in government services, encouraging residents to adopt digital payments.

Additionally, regulatory bodies like the UAE Central Bank actively promote financial inclusion, digital banking, and open banking frameworks, paving the way for a seamless digital transaction ecosystem.

The UAE has seen a rapid increase in the use of digital wallets, especially homegrown solutions like Payit. These wallets offer fast, secure, and contactless payment solutions, making transactions more convenient.

Fintech companies are also introducing innovative features like instant cross-border transfers, cryptocurrency payments, and multi-currency wallets, further driving adoption. With strong regulatory support, the fintech sector is expected to grow exponentially, making digital payments even more accessible.

The Middle Eastern e-commerce sector is projected to reach over $50 billion by 2025, significantly increasing the demand for digital payments. With more consumers prefer shopping online for convenience, retailers have integrated digital wallets, BNPL (Buy Now, Pay Later), and real-time payment solutions into their platforms.

The rise of super apps—such as Careem and Noon—also contributes to the growing use of digital transactions, as these apps offer seamless payment options for shopping, food delivery, and ride-hailing.

The adoption of Near Field Communication (NFC) technology has skyrocketed in the UAE, making contactless payments the norm. According to reports, over 90% of in-store transactions in the UAE are now contactless.

Payment terminals at supermarkets, restaurants, public transport, and government services accept tap-to-pay methods, making transactions faster and safer. The UAE has also introduced QR-based payment systems in local markets, further enhancing digital payment accessibility.

As digital payments increase, so do cybersecurity threats. To combat fraud, UAE banks and fintech firms invest in AI-driven fraud detection systems that analyze real-time transaction patterns to identify suspicious activities.

Additionally, blockchain technology is being adopted for secure cross-border payments and digital identity verification, reducing fraud risks. These advancements build consumer trust and ensure that digital transactions remain safe and reliable.

Let’s examine some key trends shaping the digital wallet payment ecosystem in the UAE for 2025.

Wearable technology, such as smartwatches and fitness bands, is increasingly being used for digital payments. With an expected global market value of $29.12 billion by 2025, wearables are becoming integral to cashless transactions.

Security is a primary concern for digital transactions. Biometric authentication methods, such as facial recognition and fingerprint scanning, are becoming standard features in digital wallets, ensuring both convenience and security.

Artificial intelligence is revolutionizing fraud prevention by identifying suspicious transactions in real time. AI-driven digital wallets analyze spending behavior to detect anomalies, reducing fraud risks significantly.

Buy Now, Pay Later (BNPL) services are being integrated into digital wallets, making it easier for users to access credit without traditional banking approval. By 2025, BNPL transactions are expected to account for over $680 billion globally.

Financial inclusion is improving as digital wallets become more accessible to underbanked populations. Governments and fintech firms are launching simplified, low-cost eWallet solutions to bridge the gap for millions worldwide.

The trajectory of digital payments is set to accelerate even further post-2025. According to forecasts, the global digital payments market will reach $137.43 billion by 2025.

With digital wallets continuing to innovate and evolve, the global shift towards a cashless society seems inevitable. Businesses, consumers, and financial institutions must adapt to these changes to stay ahead in an increasingly digital economy.

What are the payment trends for 2025?

Contactless payments, biometric authentication, AI-powered fraud detection, BNPL integration, and increased digital wallet adoption.

What is the future of digital wallets?

Digital wallets will become more integrated, secure, and AI-driven, with enhanced accessibility and cross-border payment capabilities.

What are the three types of digital wallets?

Based on functionality and accessibility, there are three types of digital wallets: closed wallets, semi-closed wallets, and open wallets.